VIDEO: Inside the 4th iii-lab - participants speak about their insurance innovations

In July 2024, current and past iii-lab participants met in Frankfurt for the iii-lab international incubator event. We spoke with the current cohort about inclusive insurance solutions they've developed so far and why this is not just another project - but a life-changing experience.

Download the flyer:

The Access to Insurance Initiative (A2ii) initiated the Inclusive Insurance Innovation Lab (iii-lab) series as a means to support the development of inclusive insurance markets. Given low insurance penetrations in many economies world-wide and vast populations still remaining unserved or underserved, the A2ii recognised that inclusive insurance development requires collaboration of different actors, both in the public and private sector as well as civil society. The iii-lab provides this space for intensive collaboration between key stakeholders of the inclusive insurance space in a year-long process.

The iii-lab has three main objectives:

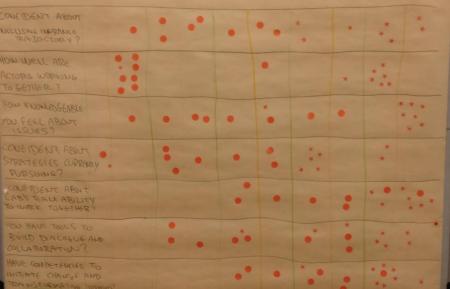

Enable dialogue and mutual learning amongst key stakeholders of the inclusive insurance sector

Equip participants to take leadership within their sector and/or organisation

Inspire participants to take action and support initial implementation of innovations developed in the iii-lab process

Videos

2022 iii-lab international dialogue

Watch this video about the iii-lab International Dialogue which hosted participants from the third iii-lab (2021-2022) with Costa Rica, Grenada, Zambia and Zimbabwe as well as alumni from previous labs.

Alumni Stories

iii-lab alumni: Barbara Chesire, Kenya, iii-lab 1

iii-lab alumni: Mohamed Feriss, Morocco, iii-lab 2

iii-lab alumni: Natalie Lopez Uris, Argentina, iii-lab 2

Sibongile Siwela, Zimbabwe, iii-lab 3

German Rodriguez, Costa Rica, iii-lab 3

Methodology

The iii-lab is based on a social lab methodology which involves gathering a diverse set of people to analyse insurance- related problems in the respective country context, gather relevant insights and collaborate to develop and test innovative solutions. Innovation methodologies like Design Thinking and its elements like user research, designing solution prototypes, testing and redefinition are included in the programme design.

In the context of the iii-lab, an innovation is defined as any type of change that is new within the particular jurisdiction. Innovations could be new regulations, new regulatory tools or approaches, innovation of products, processes, distribution channels, payment systems, service (e.g. a new value-added service that can make insurance more tangible), activities (e.g. insurance education programme), or a combination. The iii-lab consists of a series of national level and international workshops. The process has been conducted both as a face-to-face and a virtual process so far.

The philosophy of the lab is that no one in the room understands all facets of an issue nor has the perfect solution to existing challenges. This means that everybody needs to work together, and, with the appropriate time and tools, the participants can find the answers together.

Main components of the iii-lab process

Before the lab

Based on supervisors’ applications, the A2ii selects four countries to participate in the lab.

Four country teams are formed, each composed of up to sixteen key stakeholders (eight institutions) from the inclusive insurance sector

During the lab

Teams start a dialogue, build networks in national insurance sector & internationally

Teams analyse their country systems, decide on a focus area and beneficiary group

Participants conduct user research including interviews with representatives from beneficiary group defined previously

Teams prototype innovative solutions to advance the inclusive insurance market.

Teams implement their prototypes and test them in the real world. Prototypes are refined.

Throughout the programme, teams receive expert input and benefit from peer exchange across country teams.

After the lab

- Teams decide about a potential institutionalisation of their collaboration and may receive seed funding to support further implementation of their innovations.

Watch this video about the first iii-lab (2017-2018) with Albania, Ghana, Kenya and Mongolia.

Watch this video about the second iii-lab (2020-2021) with Argentina, India, Morocco and Rwanda.

