Third Inclusive Insurance Innovation Lab (2021-2022)

Third Inclusive Insurance Innovation Lab (2021-2022)

In September 2022, alumni from all three labs gathered in Frankfurt for an International Dialogue.

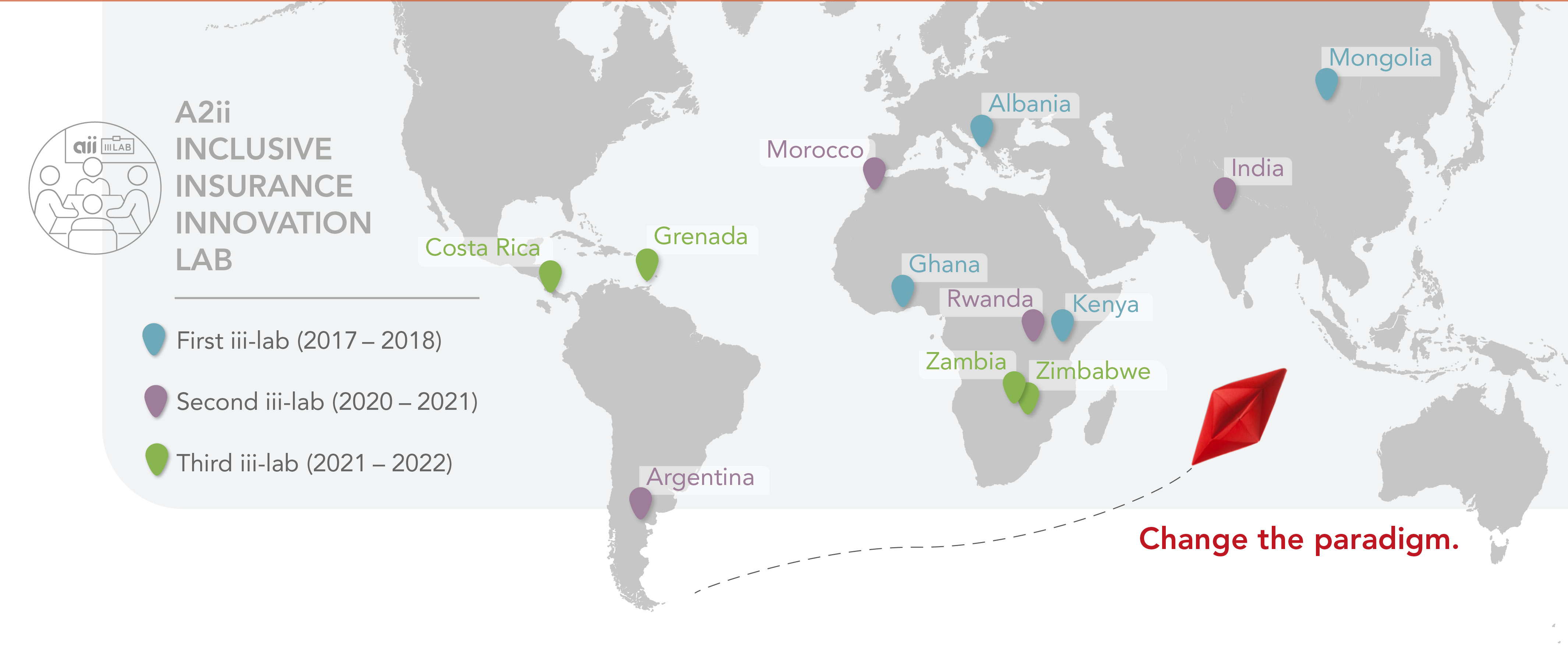

The Access to Insurance Initiative (A2ii), supported by InsuResilience Global Partnership and Reos Partners, launched the third Inclusive Insurance Innovation Lab - the climate lab - in October 2021. This is the first lab with a topical focus. Relevant stakeholders from the (inclusive) insurance sector will engage in dialogue and mutual learning and develop innovative solutions to tackle one of the greatest global threats of our time - climate change.

The key question

How can we help to increase resilience of the most vulnerable segments in our society against the impacts of climate change through innovative insurance solutions?

