A2ii Newsletter 06/21

Welcome! In this newsletter, we provide you with updates on the work of the A2ii, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Subscribe to our mailing list to receive our newsletter in your inbox.

Navigation

Recent Events | Upcoming Events | Useful tools on our website

The A2ii taking precautionary measures related to Covid-19

To safeguard the well-being of the A2ii staff and its partners, the A2ii is currently conducting all its activities through virtual formats. As soon as it is possible, we will announce a return to physical events. The A2ii will continue to communicate any changes pertaining to our events on our website, social media channels and through our newsletter.

Recent events

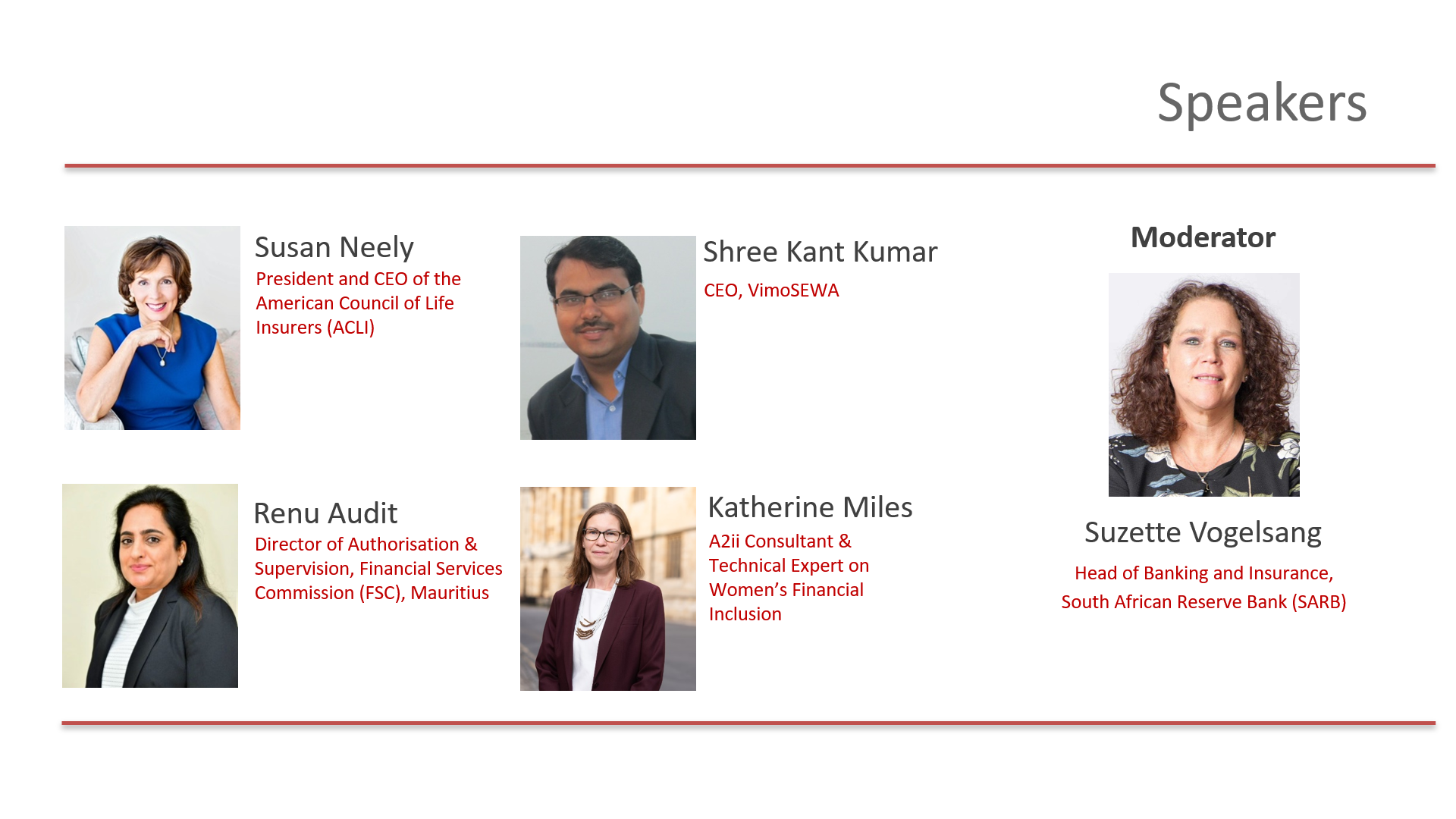

Women's Access to Insurance - A2ii-IAIS Public Dialogue | 27 May

The A2ii and IAIS welcomed close to 100 participants during the Public Dialogue on Women’s Access to Insurance.

