IFRS 17: Implications for supervisors and the industry

IFRS 17: Implications for supervisors and the industry

After almost 20 years in the making, the release of International Financial Reporting Standard (IFRS) 17 Insurance Contracts has been heralded as one of the most significant recent developments in the insurance industry.

While many are anticipating implementation challenges, the new standard (starting for annual reporting periods beginning in 2023) is projected to have a positive impact on overall financial stability as well as improve the transparency and global comparability of insurers’ financial reports.

A2ii-IAIS Supervisory Dialogue

‘Comparability is very important to help ensure that all insurers are treated consistently from a supervisory perspective, especially if supervisory actions are to be taken on the basis of balance sheet triggers,' Jeffery Yong, Senior Advisor at Financial Stability Institute (FSI) put simply during the Supervisory Dialogue on Accounting Standards and IFRS 17 that took place on 28 January. He and Peter Windsor, Senior Financial Sector Expert at the International Monetary Fund (IMF) jointly presented highlights from their recent report on accounting standards and insurer solvency assessment. The report was based on a survey of 20 insurance authorities.

In the follow-up discussion, supervisors from Bank Negara Malaysia, the Arab Union of Insurance Supervisors, Cayman Islands Monetary Authority and Zimbabwe’s Insurance and Pensions Commission outlined some of the approaches their authorities have taken regarding IFRS 17. Common measures being taken by supervisors at the initial stages include establishing working groups and dedicated IFRS 17 preparedness committees. In addition, some authorities have started data collection exercises to assess regulatory preparedness, implementation risks and challenges. Lack of technical expertise, given the complexity of the standard, coupled with other issues - such as high costs - were mentioned as immediate challenges. On the general state of preparedness, supervisors are undertaking other initiatives that aim to raise awareness, monitor progress and facilitate engagements with the industry. For instance, to maintain a feedback loop with the industry, supervisors are conducting periodic onsite visits and requiring entities to provide regular updates on their implementation progress. Supervisors are also gauging industry preparedness by launching surveys and circulars that aim to track progress as well as better understand implementation challenges that insurance entities are facing.

Regulatory approaches

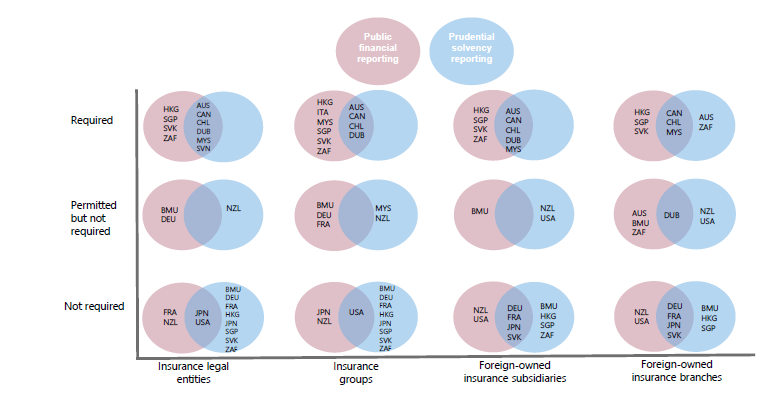

The implications of IFRS 17 for supervisors will depend on different regulatory approaches adopted, i.e., whether jurisdictions require accounting standards for prudential or public financial reporting purposes.

Source: FSI-IMF report[1] on accounting standards and insurer solvency assessment, p. 8

Notably here and as shown in the figure above, most of the surveyed authorities do not require insurers to use IFRS for prudential solvency reporting purposes. Only a handful require insurers to use IFRS for both prudential solvency reporting and public financial reporting. This pattern is very similar for foreign-owned insurance subsidiaries. As noted by Jeffery Yong, this is presumably because in most jurisdictions, the regulatory requirements imposed on foreign-owned entities do not vary greatly to requirements imposed on local insurers (see detailed breakdown in FSI-IMF report).

The requirements for insurance groups also follow a similar trend. The major difference here is that there are slightly more jurisdictions requiring groups to use IFRS for public financial reporting. Whereas for foreign-owned insurance branches, the requirements are varied, and jurisdictions adopt a wide range of approaches.

Interestingly, and contrary to findings of the FSI-IMF report, what emerged from a poll during the webinar is that the majority of the supervisors attending the Dialogue came from jurisdictions that require insurers to use accounting standards for regulatory solvency purposes.

What is the rationale?

Different regulatory approaches, as Jeffery Yong pointed out, are mostly due to historical or legacy carry over. They are a reflection of the different pace of development of regulatory frameworks as well as regulatory philosophies.

Beyond this, and in the view of the surveyed authorities, the main underlying reason is purely different objectives.

The primary aim of accounting standards is to provide transparent and comparable financial information on firms, including insurance companies, to enable investors and other market participants to make informed decisions. On the other hand, regulatory or prudential solvency standards are aimed at assessing the ability of insurers to meet their obligations to policyholders.

