Digital technologies are rapidly changing the insurance landscape worldwide. In Africa currently, mobile insurance is prevalent, but other digital technologies are on the rise too, helping to provide a large number of households with coverage for the very first time.

InsurTech creates opportunities for enhancing financial inclusion and is giving rise to new market entrants, innovative business models and efforts to change consumer habits, as well as increase uptake and understanding. The implementation of digital platforms, technology-enabled partnerships and peer-to-peer models in emerging markets, for instance is a fast-growing trend.

But while InsurTech has the potential to reach more people, empower and engage emerging customers, improve service delivery and ultimately, enhance client value, it could lead to financial exclusion, erosion of trust and even harm the reputation of the insurance industry, if not properly regulated. Supportive regulatory environments tend to leverage the opportunities provided by InsurTech to develop insurance markets, while protecting consumers.

Industry experts and insurance supervisors met at the 13th Consultative Forum in Accra, Ghana, to identify some of these challenges and opportunities and to discuss how different stakeholders can work together to facilitate innovation, consumer protection and market development.

Below, are some of the lessons learned:

Apart from South Africa, which has one of the highest insurance penetration rates in the world, insurance penetration remains very low in most African countries. According to the most recent World Map of Microinsurance for Africa (2015), less than 6% of the continent‘s population is covered by some form of microinsurance, leaving a significant share of the population unserved and potentially exposed to catastrophic risks. Additionally, low levels of financial literacy and trust in insurance companies are among the major obstacles to more inclusive insurance in Africa. In such a context, it is then paramount to establish the role of supervisors in promoting access to insurance and in market development. How can one best use InsurTech to the advantage of the customer? Moreover, how can the mandate of the regulator encourage innovation that supports the development of the insurance market?

Regulatory clarity and dialogue with the industry

Representatives from industry emphasised the importance of a supportive regulatory environment and dialogue between InsurTech start-ups and the regulator.

Innovation, at its initial stage, is frail. A nurturing regulator is needed to support it and bring it to the user. – Tang Loaec, TongjuBao

To harness InsurTech all the while protecting the financial system, the consumers and their needs, regulatory clarity and dialogue with the industry is essential. New regulatory frameworks need to be sufficiently flexible to encompass the fast-paced changes in digital technologies; to create an enabling environment for delivering economic benefits while lowering operational costs, enhancing competition by encouraging innovation, advancing financial inclusion and delivering more convenient financial services.

In Kenya, we have seen an embracing of change and embracing of collaboration whereby innovation is perceived as part of the regulatory culture. Consequently, the regulator is familiarised with new trends and their implications and potential future scenarios are identified and shared across the organisation. – Elias Omondi from the Insurance Regulatory Authority Kenya said.

A number of insurance supervisors in Africa have a general mandate for market development or promotion of access to insurance, including innovative approaches. However, those working within stringent, compliance-based regulatory frameworks will have less flexibility in supporting InsurTech innovation, than those operating within a principle-based framework.

A client-centric view of use of data and communication

Businesses are increasingly leveraging technological developments in data analytics to better understand consumers, price more accurately for risk and consequently, design better products, as well as improve monitoring to reduce the incidence and cost of fraud.

The implication is that embracing the use of new datasets has the potential to increase insurance inclusion substantively.

This data space brings with it major new risks to consumers: for example it raises the risk of consumers being excluded from insurance cover because of tailored or differentiated risk selection based on “big data” that deems certain customers too risky if no regulation exists to mitigate against such practices - Stefanie Zinsmeyer, Advisor at the Access to Insurance Initiative (A2ii).

In fact, with a more accurate modelling of risk, high-risk customers are more likely to be priced out of the risk pool or even entirely excluded if no regulation exists to mitigate against such practices.