The dialogue was moderated by Suzette Vogelsang, Head of Banking and Insurance at the South Africa Reserve Bank (SARB). Katherine Miles, A2ii consultant and technical expert on women’s financial inclusion, presented some insights from the upcoming A2ii report on ‘The Role of Insurance Supervisors in Boosting Women’s Access to Insurance’. Her presentation covered how the insurance sector and regulatory approaches can help increase women’s access to insurance, the current status of women’s access to insurance, and the particular need for data on supply and demand. She highlighted how gender-diverse leadership in insurance companies can improve performance – both in terms productivity and also also actions that facilitate access to insurance for women.

The discussion began with an overview of some of the critical barriers limiting women’s access to financial services and insurance. VimoSEWA shared their experience in India and how they have addressed these barriers, while FSC Mauritius touched on their work in promoting gender equity at a national level in Mauritius, including supervisory challenges and opportunities. The regulator is also playing a broader role in fostering access to insurance for women through financial education initiatives and increasing the composition of women within the labour force at the FSC.

In terms of global efforts, ACLI brought participants’ attention to the recently launched B20 special initiative on Women’s Empowerment and how it seeks to support the empowerment of women in the financial service sector.

To wrap up, all speakers shared their insights on how the insurance sector can leverage various digitalisation efforts to address traditional barriers that hinder access to insurance for women.

Keep an eye on our Knowledge Hub, where A2ii’s report on ‘The Role of Insurance Supervisors in Boosting Women’s Access to Insurance’ will soon be published. The recording of this Public Dialogue is available in English, French, and Spanish on the A2ii website and our YouTube channel.

iii-lab Second International Process | March-May

Despite the continued Covid-19 restrictions, the second international process of the iii-lab has made fruitful progress. Each of the four country teams hosted a learning journey, inviting their peers to virtually visit their countries and learn more about local innovations not only from the insurance world. In between the sessions, the teams have been diligently working to further develop their prototypes, choosing solutions based on issues facing the insurance market in their jurisdictions.

Argentina’s prototype focuses on raising insurance awareness and addressing cultural barriers. Their prototype involves all insurance companies working together on a social media campaign to inform the public about insurance, using tools such as storytelling and gamification. One of India’s groups is working on awareness as well; their solution proposes working with caller tunes so that people hear a message about insurance while waiting for their phone call to be answered. India’s second sub-team is developing a combi-product covering multiple risks, addressing the barrier of managing multiple products and receiving quality servicing. The prototype would entail a one-stop-shop and robust use of technology. The Moroccan team wanted to address high costs of health services in their country and developed a solution to utilise mobile phones to offer management of a minimum insurance coverage, including access to doctors through WhatsApp and lower, negotiated prices for medical services among other services.

Team Rwanda is addressing the lack of trust and information in the insurance industry, as well as a lack of products which address the needs of the population. They are using platforms like the radio, Facebook, and Twitter to raise awareness and receive feedback on customers’ needs in order to design better insurance products.

On 6 May, the teams’ hard work on their prototypes culminated in an impressive series of presentations during the pitching session. They presented an elevator pitch of their prototypes to a panel of three experts: Natalia Escobar-Mejia, Senior Policy Advisor at the IAIS, Martin Mayer, co-founder of Romeo, and Emmanuel Mokobi, CEO of Prudential Life Insurance Ghana. The panel observed the teams’ pitches and after a round of open questions, provided valuable feedback and suggestions which the teams are using to move their prototypes forward.

Upcoming events

Apply now for the CEET Inclusive Insurance Training Programme: focus on climate change and technology | 11 June

Are you an insurance supervisor from Central Europe, Eastern Europe or Transcaucasia? Would you like to better understand how themes such as climate change and technology impact the insurance sector? Apply by 11 June for the Inclusive Insurance Training Programme from A2ii and the Toronto Centre, offered free of charge to insurance supervisors.

The Programme is a combination of self-paced learning modules and live virtual sessions taking place in English from 5 to 13 July 2021. The training program is built on the IAIS Application Paper on “Regulation and Supervision Supporting Inclusive Insurance Markets” and allows participants to expand their existing supervisory skills and knowledge to develop the leadership skills needed to make positive change.

This program will have a focus on how climate change and technology are impacting access to insurance and supervision.

For supervisors wishing to participate from other regions, please register, and the A2ii Secretariat will contact you depending on available spaces. For more information, please click here.

