Access to Insurance Initiative Newsletter 03/2019

Welcome to our monthly newsletter, where we update you on the work of the Initiative, inform you about events and publications, and share experiences and learning on inclusive insurance regulation and supervision across jurisdictions.

Follow us on Twitter @a2ii_org where we serve you news and updates on #inclusiveinsurance.

View this newsletter in your browser.

Recent Events

A2ii-IAIS Regional Meeting for Insurance Supervisors in Sub-Saharan Africa

5-6 February 2019, Pretoria, South Africa

Twenty-nine delegates from thirteen insurance supervisory authorities across Sub-Saharan Africa attended the Regional Meeting in Pretoria on 5 and 6 February 2019. The meeting was jointly organised by the A2ii and the IAIS and hosted by the South African Reserve Bank.

Twenty-nine delegates from thirteen insurance supervisory authorities across Sub-Saharan Africa attended the Regional Meeting in Pretoria on 5 and 6 February 2019. The meeting was jointly organised by the A2ii and the IAIS and hosted by the South African Reserve Bank.

The main focus of the meeting was to take stock of the capacity building achievements relating to the A2ii-IAISi Regional Implementation Plan developed in 2017 and to set the agenda for A2ii-IAIS activities in Sub Saharan Africa in 2019. Participants also shared experiences on recent developments and supervisory priorities in their countries.

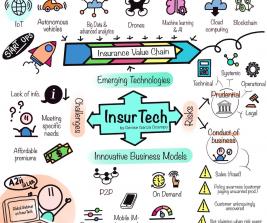

External presentations were made on the ‘Current state of insurance market growth in Sub-Saharan African’ and ‘InsurTech’. These topics generated a lively discussion as supervisors commented on practical issues in their respective markets.

Jonathan Dixon, the Secretary-General of the IAIS gave an overview of the current focus areas and activities of the IAIS. Hannah Grant, Head of the Secretariat of the A2ii, gave an update on the activities of the A2ii supporting insurance supervision and upcoming A2ii events. Craig Thorburn spoke about the activities of the World Bank in the region.

The meeting concluded with a discussion on the importance of gathering data on inclusive insurance business. The participants agreed to implement a data collection project to try and support improved inclusive insurance data collection.

A2ii at the IAIS Supervisory Material Review Task Force (SMRTF)

7 – 8 February, Washington DC, US

This meeting focused on the integration of ComFrame (common framework for group supervision) into the Insurance Core Principles (ICPs) and potential consistency issues. In addition, the ICP Glossary terms were reviewed. The meeting was hosted by the National Association of Insurance Commissioners (NAIC).

The IAIS SMRTF is responsible for discussing, providing direction and proposing solutions to issues in IAIS supervisory material under review. Of particular interest to the A2ii this includes on how proportionality should be reflected in the ICPs. The Task Force reports to the IAIS Policy Development Committee.

Capacity Building for Insurance Supervisors - Leveraging Actuarial Skills

11 – 15 February, Mauritius, Sub-Saharan Africa

Actuarial capacity is vital for effective regulation. This has been brought to the fore with the move towards risk-based approaches to supervision and the upcoming implementation of IFRS 17 yet limited tools are available to supervisors.

Actuarial capacity is vital for effective regulation. This has been brought to the fore with the move towards risk-based approaches to supervision and the upcoming implementation of IFRS 17 yet limited tools are available to supervisors.

To remedy the skills gap, the A2ii entered into a 5 year capacity building partnership with the International Actuarial Association and the IAIS in November 2017.

This Actuarial Skills Training hosted by the Mauritius Financial Services Commission was the first pilot training conducted under the partnership. 29 supervisors from 15 countries in Sub-Sahara Africa participated

Within one week, the training covered a wide range of topics, from risk management, risk-based capital, valuation and actuarial reports, to reinsurance and practical contextual issues, such as the quality of available data. A team of experienced actuaries with extensive supervisory background supported the training delivery; Eamon Kelly as the lead trainer, Elias Omondi (Insurance Regulatory Authority Kenya), Vishal Desai (Bank of England), David Rush (former APRA), and Janice Angove (A2ii). The training was funded by the Department for International Development of the UK.

