Access to Insurance Initiative Newsletter 07/2019

Welcome to our monthly newsletter, where we update you on the work of the Initiative, inform you about events and publications, and share experiences and learning on inclusive insurance regulation and supervision across jurisdictions.

Follow us on Twitter @a2ii_org where we serve you news and updates on #inclusiveinsurance.

#didyouknow #A2ii10

By 2013, the A2ii had implemented or supported 20 country diagnostics. This provided the A2ii with a strong knowledge base and a growing awareness of different approaches supervisors could take to support greater financial inclusion. In 2013, the A2ii undergoes an extensive strategy review which sees the Initiative move closer to the IAIS as its implementation partner on financial inclusion. The new strategy shifts A2ii’s activities from knowledge gathering and dissemination towards greater regional, on the ground, supervisory capacity building. In practice, the focus is on supporting regional events and peer-to-peer exchange.

Recent events

The 16th A2ii-IAIS-MiN Consultative Forum on Inclusive Insurance: Climate and disaster risk: building resilience, bridging the protection gap in Africa

12 and 13 June, Johannesburg

In the last couple of years, we have observed an increased frequency and severity of extreme weather events like droughts, floods and cyclones. We recently saw the devastating impact of cyclone Idai in Malawi, Zimbabwe and Mozambique, affecting about 3 million people. World Bank expects that the cyclone costs the three countries more than $2bn for the infrastructure and livelihood impacts.

Around 60 participants from more than 20 countries representing all stakeholder groups – including supervisors and policymakers - came together in Johannesburg to discuss potential solutions to build the resilience of the most vulnerable segments of the population against natural disasters. The industry or the government cannot address climate risk alone; broader collaboration and partnerships are crucial. A joint approach between different countries is needed to tackle this important topic. The industry can contribute by developing products that are easily accessible, affordable and understandable for smallholder farmers, while insurance supervisors can contribute by making sure regulations enable the growth of insurance to cover climate-related risks and do not create any unnecessary barriers.

Watch the recording of the 16th Consultative Forum in English or French here: https://www.youtube.com/playlist?list=PLvRCyfN5sW3gKCUrzKiItnJE4ZbN-MTHc. Presentations are available on our website in English and French.

The 16th Consultative Forum was jointly organised by the International Association of Insurance Supervisors (IAIS), the Access to Insurance Initiative (A2ii), the Microinsurance Network (MiN), and the InsuResilience Global Partnership, and hosted by the African Insurance Organisation (AIO).

SSN – A2ii – IAIS Roundtable on Insurance for Women: Specific Needs and Inclusion

12 June 2019, Buenos Aires, Argentina

The Roundtable on "Insurance for Women: Specific Needs and Inclusion", organised by the Superintendencia de Seguros de la Nación (SSN) and the Access to Insurance Initiative (A2ii), with the support of the International Association of Insurance Supervisors (IAIS) brought together about 30 representatives of insurance supervisory authorities, local industry and policymakers.

The Roundtable on "Insurance for Women: Specific Needs and Inclusion", organised by the Superintendencia de Seguros de la Nación (SSN) and the Access to Insurance Initiative (A2ii), with the support of the International Association of Insurance Supervisors (IAIS) brought together about 30 representatives of insurance supervisory authorities, local industry and policymakers.

The event was opened by the Superintendent of the Superintendencia de Seguros de la Nación (SSN), Juan Alberto Pazo, and the Executive Director of Prudential Policy at the Bank of England and Chair of the IAIS Executive Committee, Victoria Saporta, who highlighted the potential existing for the global industry by developing products to meet the women´s needs:

“Recent estimates issued by IFC, AXA and Accenture, suggest that women represent a market opportunity for insurance premiums of between US$1.45 and US$1.7 trillion by 2030. These Data also highlights that women can offer a great contribution to ensure sustainable economic development.”

Hannah Grant, Head of the A2ii Secretariat, presented on the role of regulators, supervisors and policymakers, as well as industry, to help close the gender gap.

Other topics covered at the forum included the value of women clients in insurance and training and awareness-raising programs as a means of reducing the financial capacity gap. Also, case studies were shared by the Moroccan and South African insurance supervisors of efforts to close the protection gap in their jurisdictions through tailored financial education campaigns and product offerings respectively.

The Roundtable on Insurance for Women in the news (SP): https://www.argentina.gob.ar/noticias/mesa-redonda-seguro-para-mujeres

CARTAC and CAIR Annual Conference and Workshop

19 – 21 June, Georgetown Guyana

From 19-21 June 2019, over 60 supervisory representatives from 21 Caribbean countries attended the Annual Conference and Workshop of the Caribbean Regional Technical Assistance Centre (CARTAC) in conjunction with the Caribbean Association of Insurance Regulators (CAIR).

In a half-day workshop organised by the A2ii, the topic of climate risk and nat cat insurance was introduced. The session highlighted the important role supervisors and regulators play in closing the protection gap, for example by responding to emerging technological trends, supporting the use of new technologies or legally recognising index-based insurance. Tara James, the Local Coordinator for MCII's Climate Risk Adaptation and Insurance in the Caribbean (CRAIC) project, presented two climate risk insurance products available in the region:

on the macro level, the Caribbean Catastrophe Risk Insurance Facility (CRIIF), a regional catastrophe fund for Caribbean governments to limit the financial impact of devastating hurricanes and earthquakes by providing short-term funding to support relief in the immediate aftermath of a natural disaster,

on the micro level, Livelihood Protection Policy (LPP), a parametric insurance product provides coverage against extreme weather events at the individual level, complementing CCRIF’s government-level insurance.

During the panel discussion, the regulators spoke about challenges to enabling innovative solutions to climate risk, such as the lack of a definition, restrictions in the use of distribution channels or a general lack of insurance awareness in jurisdictions. The workshop closed with a group session, where supervisors discussed potential interventions and explored regulatory and supervisory mechanisms to allow for innovations to build resilience against climate risk.

Download the A2i presentation:

Upcoming events

Stimulating Demand: The Supervisor’s role in building Insurance Awareness – A2ii-IAIS Consultation Call

18 July

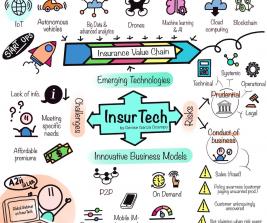

Lack of insurance demand is one of the most significant obstacles for the development of responsible, inclusive insurance markets. In managing risk, the unserved and underserved population generally do not know which risk management tools – such as insurance – exist, and they do not trust the insurance sector. This has an important impact on the willingness to buy and renew insurance products. Although the first-hand experience with insurance products is the most effective tool to increase insurance awareness, risk management and insurance awareness programmes also play an important role to confront the demand challenge.

For more information on the key issues of this call and the report, click here.

5th Eastern & Southern Africa Regional Microinsurance Conference,

13 -15 August, Zanzibar

As one of the partners of the partners supporting this regional conference, the A2ii will host a panel at the 5th Eastern and Southern Africa Regional Microinsurance Conference taking place from August 13-15 in Zanzibar.

The conference will focus on “Inclusive Insurance business models for Africa” and cover the following topics: organisational development, business strategy, technology, customer centricity, consumer education, inclusive insurance regulation and important trends in microinsurance. The panel organised by A2ii will feature several supervisors from the region as well as an industry representative who will discuss the role of supervisors in inclusive insurance market development.

If you are interested in participating, please see more information at this link.