Climate and insurance

Insurance, as part of an integrated disaster risk management framework, can strengthen the resilience of governments, businesses and individuals against the impact of natural disasters and protect natural and heritage ecosystems from adverse effects of climate change. Yet, in most developing and emerging economies, insurance penetration rates are low and vast segments of the low-income population as well as micro and small businesses remain excluded from financial protection from natural and climate risks.

The current Covid-19 pandemic has magnified existing vulnerabilities. How can we ensure that the measures that will be implemented to build back better will also increase resilience against future catastrophes, especially natural catastrophes and climate risks? The iii-lab country teams from Costa Rica, Grenada, Zambia and Zimbabwe are working together during the dynamic lab process to address this challenge.

The process

The third iii-lab is taking place virtually from October 2021 – October 2022. The process is split into three phases where each phase consists of a national and an international component. The objectives and timelines for each phase are described below:

Discovery Phase (October – December 2021:) Participants get to know each other more closely and reflect on pressing issues regarding natural and climate risks in their country. Based on this analysis teams define their focus/innovation areas. All country teams meet in global sessions to discuss the main challenges identified at the national level. Participants share knowledge, practice and experience from different jurisdictions, sectors and perspectives.

Innovation phase (January – May 2022): Country teams start developing the ideas for the innovations needed in their respective countries and prototype the most promising ones. During an international innovation event all country teams present their prototypes and receive feedback by their peers and international experts. Experience and knowledge is transferred across teams. Each country team leaves with a designed experiment and testing plan to check if their prototypes work in the real world.

Implementation phase (June – September 2022): The country teams start experimenting, testing and implementing the newly developed prototypes. Peer supporting sessions are held in which all country teams participate. Country teams are able to learn from each other’s challenges in implementation, receive feedback and renew motivation for their implementation.

One year after the first national workshops, the Inclusive Insurance Innovation Lab officially comes to an end while the implementation of innovations continues under the responsibility of the country teams. Results of the lab will be disseminated nationally by the country team and on a regional and global basis through A2ii.

Participating countries

Participants in the climate lab are: Costa Rica, Grenada, Zambia and Zimbabwe.

Participating organisations

Costa Rica: Superintendencia General de Seguros (SUGESE), Instituto Costarricense de Turismo, Instituto Nacional de Seguros (INS), BN Sociedad Corredora de Seguros, S.A., SAGICOR Seguros, Pan-American Life Insurance, Aseguradora del Istmo, Seguros Lafise, Popular Seguros Correduría de seguros S.A.

Grenada: Grenada Authority for the Regulation of Financial Institutions (GARFIN), Ministry of Agriculture, Lands and Forestry (MoA), Ministry of Tourism, Civil Aviation, Climate Resilience and the Environmet, Ministry of Finance, Economic Dev, Physical Dev and Energy (MoF), Grenada Development Bank (GDB), Grenada Cocoa Association (GCA), Grenada Co-aperative League Limited (GCLL), Grenada Co-operative Nutmeg Association (GCNA)

Zambia: Pension and Insurance Authority (PIA), Microinsurance Technical Advisory Group (TAG Zambia), Ministry of Finance, Insurance Brokers Association of Zambia (IBAZ), FSD Zambia, Mulimi (a social enterprise working with farmers) and Muzika (A non-profit working with small holder farmers), Insurance Association of Zambia, Zambia federation of associations of women in business - works with women farmers (ZAFWEB).

Zimbabwe: Insurance and Pensions Commision (IPEC), AFC (formerly Agribank), Insurance Council of Zimbabwe (ICZ), Insurers Brokers Association of Zimbabwe (IBAZ), World Food Programme Zimbabwe (WFP), Zimbabwe Farmers Union (ZFU), Women Farmers Land and Agriculture trust (WFLA), Ministry of Agriculture (MoA), Ministry of Finance (MoF)

Further information

Photo gallery

iii-lab 3 Flyer

Click the button below to download and view the flyer.

Latest Updates

2 years later – what are the long-term outcomes?

Costa Rica

Team Costa Rica conceived “Fu-Turismo”, an open climate web tool to build awareness of climate change in the tourism sector while at the same time promoting risk reduction and coverage solutions. Primary beneficiaries of this innovative tool are micro, small, and medium entrepreneurs from the tourism sector, which are heavily affected by the impacts of natural and climate events.