Apply now for the Inclusive Insurance Innovation lab (iii-lab) on Climate | 18 June

The 3rd Inclusive Insurance Innovation Lab (iii-lab) 2021-2022 is an international capacity-building programme where 3-4 country teams composed of key stakeholders from the insurance sector will work on innovative insurance solutions to tackle one of the greatest global threats of our time – the impact of climate change, especially on the most vulnerable segments of the population.

The iii-lab will be guided by the following question: How can we help increase the resilience of the most vulnerable segments in our society against the impacts of climate change through innovative insurance solutions?

The deadline has been extended to 18 June. Click here for more information.

A2ii-IAIS Supervisory Dialogue on Climate-related risks in the insurance sector | 8 July

Globally, there is an increasing understanding and awareness of the potential impact of climate change on the financial system, including the insurance sector. Climate change, and the corresponding adaptation and mitigation initiatives, such as the reduction of greenhouse gas emissions (GHG), are expected to have wide-ranging impacts on the structure and functioning of the global economy and financial system. For the insurance industry, climate change also presents an opportunity to build greater resilience. Meanwhile for supervisors, an adequate response will be required to address both the risks and opportunities emerging from climate change, including meeting the objectives of protecting policyholders, contributing to financial stability and promoting the maintenance of a fair, safe, and stable insurance market.

On 8 July, the A2ii and IAIS will be hosting a dialogue based on the Sustainable Insurance Forum (SIF) and IAIS joint Application Paper on the Supervision of Climate-Related Risks in the Insurance Sector. The paper aims to support supervisors in their efforts to integrate climate risk considerations into the supervision of the insurance sector.

Participants will hear from experts from the SIF and IAIS who will present highlights from the application paper as well as invited supervisory authorities who will share experiences related to supervision of climatic risks in emerging and developing markets.

This webinar will be open to supervisors only and will take place at 10:00 CEST in English (with simultaneous French interpretation) and 16:00 CEST in English (with simultaneous Spanish interpretation). It will last one hour and will take place via WebEx.

Click here to register.

If you have any questions or comments, please send them to dialogues@a2ii.org.

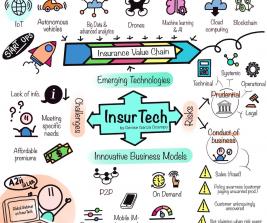

Regional Conference on Inclusive Insurance in the CEET region | 1-2 September

Access to affordable insurance plays an important role in sustainable economic development. There is a need for all stakeholders to work together in addressing the insurance protection gap in the region. The significant uninsured exposure to national catastrophes remains a particular challenge of climate change.

Policymakers need to align their disaster prevention and relief efforts with additional risk management tools, such as insurance, to facilitate market development.

Representatives from supervisory authorities, the industry and stakeholders involved in inclusive insurance are invited to discuss how new tech-enabled business models and supervisory approaches could help increase the very low insurance penetration rates across Central and Eastern Europe and the Transcaucasian (CEET) region.

This virtual event is hosted by the Access to Insurance Initiative (A2ii), Insurance Supervision Agency of Slovenia (AZN), International Association of Insurance Supervisors (IAIS), Munich Re Foundation, and the Microinsurance Network (MiN). It will take place on 1-2 September, divided into four sessions:

Session 1: Overview of the Inclusive Insurance landscape in the CEET Region

Session 2: Climate risk and agricultural insurance

Session 3: Digitalisation

Session 4: How to create value for customers

Registration is open now at this link.

Useful tools on our website

Covid-19 Insurance Supervisory Response Tracker

Global tracker of supervisory responses, insurance news and learning resources. Share relevant news with us via secretariat@a2ii.org, by tagging Access to Insurance Initiative on LinkedIn or by mentioning us on Twitter.

Supervisory KPIs Lexicon

Interactive, searchable directory of KPIs for insurance supervisors across four pillars: prudential soundness, market conduct, insurance market development and the Sustainable Development Goals.

Inclusive Insurance Regulations map

The interactive map incorporates data about existing inclusive insurance regulation and regulation which supports inclusive insurance sourced through A2ii's research, work and interaction with supervisory authorities worldwide.

Insurance and the Sustainable Development Goals (SDGs)

The SDG pages include resources on the importance and the role of insurance across nine SDGs: 01 No Poverty, 10 Reduced Inequalities, 02 Zero Hunger, 03 Good Health and Well-being, 05 Gender Equality, 08 Decent Work and Economic Growth, 09 Industry Innovation and Infrastructure, 13 Climate Change and 17 Partnerships for the Goals.

ICP Self-assessment Tool

The tool is intended to help supervisors assess the level of observance of the Insurance Core Principles (ICPs).