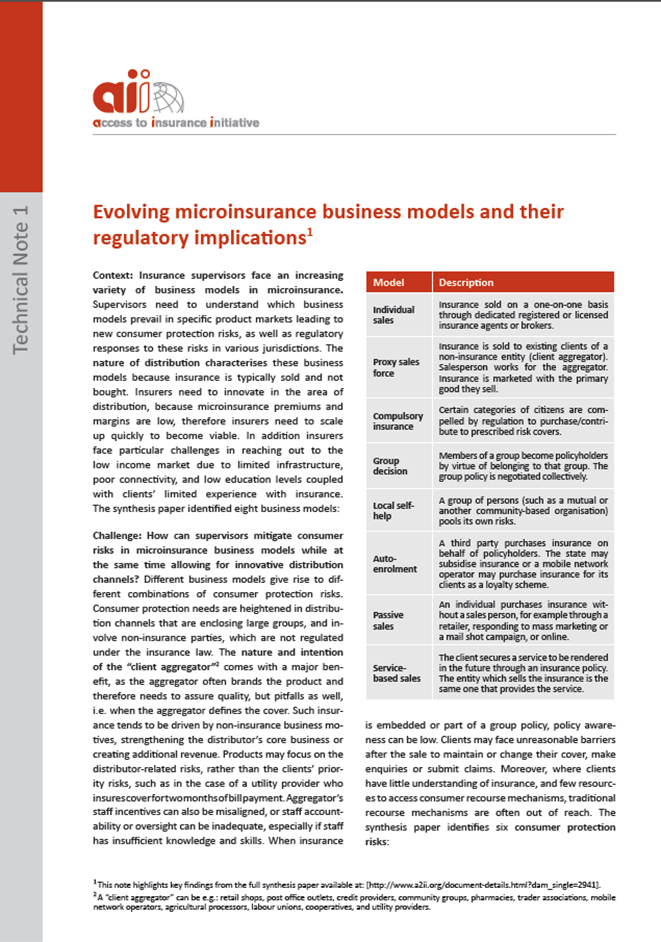

Context: Insurance supervisors face an increasing variety of business models in microinsurance. Supervisors need to understand which business models prevail in specific product markets leading to new consumer protection risks, as well as regulatory responses to these risks in various jurisdictions.

Context: Insurance supervisors face an increasing variety of business models in microinsurance. Supervisors need to understand which business models prevail in specific product markets leading to new consumer protection risks, as well as regulatory responses to these risks in various jurisdictions.

The nature of distribution characterises these business models because insurance is typically sold and not bought. Insurers need to innovate in the area of distribution because microinsurance premiums and margins are low, therefore insurers need to scale up quickly to become viable. In addition, insurers face particular challenges in reaching out to the low-income market due to limited infrastructure, poor connectivity, and low education levels coupled with clients’ limited experience with insurance.