Challenges and supervisory demands in facilitating migrant insurance

Challenges and supervisory demands in facilitating migrant insurance

The International Organisation for Migration estimated that 281 million people, almost four per cent of the world’s population, were living outside their home countries in 2020. The World Bank calculates that in 2021, $773 billion were sent as remittances, although this number is estimated to be much higher if informal remittances were taken into account.

There is extensive literature about the link between migrant remittances and the potential for economic development and poverty reduction in the home countries, especially in those where remittances account for up to 30 per cent of the countries’ GDP.

SDG 10 features remittances as one of the central topics of the development agenda: ‘By 2030, reduce to less than 3% the transaction costs of migrant remittances and eliminate remittance corridors with costs higher than 5%' from the average 6 per cent that is currently, but this cost could be reduced even further with digital remittance senders, to around 1 per cent.

Migrant workers profile

Migrants tend to work riskier jobs than other population groups, which makes them have a 2.5 times higher workplace mortality rate than non-migrants. Yet, almost 70 per cent lack comprehensive social protection schemes. This rate is even higher in low-income countries, where less than 3 per cent have portable social security. Given the higher risk that migrants usually face, they would greatly benefit from insurance that targets their specific needs.

This is especially true for the case of women migrants, who compose almost half of the total migrant population. Women migrants face the same risks as their male counterparts, with some additional conditions that place them in a more vulnerable position. Among these additional characteristics; although their average income is 20% lower than men’s, women remit a higher percentage of their wages. This is due to their often greater responsibility for taking care of children and elderly in the home country, which also means the social cost of migration is higher, given the expected societal role of women as caretakers.

Remittances as insurance

Remittances often function as insurance (and pensions) when there is a gap of protection in the home country. When emergencies occur, it is not uncommon for households to ask for financial support from members that have migrated to other regions or countries. This has been one of the ways in which remittances contribute to protect families from falling into poverty when unexpected events happen. However, this strategy still places the families (and migrants) at risk in case the migrant faces illness, unemployment, or death, or in case the receiving households need more resources than the migrant is able to provide. Apart from this, using remittance money to deal with emergencies also means that these remittances are not being used for other purposes such as savings or productive investments, which could promote the economic development of the household, as well as the society as a whole.

In the last years there has been an increased interest in migrant insurance and social protection schemes. Some jurisdictions have made efforts to include their migrant population abroad by making insurance mandatory for workers leaving their home country, or allowing migrants to contribute to pension schemes through their embassies and consulates (eg Mexico, Philippines, Bangladesh). There have also been regional and bilateral agreements, but these often do not cover the main migration corridors. Despite the increased interest in migrant insurance and social protection schemes, migrants are still a new target group for inclusive insurance.

Some of these efforts to develop migrant workers’ protection schemes and the barriers that relate to the cross-border nature of international migration were the topic of the last A2ii-IAIS Dialogue.

Public Dialogue on Regulatory challenges and supervisory demands in facilitating remittance-linked insurance

On 29 September 2022, the Public Dialogue on Regulatory challenges and supervisory demands in facilitating remittance-linked insurance took place. This Dialogue was jointly organised by A2ii, IAIS and UNCDF and the recording is available on A2ii’s website.

