Beyond data - leveraging technology for inclusive insurance - 12th Consultative Forum

View the presentations here.

The 12th Consultative Forum (CF12) on the topic of InsurTech: rising to the regulatory challenge took place on 20 March in Colombo, Sri Lanka gathering high-ranking representatives from the regulatory and supervisory bodies (in Asia), industry, NGOs and other stakeholders.

For InsurTech to facilitate the way to inclusive insurance, continued dialogue on regulatory approaches to innovation and consumer protection is necessary. The panellists of the CF12 explored concrete, country-specific examples, where InsurTech created opportunities to reach the unserved and under-served customers, and subsequently looked at the challenges for regulators in the face of new business models, and their role in facilitating innovation, while protecting the customers.

“New technologies might be a tool, but are certainly not a panacea”, said Arup Chatterjee, Principal Financial Sector Specialist, Asian Development Bank, The Philippines in his keynote speech. Chatterjee highlighted several important points, such as the importance of infrastructure, broadband access and the accessibility of mobile technology as preconditions to meaningful action, and the need for government involvement, particularly in risk management.

A new ecosystem is in place for inclusive insurance. Market dynamics are shifting, but most importantly, new customer behaviour and expectations are emerging. With change comes the challenge of leveraging technology to serve the customer and create new customer engagement models. In his opening remarks, Peter van den Broeke, IAIS Senior Policy Advisor responsible for inclusive insurance, FinTech and sustainable insurance, referred to the initiatives of the IAIS in response to these innovations in the insurance sector, including its Report on FinTech Developments in the Insurance Industry (March 2017). He underlined the importance of all stakeholders helping each other in the interest of the policyholder to understand the fast developments that are taking place and making them work for inclusive insurance.

“InsurTech heralds the advent of the Fourth Industrial Revolution. The speed of change has no historical precedent. When compared to previous industrial revolutions, change is occurring at an exponential, rather than a linear pace. When it comes to greater access to insurance, these are exciting and unprecedented times”, said Hannah Grant, Head of the Access to Insurance Initiative Secretariat.

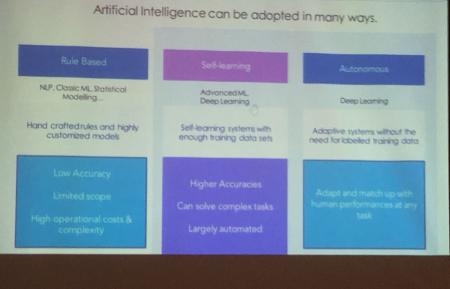

In the discussion facilitated by Katharine Pulvermacher, Executive Director of the Microinsurance Network, innovative InsurTech applications were presented by TongJuBao (Peer-to-Peer insurance), AXA and Arya.ai, who apply artificial intelligence and deep learning to insurance processes. One of the key messages emerging from the discussion was the necessity for the human touch in advanced data analytics and artificial intelligence application. The make-up of artificial intelligence systems and how the rules that direct them are built is critical. From an industry perspective, while the industry is moving at a speed of 150km/h, the regulators are lagging behind at 30km/h. The gap and time taken for regulations to be implemented kill the model. For regulators, testing and learning environments are important enablers of dialogue and catching up with the industry.

The importance of understanding technology to create closer relationships with the policyholder, the unserved and the under-served, as opposed to using it for improving insurance innately is critical to trust. “Insurance is yet to be recognised as a risk mitigation tool by many parts of the population. The low penetration rate is the indicator of this”, said Indrani Sugathadasa, former Chairperson of the Insurance Regulatory Commission of Sri Lanka.

The panel facilitated by Stefanie Zinsmeyer, Advisor at the A2ii, explored how supervisors can strike a balance between facilitating innovation and protecting consumers. To kick off this panel, Peter van den Broeke shared the views of the IAIS in its Report on FinTech Developments in the Insurance Industry based on scenario analysis of FinTechs development and their potential impact on aspects such as competitiveness, customer choice and consumer protection.

India and Pakistan have issued specific regulations for their countries. Examples of their practices helped inform the panel discussion. To support ‘safe growth’, the regulator should allow innovation to happen, even when lacking appropriate regulation. Sandboxes and other initiatives by supervisors could facilitate this.

The potential value of meeting the customers’ needs also brings new risks. One such risk, the panellists pointed out, comes with the issue of data protection and the questions of data and public intelligence ownership. Another comes with the usage of big data and subsequently pricing out low-income consumers due to segmentation.To mitigate them, supervisors must monitor and understand the market, and above all, be open to innovation. More clarity in this regard is paramount.

The Forum concluded with focus groups on peer-to-peer insurance, on-demand-based insurance, big data and advanced data analytics, and the use of blockchain and distributed ledger technology.

CF12 marked the first of a series of three events in 2018, with subsequent events due to be held in Africa in May and Latin America towards the end of the year.

The series focuses on InsurTech and inclusive insurance and is organised by the International Association of Insurance Supervisors (IAIS), the Microinsurance Network (MiN) and the Access to Insurance Initiative (A2ii). CF12 was hosted by the GIZ Regulatory Framework Promotion of Pro-poor Insurance Markets in Asia (RFPI-Asia).

More Information:

Consultative Forum website: at this link

Twitter handles: Follow #12thCF @a2ii_org @NetworkFlash #IAIS #InsurTech #technology #digitisation #inclusiveinsurance #innovation #p2pinsurance #OnDemandInsurance #BigData #telematics #blockchain

Media Contacts

Stephen Hogge, IAIS, Senior Policy Advisor for Communications, stephen.hogge@bis.org

Annalisa Bianchessi, MiN, Senior Communications Manager, abianchessi@microinsurancenetwork.org

Dunja Latinovic, A2ii, Communications Advisor, dunja.latinovic@giz.de

About the organising partners

The International Association of Insurance Supervisors (IAIS)

The International Association of Insurance Supervisors (IAIS) is a global standard-setting body promoting effective and globally consistent supervision of the insurance industry in order to develop and maintain fair, safe and stable insurance markets for the benefit and protection of policyholders and to contribute to global financial stability. Its membership includes insurance regulators and supervisors from more than 210 jurisdictions. www.iaisweb.org

The Microinsurance Network (MiN)

A not-for-profit membership-based association, the Microinsurance Network is driven by its vision of a world where people of all income levels are more resilient and less vulnerable to daily and catastrophic risks through improved access to effective risk management tools. Low-income consumers lie at the heart of our mission. We work with a broad range of stakeholders around the world to prioritise the needs, interests and well-being of our ultimate beneficiaries. www.microinsurancenetwork.org

The Access to insurance initiative (A2ii)

The Access to Insurance Initiative (A2ii) is a unique global partnership working with development agencies, insurance supervisors, international insurance bodies and local entities with the mission to inspire and support insurance supervisors to promote inclusive and responsible insurance. The A2ii is the implementation arm of the IAIS on financial inclusion and capacity building, a partnership which provides close connections with insurance supervisors and regulators worldwide. www.a2ii.org