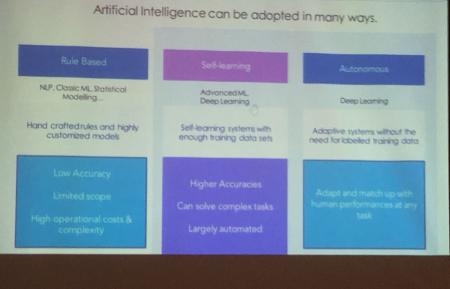

InsurTech — the variety of emerging technologies and innovative business models that have the potential to transform the insurance business — holds vast potential for improvements in insurance product design, the development of better-tailored products and reducing administrative costs. These efficiency gains can lead to lower premiums, better client servicing and faster payouts.

According to the World Insurance Report 2017, there are now around 1,000 InsurTech start-ups representing a combined investment of USD 2 billion. These pioneers are making use of big data and advanced data analytics to develop ways of digitising processes from initial application and contracting, through to premium collection and payouts for claims, using mobile and blockchain technology and experimenting with new business models, such as peer-to-peer insurance.

While the InsurTech revolution undoubtedly offers vast and untapped opportunities, it also embodies a challenge for regulatory frameworks that must now consider new business models, new actors in the insurance value chain, data protection, cybersecurity and consumer education. To meet this challenge, supervisors have to strike a balance between facilitating innovation, increasing the inclusiveness of the insurance sector, and maintaining the conditions for a fair, safe and stable insurance sector for the benefit and protection of policyholders.

The 12th Consultative Forum on microinsurance regulation for insurance supervisory authorities, insurance practitioners and policymakers addressed the consequences of rapid technological change in the inclusive insurance sector, exploring how regulators are responding to the need for oversight, consumer protection, stability in the business and financial systems while supporting and encouraging innovation.

Presentations

Panel 1: InsurTech applications in inclusive insurance and related regulatory challenges in Asia

Tang Loaec, Founder, P2P Protect, TongJuBao, China

Monnida Musicabud, Strategic Development and Regional Head of Emerging Customer Strategy Department, AXA Asia, Thailand

Vinay Kumar Sankarapu, Founder and CEO, Arya.ai, India

Panel 2: supervisory approaches on InsurTech and regulatory challenges: how can supervisors support innovation while protecting the customer?

Peter van den Broeke, Senior Policy Advisor, International Association of Insurance Supervisors (IAIS)

Sabahat Ul Ain, Deputy Director, Policy, Regulation and Development Department, Insurance Division, Securities and Exchange Commission of Pakistan

Yegnapriya Bharath, Chief General Manager, Non-Life Department, Insurance Regulatory and Development Authority of India

Focus group 4: Block chain and digitisation of insurance processes

Peter van den Broeke, Senior Policy Advisor, International Association of Insurance Supervisors (IAIS)