The lessons learnt from this first pilot is currently being incorporated to benefit future training under the A2ii-IAA-IAIS partnership – with the second Actuarial Skills Training for supervisors from the Caribbean region coming up soon from 1-5 April in Trinidad and Tobago.

To further deepen the impact of the training, a number of opportunities for ongoing peer exchange and expert support will be provided to participants through webinars as well as individual follow-ups.

3rd International Dialogue of the Inclusive Insurance Innovation Lab

20 - 22 February 2019, Nairobi, Kenya

A third international dialogue of the Inclusive Insurance Innovation Lab (iii-lab) took place at the initiative of the lab participants and was kindly hosted by the Insurance Regulatory Authority of Kenya. The event focused on moving forward the innovations generated through the iii-lab process.

Participants provided each other with valuable peer support. Kenyan experts on inclusive insurance engaged in dialogue with the group and participants went on learning journeys to an innovation hub, an insurance company, and an intermediary that is driving index insurance in Kenya. The workshop also provided insights on how to collaborate effectively with other stakeholders.

A2ii presents at the International Insurance Forum (IIF) 2019 – CEE & SEE Regional Actuarial Insurance Conference

28 February, Skopje, North Macedonia

The International Insurance Forum (IIF) 2019 – CEE & SEE Regional Actuarial Insurance Conference was organised by the Insurance Supervision Agency of Macedonia and XPRIMM on the topic of Inclusive Insurance.

The A2ii presented on two panels on topics of “Promoting responsible inclusive insurance growth – the role of the supervisor” and “Ratios and cost structures in inclusive insurance supervision”.

Presentations and videos of the event can be downloaded from the conference website here.

Geneva Association, Progress Seminar

28 February – 1 March, Geneva, Switzerland

During a panel discussion on ‘Inclusive growth and resilience: Can regulation help spur inclusive growth and resilience, and if so, should it?’ Hannah Grant from the A2ii shared with participants A2ii observations and examples of supervisors increasingly focusing their resources on supporting insurance market development.

The panel chaired by IAIS Secretary General Jonathon Dixon included representatives from the World Bank, Insurance Development Forum, CIC Insurance Group from Kenya and a representative from the Namibian insurance supervisory authority (NAMFISA). This broad cross-section of stakeholders provided for a lively discussion on proportionate regulation, the supervisor's role in market development beyond just putting enabling regulations in place and the impact of (digital) innovation and regulatory sandboxes.

All speakers agreed that the supervisor has a leading role to play in market development; however, for this to make a difference, all stakeholders need to support these efforts and work together.

IAIS committee and working group meetings

25-27 February, Basel, Switzerland

The A2ii presented to the IAIS Implementation and Assessment Committee (IAC) meeting on upcoming 2019 activities and some of its major 2018 projects including the work on InsurTech, the Inclusive Insurance Innovation Lab and the supervisory actuarial skills training. Reports were also provided by the International Monetary Fund, Sustainable Insurance Forum and Financial Stability Institute. In addition, the IAC discussed the implementation of ComFrame as well as implementation assessment of the Holistic Framework (a framework to assess and mitigate systemic risk in the insurance sector).

The A2ii also provided an update to the Self-Assessment Working Group on the Self-Assessment Tool (SAT).

What is the SAT and how does it work?

The tool is a joint A2ii – IAIS project; it is an online platform for supervisors to test their compliance against individual Insurance Core Principles (ICPs) at their convenience.

The assessments within the tool will be based on the questionnaires previously developed for the IAIS Self-Assessment and Peer Review (SAPR) process.

The launch of the tool is foreseen towards the end of 2019.

Supervisors at the meeting welcomed the initiative and a short discussion was held on data protection and the challenge of ensuring supervisors are provided with valuable qualitative as well as quantitative feedback through the online automated process.