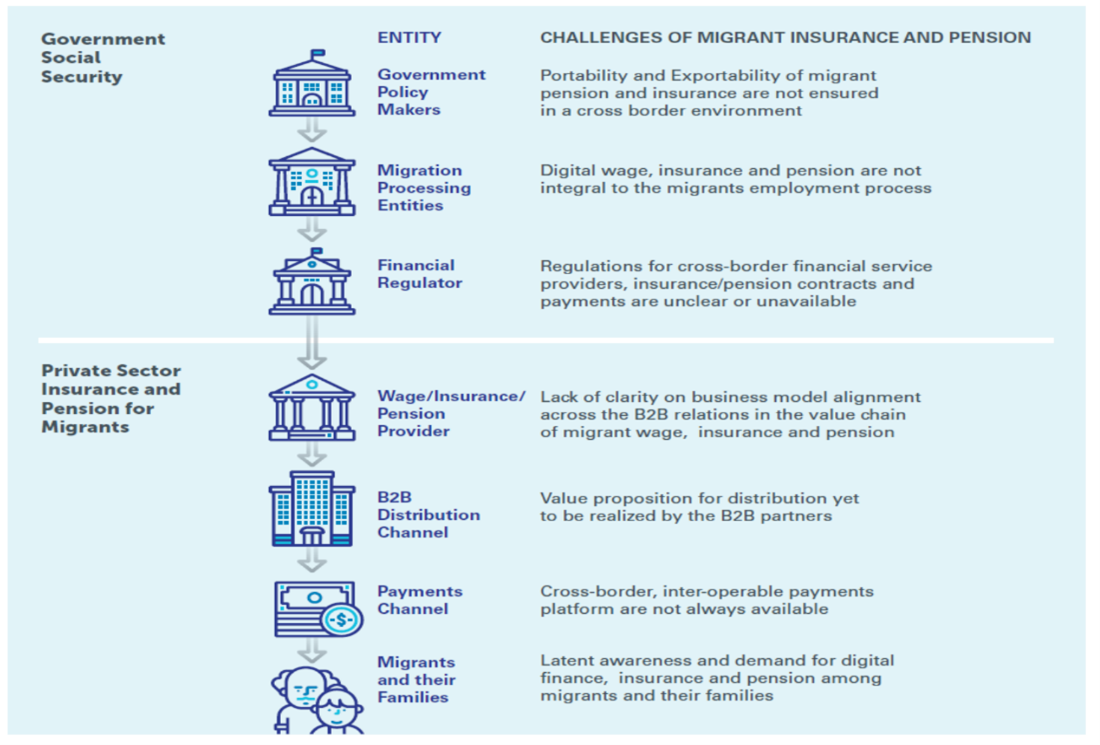

After the welcoming remarks from A2ii and IAIS, William Price, CEO of D3P Global, presented an overview of the potential size of insurance and pensions demand in the remittance-sending market. Price highlighted the importance of reducing the cost of sending remittances and presented models that facilitate insurance and pension for migrants and their families, by combining Government Social Security and Private Sector Insurance and Pension for Migrants.

Finally, Price shared the results of the UNCDF’s research on the topic, for which 50 interviews were conducted. He focused on the top 10 that were identified as priorities for regulators:

- Insurers need to operate cross border

- Government mandates and auto enrolment significantly increases coverage. Relying on voluntary measures isn’t enough

- Government mandated insurance for health, life and repatriation needs to be simpler and low cost

- Government needs to be proactive, it’s not only market development

- Using embassies as contact points to link to home population I host country

- Gulf Cooperation Council (GCC) region have very generous public pensions for citizens (in progress)

- Technology is very important, but there are often multiple regulators involved and need to get a common approach

- Migrants should get the same government incentives for pensions than those who live in the home countries.

- No link so far to WHO initiatives surprisingly

- Leverage Environmental Social Governance (ESG) by companies to expand provision

The panel discussion moderated by Manuela Zweimüller, Head of Implementation of the IAIS, featured Garance Wattez-Richard, Head of AXA Emerging Customers, Brian T. Gale Sibuyan, Manager of Regulation, Enforcement and Prosecution Division in the Philippine Insurance Commission, and Jeremy Leach, Founder and Executive Director of the Insurtech Inclusivity Solutions.

The speakers identified two main areas where the challenges reside, one being the lack of harmonisation between home and host countries' regulations and the second KYC and security requirements. These challenges can be summarised as:

Lack of harmonisation between home and host countries:

- Local underwriting licences: Jurisdictions requiring insurers operating in their territory to obtain a local underwriting licence. This makes operating one product in two separate jurisdictions challenging for insurers.