The tool is a one-stop-shop solution with three key modules designed to help MSMEs from the tourism sector to 1) understand climate related hazards that have the potential to damage their businesses, 2) to assess the specific level of risks based on the geographic location and characteristics of the business, etc.; and 3) to take action to strengthen the resilience of their businesses, staff members and communities against natural events, e.g. through the purchase of an adequate insurance product. After the official end of the program, the team partnered with GIZ Costa Rica to contract a project manager to develop and launch the web tool. In addition, the project is one of the three national projects chosen to be part of the Global Risk Management Alliance (GRMA) support for Costa Rica which aims to give a risk assessment to quantify flood risk and probabilistic risk estimation, current and future, as basis for developing financial resilience options in the tourism sector.

“For us, the lab was an incredible personal and professional experience; it was of great growth and learning. For the Costa Rica team, it was an experience in which we learned to work with a multi-sectoral approach, all for the same purpose. This work dynamic we learned, and we continue to apply it in other projects, focusing on problems rather than jumping straight to solutions, and take the necessary time to develop solutions that truly impact the purposes we seek.” – German Rodriguez, SUGESE

Grenada

Team Grenada intended to create a Mutual Risk Pool to assist farmers and fisher-folk severely impacted by the effects of climate change, mainly the increasing number and frequency of hurricanes. However, due to the various challenges encountered by the team, an alternative instrument was explored. As a result, the Supervisory Authority (GARFIN) approved a parametric insurance product offered in other countries in the region. The product provides insurance protection against tropical cyclones ranging from tropical storms to category 5 hurricanes. One of the iii-lab members, the Grenada Co-operative League, is serving as an agent ensuring access to their members. Farmers can purchase coverage through the agent or register directly with the insurance company. The launch of the product was accompanied by marketing and awareness campaigns through radio and television and as such the wider public is aware. A first payout was triggered when hurricane Beryl hit Grenada in July 2024. This could provide substantial protection to those already subscribed for the policy and led the solution into a ‘tested and proven’ status, generating expectations of faster demand growth in the following months and years. After the successful launch of the first parametric hurricane protection product, two other insurance companies on the island have applied for a license to offer similar coverage.

Zambia

Recognising a significant gap in insurance awareness among farmers, the team identified an opportunity to enhance vulnerable populations' understanding of insurance and connect them to existing climate risk-based products, such as Weather Index and Agriculture Insurance. Their approach involved engaging community champions and distributing printed materials to raise awareness across all ten provinces of Zambia while mobilising multiple stakeholders to support the initiative. The team successfully developed educational materials and secured external funding for printing.

Following the official conclusion of the lab, the Insurance Supervisory Authority integrated the team’s prototype into two key initiatives launched in 2022/23: an Insurance Ambassadors Program and a cooperation agreement with the IFC to seek technical support for scaling consumer awareness efforts under various agricultural insurance programs.

The Insurance Ambassadors Program was designed to equip ambassadors with essential knowledge about insurance, enabling them to educate their communities on policyholder benefits, rights, and responsibilities. A major barrier to market penetration had been the lack of trust in insurance products. Ambassadors discovered that even farmers enrolled in government-subsidised insurance programs were often unaware they had insurance until the campaign reached them through trusted community members in their new roles as Insurance Ambassadors.

As of July 2024, the program has trained over 420 individuals, including agricultural extension officers, civic leaders, market vendors, teachers, and university students, covering four agriculturally dominant provinces. Beyond raising awareness, the campaign is expected to foster greater engagement, encouraging policyholders to provide feedback on existing insurance products.

Looking ahead, the next milestone is to train 1,000 representatives across various regions of Zambia by the end of 2025, further strengthening insurance literacy and trust among smallholder farmers and rural communities.

“This is proving to be an effective model, as most of those trained, such as extension officers and teachers, are trusted members of the community when it comes to knowledge acquisition.” Doreen Kambanganji, Communications Manager at Pensions and Insurance Authority, Zambia

Zimbabwe

In Zimbabwe, the team developed a parametric insurance product called Farmer’s Basket, designed to enhance resilience and provide financial protection against climate and disaster risks for smallholder farmers in rural areas. The product is bundled with essential agricultural inputs such as pesticides, fertilizers, and irrigation equipment.

