Access to Insurance Initiative Newsletter 4/2017

Welcome to our monthly newsletter, where we update insurance regulators and supervisors on the work of the Initiative, inform you about events and publications, and share experiences and learning across jurisdictions.

Visit us at www.a2ii.org.

Recent Events

Responsible Finance Forum VIII on "Opportunities and Risks in Digital Financial Services - How do we best Protect Consumers and their Privacy?"

27 - 28 April, Berlin, Germany

Last week A2ii attended the 8th Responsible Finance Forum, which discussed the Opportunities and Risks in Digital Financial Services and how to protect consumer data and privacy. This year’s Forum was hosted by the German Federal Ministry for Economic Cooperation and Development (BMZ), preceding the Forum and Plenary of the G20 Global Partnership for Financial Inclusion (GPFI) on 2-4 May 2017 in Berlin. The Forum is co-organized by The Better Than Cash Alliance, Consultative Group to Assist the Poor (CGAP), Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH, International Finance Cooperation (IFC), United Nations Capital Development Fund (UNCDF) and the World Bank.

Digital Financial Services hold enormous potential for financial inclusion, having enabled 700 million adults access to financial services between 2011 and 2014 alone. At the same time, digitization in the financial sector raises new challenges related to data protection and privacy. These specific challenges are particularly related to the usage and (often automated) processing of alternative data or big data for decision-making processes in the financial services. The event sought to identify areas for action and investment to advance responsible finance.

Jonathan Dixon, Chair of the IAIS Implementation Committee and Chair of A2ii and Deputy Registrar at the Financial Services Board South Africa, spoke about the opportunities for insurance, how having more risk information can support underwriting and how efficiency can be improved and that Digital Financial Services allow creating incentives for consumers to change their behavior, but also talked about the consumer protection risks and the risk of financial exclusion for vulnerable customers and the new players that emerge in the market. Supervisors need to ensure the fair treatment of customers and concluded that supervisors need to better understand the risks and emphasized that public-private cooperation between the regulator and the industry is important.

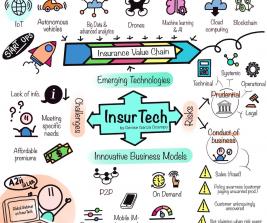

Peter van den Broeke from the IAIS Secretariat highlighted the need for cooperation between the insurance supervisor, the data protection regulator and other regulators. Insurance supervisors need to look at what data is collected and how it is used to calculate premiums. To support insurance supervisors the IAIS recently published a report on FinTech Developments in the Insurance Industry and is currently developing an Application Paper on the Use of Digital Technology in Inclusive Insurance. As member of the IAIS drafting group on the Use of Digital Technology in Inclusive Insurance, the A2ii supports the development of this Application Paper.

ASSAL Conference on “Pension System: Challenges and Perspectives” and ASSAL-FSI-IAIS High-Level Meeting on “Global Insurance Standards and Supervisory Priorities in the Americas”

17-20 April 2017, Santiago, Chile

On 17-18 April, the A2ii attended a conference on “Pension System: Challenges and Perspectives. The role of Pension Fund Managers and Insurance Companies”, which was jointly organised by the Association of Latin American Insurance Supervisors (ASSAL), the International Association of Pension Fund Supervision Agencies (AIOS) and the International Association of Insurance Supervisors (IAIS) in Santiago, Chile. The event looked at challenges and perspectives relating to pension systems, such as mechanisms for mitigating the longevity risk and adjustments to current parameters of pension systems, among other topics.

In the context of the ASSAL Conference, the Financial Stability Institute (FSI), jointly with ASSAL and the IAIS, organised a “High-Level Meeting on Global Insurance Standards and Supervisory Priorities in the Americas” on 20 April. Besides presenting and discussing insurance regulatory reforms and implementation in the region, the seminar tackled specific topics of particular relevance for Latin American countries such as insurance capital standards for internationally active insurance, reinsurance supervision and InsurTech. The seminar was attended by almost 50 insurance supervisors from Latin America.

Increasing Women’s Financial Protection: What Can Insurance Do?

20 April 2017, Washington D.C.

At a side event to the 2017 World Bank Group-IMF Spring Meetings on “Increasing Women's Financial Protection-What Can Insurance Do?” insurance supervisors, industry representatives, development partners and civil society organisations discussed the role of the insurance industry and its stakeholders in increasing financial protection for women through targeted approaches. The event marked the launch of ''Mainstreaming Gender and Targeting Women in Inclusive Insurance: Perspectives and Emerging Lessons ", which was prepared by GIZ on behalf of the German Federal Ministry for Economic Cooperation and Development (BMZ), IFC, Women’s World Banking and A2ii (see below). During the event, these organisations committed to continue their collaboration, under the umbrella of the G20 Global Partnership for Financial Inclusion (GPFI), to build evidence for the business case, engage stakeholders and enhance knowledge sharing to stimulate the market development of women-targeted inclusive insurance.

More information on the event, including a link to the recording, can be found here.

Download the compendium “Mainstreaming Gender and Targeting Women in Inclusive Insurance” in the Recent Publications section below.