- Restrictions on marketing and cross-border selling: When foreign insurers lack commercial presence or licencing in a jurisdiction, they also face restrictions when marketing and selling products in a local market. This means migrants cannot purchase insurance for their relatives back home as collecting premiums from abroad by home country insurers is a grey area compliance-wise.

- Definition and legal remit of intermediaries. Remittance service providers (RSP) and money transfer operators (MTOs) are in a privileged position to act as intermediaries due to their constant contact with both ends of remittance corridors. However, the legal permits that allow them to bundle insurance with their services and to collect premiums vary across different jurisdictions. Also, the ability for RSPs to act as group policyholders would make it easier and lower cost to administer, but this also varies across jurisdictions. This point continues to be a grey area in many cases.

- Data protection requirements. Some jurisdictions have strict regulations for data protection, and companies are required to host the data locally. This hinders the development of cloud-based, digital platforms, which have grown in the last years and proven to be able to reduce costs significantly.

- Insurable interest across borders. There is a lack of clarity on whether the ‘duty of support’ that a migrant might have taking care of financial dependants in the home country can be considered a reasonable insurable interest.

KYC and security requirements:

- KYC requirements: In some jurisdictions, obtaining insurance policies locally is impossible if a person does not have a local ID or proof of residence. Focusing more on proof of identity instead of proof of residency could make insurance accessible to a larger number of people. Also, KYC requirements for life insurance tend to be stricter than for RSP, which further hinders RSP from distributing insurance.

- Anti-Money-Laundering/ Combating Financing of Terrorism: Regulation on AML/CFT tends to be very strict. However, given the size of money transfers being sent through RSP (average remittance being USD 300), the likelihood of criminal money transfers through these channels is low.

Overall, the discussion reflected the need for a clearer, simpler regulation and products tailored to migrant’s needs.

International Conference for Inclusive Insurance 2022

Some emerging best practices and solutions, also discussed at the UNCDF-hosted panel discussion on Insurance and Pension for Migrant Workers during the ICII (recording here), in the follow up of this Dialogue are:

- Government-sponsored mandatory insurance coverages or with auto-enrolment feature (opt-out models) have been proven to be the most efficient for improving uptake (e.g. Philippines and Bangladesh compulsory insurance of migrants).

- Remittance-linked insurance products, although still facing many ‘grey areas’, have had some success at improving uptake (e.g. Fintech Inclusivity Solutions, AXA, Rise, HelloPaisa - Democrance), also allowing for bundling of insurance across different types of remittance services enables scale and sustainability.

Some aspects that could be considered the ‘way forward’ for insurance supervisors to enable more products to come to market while still achieving a high level of consumer protection are:

- Learnings from the developments made in the supervision of microinsurance can be applied to migrant insurance.

- Increased collaboration between jurisdictions to avoid double regulation. Agreements among jurisdictions that are part of remittance corridors are an example.

- More collaboration between insurance supervisors and other financial authorities is needed to create an enabling environment for developing new products. This is especially true for digital products.

- Reducing regulatory burdens by increasing mutual recognition of the supervision carried out between jurisdictions.

Conclusions

The recent research and dialogues have highlighted the size and economic importance of migrant population, and their remittance behaviour has proven that there is a business case for migrant insurance. Migrants also face significant risks that are currently not being covered by traditional products.

Although there have been some efforts to develop insurance products for migrants, there are still barriers that need to be overcome, mainly related to regulation. These affect two main areas: lack of harmonisation between home and host countries, and KYC/AML requirements.

“Hopefully in five or six years we will be in a position where we have a panel to talk more about success stories on migrant insurance and pension systems than challenges”

Premasis Mukherjee, ICII 2022

Despite these challenges, there are attempts to overcome these by applying creative solutions and innovation, and regulators can help this process by increasing collaboration between jurisdictions, as well as increasing communication with other regulatory authorities.