In 2024, the team piloted the in the Goromonzi area, reaching over 4,000 smallholder farmers. Feedback from farmer interviews and focus group discussions highlighted concerns over high premium rates and challenges with distribution channels. However, the strong interest from farmers prompted the Insurance Council of Zimbabwe (ICZ) – a consortium of short-term insurers and reinsurers - to step in as the underwriter and offer financial and logistical support for the initiative.

In October 2024, nearly 1,800 smallholder farmers—about 65% of them women— celebrated a significant milestone as they received their first insurance payouts under the Farmer’s Basket. Each farmer received $65 as compensation for maize production losses suffered during the 2023-2024 agricultural season, which was severely impacted by an El Niño-induced drought. The farmers paid $15 premiums. The payout provided much-needed relief, demonstrating the critical role of innovative insurance solutions in mitigating climate-related risks, and supporting farmers’ livelihoods.

Riding on the success of the Farmer’s Basket, ICZ collaborated with the Government of Zimbabwe and other partners to expand the programme to other parts of the country’s eight rural provinces. As a result, nearly 17, 000 smallholder farmers signed up for the Farmer’s Basket in the 2024/25 farming season.

“The iii-lab improved my leadership skills, it taught me how to listen to others, to the small voices. Most people will design products from a bottom perspective without consultations with the consumers of the product. The lab taught me that if you engage you learn a lot more from the people”. - Sibongile Siwela, Insurance and Pensions Commission (IPEC), Zimbabwe

Lab alumni speak on their experiences

German Rodriguez, Costa Rica, iii-lab 3

Sibongile Siwela, Zimbabwe, iii-lab 3

Follow-up Call on Innovations

After an eight-month hiatus, the third inclusive insurance innovation (iii) lab had a follow-up call on 22 June 2023. The purpose of this call was for iii-lab participants from Costa Rica, Grenada, Zambia and Zimbabwe to update on the initiatives undertaken and implementation progress of respective prototypes developed since October 2021. Each of the countries provided the following updates:

-

Costa Rica

Costa Rica’s climate web tool "FuTurismo” is an online platform to help build awareness on the impact of climate change within the small and medium enterprises tourism sector. In addition, it provides risk assessments and sustainable risk management solutions including insurance. The team began working on a roadmap for the development of the prototype and is currently in the process of hiring a project manager to help implement the different modules of the web tool. The team is also engaged in close consultations with various government agencies to ensure that the tool covers various aspects of climate risk resilience as broadly as possible. Participants were also updated of Costa Rica’s intention to be a member of the Global Risk Modelling Alliance.

-

Grenada

Grenada’s innovation of a mutual risk pool was developed to provide farmers and fisherfolk relief after a declared climate risk related event. This has resulted in a partnership with a company that offers parametric solutions to provide coverage through a product called “flexible hurricane protection (FHP)”. This product is designed to provide insurance protection against tropical cyclones ranging from tropical storms to category 5 hurricanes. The team is now planning to promote the product and raise the awareness of the target group using different channels like town hall style meetings, as well as television and radio. In addition, deliberations are ongoing to try and secure financing to lower premiums and increase coverage.

-

Zambia

Following an observed gap in insurance awareness among farmers, the Zambia team saw an opportunity to design a solution to increase vulnerable populations’ knowledge of insurance through various awareness campaigns. The team’s idea was to engage community champions and utilise printed materials to help raise awareness in all ten provinces of Zambia, whilst mobilising multiple stakeholders to help support their campaign. The team has now developed the material and secured external funding for printing.

