Talleres y seminarios

12th Consultative Forum on InsurTech

View the presentations here.

The International Association of Insurance Supervisors (IAIS), the Microinsurance Network (MIN) and the Access to Insurance Initiative (A2ii) are pleased to invite you to the 12th Consultative Forum on:

InsurTech: rising to the regulatory challenge.

Tuesday 20 March 2018 from 09:00 to 17:30

Colombo, Sri Lanka

Download the Invitation (save the date), the Programme of the Forum and the pre-event Press release.

Register for the event.

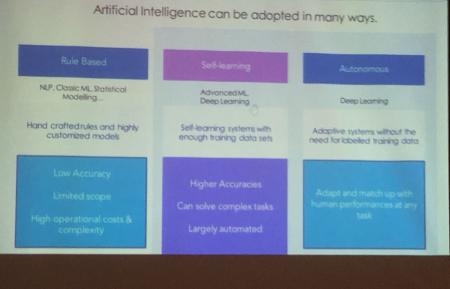

InsurTech — the variety of emerging technologies and innovative business models that have the potential to transform the insurance business — holds vast potential for improvements in insurance product design, the development of better-tailored products and reducing administrative costs. These efficiency gains can lead to lower premiums, better client servicing and faster payouts.

According to the World Insurance Report 2017, there are now around 1,000 InsurTech start-ups representing a combined investment of USD 2 billion. These pioneers are making use of big data and advanced data analytics to develop ways of digitising processes from initial application and contracting, through to premium collection and payouts for claims, using mobile and blockchain technology and experimenting with new business models, such as peer-to-peer insurance.

While the InsurTech revolution undoubtedly offers vast and untapped opportunities, it also embodies a challenge for regulatory frameworks that must now consider new business models, new actors in the insurance value chain, data protection, cybersecurity and consumer education. To meet this challenge, supervisors have to strike a balance between facilitating innovation, increasing the inclusiveness of the insurance sector, and maintaining the conditions for a fair, safe and stable insurance sector for the benefit and protection of policyholders.

The 12th Consultative Forum on microinsurance regulation for insurance supervisory authorities, insurance practitioners and policymakers will address the consequences of rapid technological change in the inclusive insurance sector, exploring how regulators are responding to the need for oversight, consumer protection, stability in the business and financial systems while supporting and encouraging innovation.

Discussions will focus on how various stakeholders — insurance supervisors and policymakers, private sector insurance, data and technical service providers — can cooperate and align their respective roles to achieve sustainability and scale while ensuring that clients receive fair treatment. The first of a three-part series, this Forum will be followed by two further Consultative Forums on the topic in Africa and Latin America.

The 12th Consultative Forum will take place on Tuesday 20 March in Colombo, Sri Lanka, alongside the Mutual Exchange Forum on Inclusive Insurance (MEFIN) Public Private Dialogue 5 (21-22 March 2018). Approximately 60 high-ranking representatives from insurance supervisory authorities, the industry and the public sector are expected to attend the event. If you need an official invitation, please request this by email to Jenny Nasr (jnasr@microinsurancenetwork.org). For queries about visa requirements, please contact Ms. Jenine Gadiana (Jenine.gadiana@giz.de).

Consultative Forums aim to stimulate the dialogue between policymakers, supervisors, the industry and other stakeholders that is critical to fostering knowledge and sound policymaking in the field of inclusive insurance.

We warmly invite you to enrich this seminar with your participation and contribution.

Please mark Tuesday 20 March 2018 in your calendar. To participate in the Consultative Forum, please register here by 12 March 2018, close of business, Central European Time.

Jonathan Dixon, IAIS Hannah Grant, A2ii Katharine Pulvermacher, MIN

Below you can download the Save the Date and the Programme for the event.