Participating countries

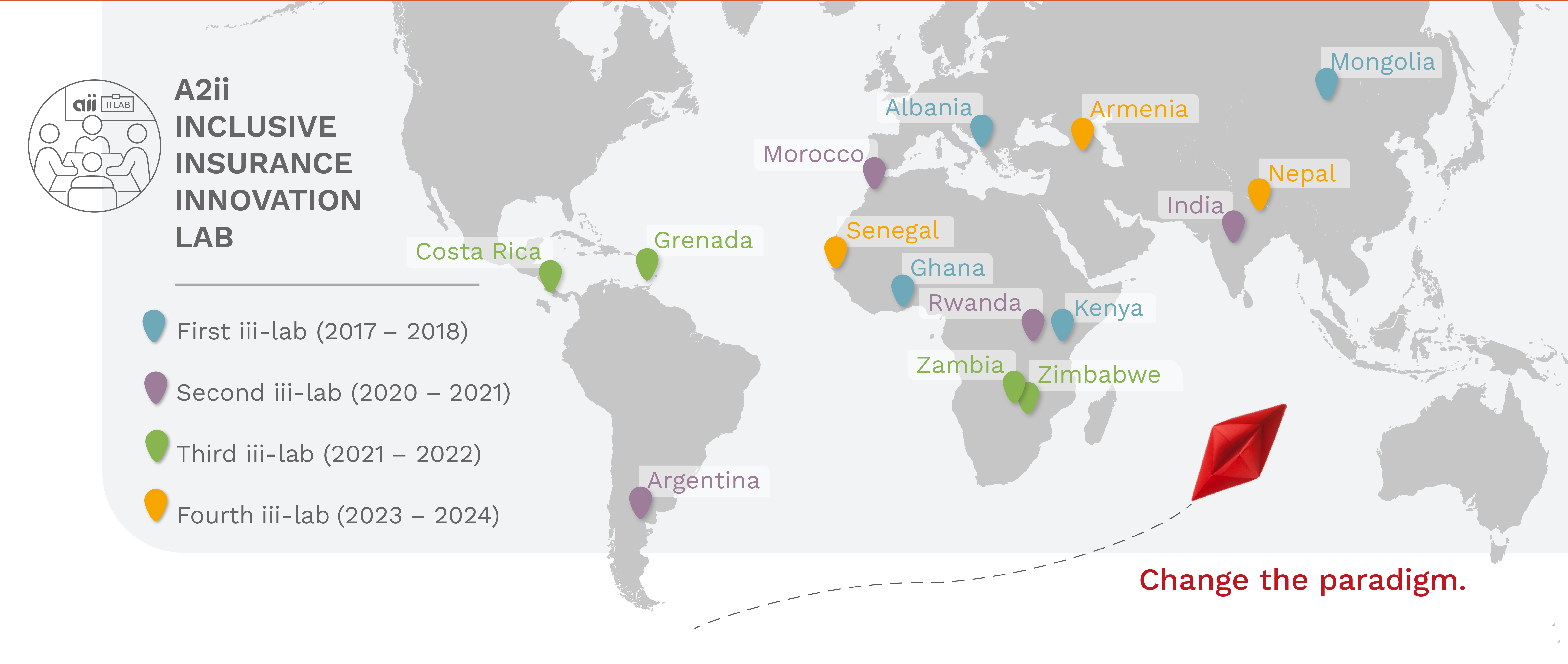

The first iii-lab took place in 2017/18 with Albania, Ghana, Kenya and Mongolia.

The second iii-lab took place in 2020/21 with Argentina, India, Morocco and Rwanda.

The third iii-lab took place in 2021/22 with Costa Rica, Grenada, Zambia and Zimbabwe and is focusing on climate risk resilience.

The fourth iii-lab is taking place in 2023/24 with Armenia, Nepal and Senegal and is the second iii-lab focusing on climate risk resilience.

The Inclusive Insurance Innovation Lab was developed together with the Global Leadership Academy and is implemented in partnership with Reos Partners.

The lab would not have been possible without the support of Dutch Directorate-General for International Cooperation (DGIS).