-

Zimbabwe

The Zimbabwe team has been working with an actuary to price its innovation of a Farmer’s Basket Bundle that aims at offering affordable Germination Cover and Area Yield Index Insurance (AYII) bundled with inputs like pesticides, fertilizers, among others. In parallel, the team has partnered with government ministries to assist in risk identification and data collection processes. Plans are also underway to engage other stakeholders to assist with the consumer protection matters. The product is expected to be piloted ahead of the next cropping season.

iii-lab 3 country teams present at the International Dialogue in Frankfurt

From 19 to 21 September, the A2ii Inclusive Insurance Innovation Lab (iii-lab), hosted the 2022 International Dialogue gathering country teams from the third cohort: Costa Rica, Grenada, Zambia and Zimbabwe, along with lab 1 and lab 2 alumni from Albania, Argentina, Ghana, Kenya, Mongolia, Morocco, and Rwanda.

The third iii-lab – the climate lab – country teams presented new approaches they have developed aiming at tackling one of the greatest global threats of our time - climate change.

Costa Rica developed a web-based open platform for small hoteliers to increase resilience of their businesses through risk assessments and sustainable solutions.

Grenada worked on a mutual risk pool to provide direct relief to famers and fisherfolk after a declared climate-related disaster.

Zambia developed a pilot to raise awareness on insurance by engaging community champions to disseminate information to farmers and other agriculture stakeholders.

Zimbabwe worked on The Farmers’ Basket bundle which offers affordable Area Yield Index Insurance (AYII) with inputs like pesticides, fertilizers, and irrigation equipment, among others.

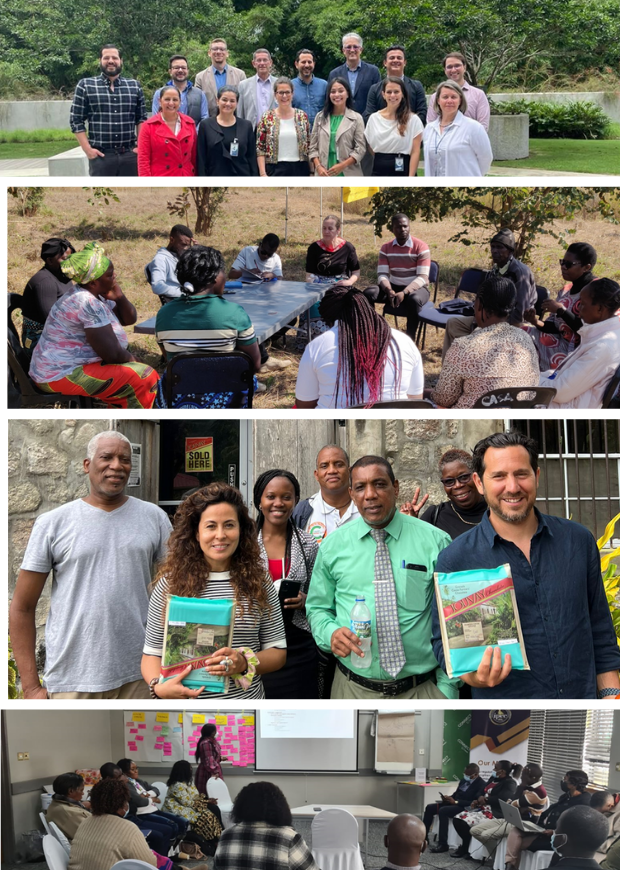

iii-lab Country Workshops

Click here to view more photos in the photo gallery.

During the past nine months, the multi-stakeholder teams of iii-lab three, the ‘climate lab’, have worked collectively on innovative solutions to increase resilience of the most vulnerable segments in their societies against the impacts of climate change.

In June, the four iii-lab teams from Costa Rica, Grenada, Zambia and Zimbabwe gathered outside the virtual world for the first time. Each country team met for a two-and-a-half-day workshop to reflect on the journey they have embarked on since October 2021.

In the workshops, the country teams continued working on their initial prototypes and planned further steps to the implementation and institutionalisation of the process. In addition, the teams were able to present their work to external stakeholders to receive their feedback. The workshops ended with defining a road map for a sustainable continuation of the work once the iii-lab programme ends. The iii-lab hosting team passed on the ownership and responsibility of the lab to each team.