Participate in our Events!

22nd A2ii-IAIS Consultation Call on “The Importance of Insurance Regulation in Disaster Resilience”

18 May 2017

Our next Consultation Call will be held on 18 May on the topic of “The Importance of Insurance Regulation in Disaster Resilience”. This call will explore the important role that insurance regulation plays in facilitating the deployment of insurance sector resources at the macro, meso and micro level in a given country or region to enhance resilience to natural catastrophes. In the call, we will discuss the scale and nature of the exposure, specific laws and regulations that could facilitate – or impede – deployment of insurance sector resources.

Four calls will be held, two in English at 10am and 3pm CEST, one in French at 12am CEST and one in Spanish at 5pm CEST.

To register or for more information, please click here.

We are always keen to hear preferred topics from supervisors and encourage you to submit any requests for future calls either to consultation.call@a2ii.org or through our website.

10th Consultative Forum on ‘Scaling up agricultural index insurance in Africa: building disaster resilience of smallholder farmers’

24-25 May 2017, Kampala, Uganda

The African Insurance Organisation, IAIS, the Microinsurance Network and the A2ii will hold its 10th Consultative Forum on “Scaling up agricultural index insurance in Africa: Building disaster resilience of smallholder farmers” on the afternoon of Wednesday, 24th May and morning of Thursday, 25th May 2017 in Kampala, Uganda.

This Forum will focus on the challenges and opportunities of agricultural index-based insurance and explore how the various stakeholders – insurance supervisors, the industry, policymakers and donors – can cooperate and align their respective roles to achieve sustainability and scale while ensuring fair treatment of smallholder farmers.

The Consultative Forum takes place alongside the 44th AIO Conference and General Assembly. Supervisors, policymakers and industry players are highly welcome to attend.

Further information and the draft agenda are available here. To register, please click here.

For queries please contact A2ii Sub-Saharan Africa regional coordinator Janice Angove (janice.angove@fsb.co.za).

Recent Publications

Mainstreaming Gender and Targeting Women in Inclusive Insurance: Perspectives and Emerging Lessons

The collection of notes and case studies, “Mainstreaming Gender and Targeting Women in Inclusive Insurance: Perspectives and Emerging Lessons”, covers a number of themes related to the demand and supply of insurance products for women, with a focus on the inclusive insurance market. The publication highlights how the insurance needs of women are different from those of men: women are more at risk of losing their income because of pregnancy, divorce or separation, as well as constraints imposed by society and laws. The insurance industry can play a major role in increasing financial protection for women—including those from low-income levels—through approaches that target their specific needs. Insurance companies can design coverage for their illness, pregnancy, and assets, while protecting their savings to cope with financial challenges.

The compendium also emphasises the role of insurance industry stakeholders in bringing a women-oriented focus to inclusive insurance. In particular, insurance regulators and supervisors can play an important role in promoting inclusive insurance for women by removing regulatory barriers that hinder women’s access to insurance, gathering and analysing sex-disaggregated industry data on access and usage of insurance by diverse product types, and adapting complaint infrastructure to ensure it is accessible and responsive to women’s needs in order to address consumer protection concerns for women.

This publication was developed as part of a collaborative effort between GIZ’s Sector Initiatives Social Protection and Global Initiative for Access to Insurance on behalf of the German Federal Ministry for Economic Cooperation and Development (BMZ), International Finance Corporation, Women’s World Banking, the Access to Insurance Initiative, and the Self-Employed Women’s Association.

Download the complete Compendium here. The A2ii’s contribution on “The Role of Insurance Regulation in Promoting Inclusive Insurance for Women” is available in English, French and Spanish.

Spanish reports of the 17th, 18th and 19th A2ii-IAIS Consultation Calls

The Spanish reports from Consultation Calls 17-20 are now available. Please see below for details on each report.

17th A2ii-IAIS Consultation Call on “Experiences in implementing regulatory frameworks for inclusive insurance” held on 21 July 2016. Available here.

18th A2ii-IAIS Consultation Call on “How supervisors can help enable access to insurance for migrants” held on 22 September 2016. Available here.

19th A2ii-IAIS Consultation Call on “Data protection challenges in mobile insurance” held on 24 November 2016. Available here.

Report of 20th A2ii-IAIS Consultation Call on ‘Reinsurance’

The report from the 20th Consultation on ‘Reinsurance’, which took place on 26 January 2017, is now available in French and Spanish. The topic of the call was selected in response to requests from the IAIS Executive Committee as well as Latin American supervisors and welcomed a record number of participants. To read more about discussions and content please click here.

Announcements

Staffing Update

We are very happy to welcome Benjamin A. Antwi-Boasiako to our team. Amongst other activities, Benjamin will be supporting A2ii’s knowledge generation work, in particular in the area of agricultural insurance and disaster resilience, our capacity building activities as well as our communication activities.

He has ten years of insurance industry experience, including index-based insurance product development. A Chartered Insurer and an Associate of the Chartered Insurance Institute of London (CII), Benjamin is currently finalising his PhD at Technische Universität Dresden, Germany, which focuses on the insurance of extreme natural events in developing countries.