Section 3, 16, of the FSI-IMF report

Comparability

There is a general agreement that IFRS 17 will greatly improve comparability between insurers, and it is precisely this commonality that both accounting and prudential regulatory standards share, even though there are differences. Additionally, both sets of standards also provide an accurate reflection of the financial condition of firms.

Use of IFRS 17 for prudential purposes

Is IFRS 17 well suited to be used for regulatory solvency assessment of insurers? Interestingly, the majority of supervisors in the Dialogue gave an affirmative response to this question. On the other hand, few of the surveyed jurisdictions in the FSI-IMF report plan to adopt IFRS 17 for regulatory or prudential solvency purposes. Reasons being comparability, stability, differing objectives, costs and materiality issues. Some plan to use the standard as a starting point and modify it later for regulatory solvency purposes.

Notably, Peter Windsor, IMF, pointed out that their report’s findings also gave divided results on whether insurers need to implement IFRS 17 so that their financial positions are comparable across jurisdictions.

A concern among the surveyed jurisdictions is the principles-based nature of the standard that allows a wide range of accounting practices, which may lead to some differences in valuation results.

Section 6, 49, of the FSI-IMF report

Impact on supervisors

Supervisors generally agree that IFRS 17 will positively impact their markets, citing that the new standard will bring with it easier performance assessment, transparency of profitability trends, and updated measurements of insurance liabilities. Other supervisory implications that emerged include no material impact, higher premiums for policyholders or withdrawal of certain products.

Supervisors may need to review their regulatory approach. Particularly relevant for supervisors in emerging and developing economies is the application of a premium allocation approach - a simplified form of implementation of IFRS 17.

Several of such economies have large life insurance industries with long term products and have a significant amount of general insurance or life insurance, or property and casualty insurance. These are typically one-year sort of products and will fit into the premium allocation approach, which is a simplified approach, which would mean that implementation of IFRS 17 will be a little less complex in those jurisdictions that primarily have that kind of insurance landscape.

-Peter Windsor, Senior Financial Sector Expert at the International Monetary Fund (IMF)

What about IFRS jurisdictions where regulatory solvency assessment is not based on accounting standards? Do insurance supervisors need to consider IFRS 17? Poll results during the Dialogue showed that most supervisors agree that they need not be concerned about IFRS 17 in such cases.

Indeed, from a supervisory perspective, accounting standards may seem to be less relevant than prudential or regulatory solvency standards, but as Jeffery Yong highlighted, accounting standards will be useful to assess how sustainable an insurer’s business model is, for instance.

Impact on insurers

IFRS 17 is without a doubt a significant implementation challenge, so much so that, as Peter Windsor put it, it has been sometimes called an ‘IT project rather than an accounting project. This means there are operational risks attached to it. Further possible impact on insurers includes capital flight, a high cost of implementation (given that it is a more complex approach to insurance accounting compared to current practices), and misaligned incentives in terms of what supervisors and insurers should focus on. Supervisors and insurers in jurisdictions that do not use accounting standards should be aware that insurers can still be impacted by IFRS 17 (see page 13 of the report for more).

Where supervisors have carried out impact assessments on their insurers, a wide range of results have been revealed. For instance, it is expected that impact on non-life insurers will be less significant and particularly for short-term insurance business that qualifies for the simplified premium allocation approach. Furthermore, in the longer term, IFRS 17 will positively impact the sustainability of insurers’ business models as insurers will discontinue economically unprofitable products that relied on upfront profit recognition. Additionally, and in line with Insurance Core Principle 8 Risk Management and Internal Controls, IFRS 17 is expected to contribute positively to enhancing insurers’ enterprise risk management frameworks prompted by a need for insurers to have stronger actuarial functions and data governance controls. Finally, and as highlighted in the dialogue, under IFRS 17, it is expected that there will be potentially better market conduct outcomes in line with the principle of treating customers fairly, i.e. insurers will now be incentivised to maintain insurance policies for a longer period as their profits also emerge more gradually (see page 13 – 15 of the report for more).

Implementation challenges ahead

In many cases, the potential impact of IFRS 17 remains a grey area as the majority of the surveyed jurisdictions reported not to have undertaken any impact assessment studies. Yong and Windsor recommended that supervisors should be organizing or advocating quantitative impact studies no later than this year. Their advice for supervisors who do not intend to use IFRS 17 as a basis for solvency assessment is to still have consultations with the industry about the standards, and in the medium term, reconsider implementing them.

Furthermore, to facilitate implementation, technical expertise is needed given the principles-based nature of the standards. This is already a major challenge given the overall shortage of actuarial and accounting experts, particularly in emerging and developing economies.

Certainly, this has just been the tip of the iceberg. The FSI-IMF report gives a deeper overview, and for greater detail on what came up during the webinar, including how some Regulatory Preparedness Committees are operating, see the presentations on our website here. The recording of this webinar is also available on request for insurance supervisors only.

[1] This report is also available as Working Paper No.20/146 on the IMF website.