Upcoming Events

RegTech and SupTech: Implications for Supervision – A2ii-IAIS Consultation Call

21 March

On 21 March, the A2ii and IAIS will be hosting a consultation call on “RegTech and SupTech: Implications for Supervision”. This webinar will be conducted in 3 languages – French, Spanish as well as English, and will be an opportunity for supervisors to learn about the implications of automated systems and processes involving the current use of supervisory technology (SupTech), and regulatory technology (RegTech) on supervisory work. Supervisors on the call will hear from an expert from the Toronto Centre, and also from The Financial Stability Institute report on the same theme: Innovative technology in financial supervision (suptech) – the experience of early users.

To register for this consultation call, please follow this link here.

Capacity Building for Insurance Supervisors - Leveraging Actuarial Skills

1 – 5 April, Trinidad, Caribbean

The Training “Capacity Building for Insurance Supervisors - Leveraging Actuarial Skills” is jointly organised by the International Actuarial Association (IAA), the International Association of Insurance Supervisors (IAIS) and the Access to Insurance Initiative (A2ii) and funded by the UK Department for International Development

The training aims at strengthening the understanding and application of actuarial concepts and tools needed to support effective insurance supervision and regulation.

More information can be found on our website.

15th Consultative Forum on Inclusive Insurance: Climate and disaster risk- building resilience, bridging the protection gap

7 May, Panama City, Panama

15th Consultative Forum provides a platform for dialogue between policymakers, insurance regulators, industry and supervisors, as well as the opportunity to meet with and learn from colleagues involved in disaster risk reduction and climate change adaptation from Latin America and other regions. The Forum will explore how different stakeholders can collaborate to reduce the protection gap and help to build resilience in the face of climate risk and natural disasters.

The forum is organised by the International Association of Insurance Supervisors (IAIS), the Access to Insurance Initiative (A2ii) and the Microinsurance Network (MiN). It will take place alongside the FSI – ASSAL – IAIS Regional Seminar for Insurance Supervisors of Latin America (8-10 May 2019) and will be hosted by the Superintendencia de Seguros y Reaseguros de Panamá and supported by the Association of Insurance Supervisors of Latin America (ASSAL).

For more information, please refer to the link here. To register, please follow this link.

Recent Publications

Regulating InsurTech: Role of the regulator in managing data risks and protecting consumers – A2ii-IAIS Consultation Call Report

Regulating InsurTech: Role of the regulator in managing data risks and protecting consumers – A2ii-IAIS Consultation Call Report

January 2019

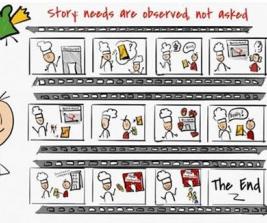

In 2018 the A2ii focused on the theme of InsurTech, its status and regulatory challenges and recently published a report on Regulating for responsible innovation. This call took place on Thursday, 24 January 2019 and explored the risks and potential of the use of new data. Experts gave an overview of how to regulate for responsible data innovation and the role that insurance regulators play in dealing with consumer data protection and risks.

The report can be accessed here.

InsurTech - Rising to the Regulatory Challenge a summary report of the IAIS-A2ii-MiN Consultative Forums 2018 for Asia, Africa and Latin America

InsurTech - Rising to the Regulatory Challenge a summary report of the IAIS-A2ii-MiN Consultative Forums 2018 for Asia, Africa and Latin America

Over the course of 2018, the International Association of Insurance Supervisors (IAIS), the Access to Insurance Initiative (A2ii) and Microinsurance Network (MiN) organised three Consultative Forums on the topic of 'InsurTech - rising to the regulatory challenge'. The forums provided a platform for in-depth discussions about the future of insurance and regulation given the rise of new digital technologies.

Over two hundred high-ranking representatives from insurance companies, digital providers, policymakers and regulators from 49 countries shared their views on how different stakeholders can work together to facilitate innovation, consumer protection and market development. This report is a summary of all three Forums, including the discussions and key messages.

To access the report click here.