Another pillar of the client-centric view of use of data and communication is improved customer experience. Mistrust is present among the consumers, and more needs to be accomplished to mitigate that. Stefanie Zinsmeyer (A2ii) presented early findings from the study on the role of insurance regulators in dealing with consumer data protection risks arising from increased data availability and usage:

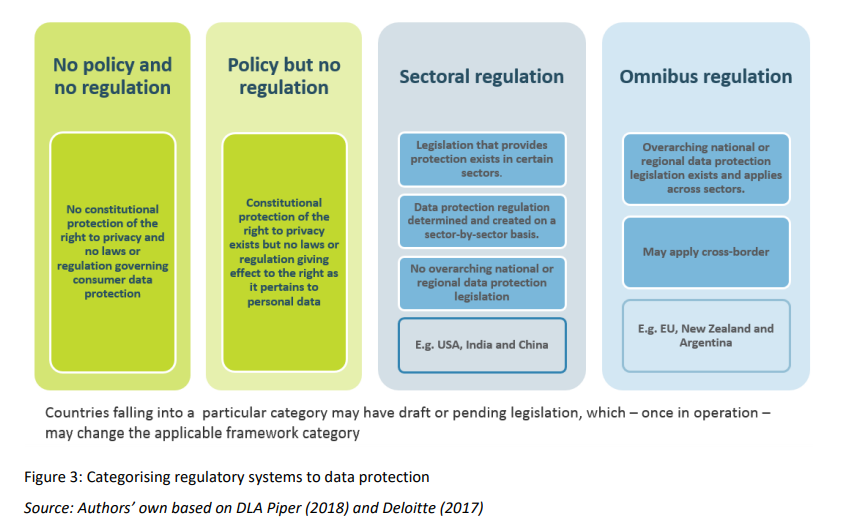

An insurance regulator’s role in, and approach to, dealing with data risks hinges on their mandate and the regulatory context in which they operate. The existing data protection regulatory system differs across countries. Many, especially developing countries, do not have explicit data protection and data privacy regulations in place. Among those that do, the approach to regulation falls into two categories: sectoral and omnibus.

Craig Thorburn, Lead Insurance Specialist at The World Bank, shared evidence from a pilot study and mystery shopping carried out in Tanzania, which showed that in many cases customers were not being fully informed about the insurance products they were buying, noting that features like the terms and conditions, policy exclusions and the claims process were generally not being explained to shoppers, resulting in an overall poor customer experience.

Leona Abban, Client Relations Manager at MicroEnsure, reinforced the need to improve the customer experience.

The single biggest problem in communication is the illusion that communication has happened. If a customer leaves, having not understood what your sale or pitch was, then no communication has taken place, she said.

Final thoughts

InsurTech is starting to play an important role around the business case, yet there is the risk of technology destroying markets by implementing short-term initiatives too quickly, without understanding the consequences and the impact that it could have on the market. – Mia Thom, Technical Director at the Centre for Financial Regulation and Inclusion (Cenfri).

Supervisors’ mandate for market development or promotion of access to insurance and innovative approaches requires dialogue and cooperation, capacity building and ongoing review of regulatory regimes. Speaking on good practices for regulation and supervision in InsurTech, Craig Thoburn presented five principles to consider, which were recently relayed by Francois Groepe, the Deputy Governor of the South African Reserve Bank:

1. Focused attention on innovation as a result of technological advancements and the active review of regulatory regimes;

2. Creation of innovation facilitators such as hubs, sandboxes and close dialogue with the industry to keep close to emerging developments and foster shared learning;

3. Coordination, collaboration and communication between domestic regulators;

4. Global cooperation with standard-setting bodies;

5. Building staff capacity through deep knowledge of exponential technologies.

In conclusion, while vast opportunities exist for insurance providers and InsurTech companies– both to improve the quality and efficiency of their services, as well as reach out to a large segment of the unserved population – technology alone is by no means a panacea. A conversation between the industry and the regulator is critical to use technological innovations safely and responsibly.

To view all the presentations from the 13th Consultative Forum visit the A2ii website.

To watch the full video of the 13th Consultative Forum visit the A2ii Youtube channel.

The 13th Consultative Forum on Mobile Insurance and InsurTech was organised by Access to Insurance Initiative (A2ii), Microinsurance Network (MiN), International Association of Insurance Supervisors (IAIS) and it was hosted by the African Insurance Organisation (AIO).