Costa Rica

The Costa Rica implementation workshop took place from 8 – 10 June in San José, Costa Rica and was hosted by the insurance supervisory authority SUGESE. Participants included representatives from SUGESE, insurance companies and the Ministry of Tourism. The team are developing a prototype for a climate web tool called Fu-Turismo that aims at building awareness of climate change in the tourism sector while at the same time promoting risk reduction and coverage solutions. Primary beneficiaries of this innovative tool are micro, small and medium entrepreneurs from the tourism sector, which are heavily affected by the impacts of natural and climate disasters. During the workshop external stakeholders gave feedback on the prototype the team developed.

Grenada

The Grenada implementation workshop took place from 27 - 29 June in St. George’s, Grenada and was hosted by the insurance supervisory authority GARFIN. Participants included representatives from GARFIN, the Grenada Development Bank, farmers cooperatives and the Ministries of Finance and Agriculture. The team continued working on their initial prototype, a mutual risk pool that provides direct relief to farmers and fisherfolk after a declared climate-related disaster.

Zambia

The implementation workshop for the Zambia team was held from 14 - 16 June in Lusaka, Zambia and was hosted by the Pensions and Insurance Authority (PIA), Zambia. The workshop had representatives from all stakeholders of the lab team including PIA Zambia, Ministry of Finance - Zambia, FSD Zambia, Microinsurance TAG, Farmer support organisations such as Musika, ZAFWEB and Mulimi and insurance industry representatives like the Insurance Association of Zambia, Insurance Broker’s Association of Zambia.

This workshop was an opportunity for the team to refine their prototype idea of developing an insurance awareness campaign aimed at promoting greater awareness and trust in climate risk insurance amongst small holder farmers in Zambia, leveraging the social capital of trusted figures like agriculture insurance officers and community leaders.

During the previous phases of the workshop, the team has identified the critical gaps of information and awareness that smallholder farmers in Zambia face, they tested these assumptions in a focused group discussion with smallholder farmers just outside Lusaka. The insights received from the discussions with farmers helped the team further tighten their idea on their information campaign prototype which was shared with a wider set of representatives from the insurance industry on Day 3.

The refined prototype idea consists of developing an information campaign that works at a generic level for generic index insurance solutions, the content would be provided for the various insurance players in the Zambian market. This information would then be taken to the farmers via mobile phones, local input providers and other entities with a last mile connectivity, including extension offices and local leaders.

Zimbabwe

The Zimbabwe implementation workshop took place from 21 – 23 June in Harare, Zimbabwe and was co-hosted by the Insurance and Pensions Commission of Zimbabwe (IPEC). Participants included representatives from IPEC, the Insurance Council of Zimbabwe, the Insurance Brokers Association of Zimbabwe, the Zimbabwe Farmers’ Union, AFC Holdings, Women Farmers Land Association Trust, Champions Insurance, Pivot Africa, World Food Programme, and the Ministry of Finance.

The team worked on developing a prototype product called “Farmer’s Basket” that aims to strengthen resilience and provide protection from climate and disaster events for smallholder farmers in rural areas of Zimbabwe. As part of the workshop, they went on a field visit to the Goromonzi area and met with local farmers to discuss the prototype and receive feedback.

The Farmer’s Basket is intended to be a bundle of services. This includes area yield insurance with riders for life and funeral risks, information services on weather and market rates, insurance for farm inputs, and finally, linking these efforts to other infrastructure level efforts being undertaken by the government, which includes digging 35,000 boreholes for irrigation services.

The workshop ended with the team defining its workplan for the next 3 months. The group formed multiple small teams to address different areas of coordination and work as part of their plan. A robust proposal to be further tested should be ready by the end of the lab in September this year.

iii-lab teams pitch their initial prototypes to expert panel

Since mid-March, inclusive insurance innovation lab (iii-lab) country teams from Costa Rica, Grenada, Zambia and Zimbabwe have been working on the national level to develop their initial prototypes, choosing solutions aimed at increasing resilience against climate risks in their jurisdictions.

On 3 and 4 May, teams had the opportunity to present an elevator pitch of their prototypes to a diverse panel of experts, namely Rachel Field (R.K. FIELD, LLC), Hannah Grant (Access to Insurance Initiative), Agrotosh Mookerjee (Risk Shield), Elias Omondi (FSD Africa) and Shilpi Shastri (Winclusivity). The panel was impressed by the brilliant presentations and provided constructive feedback and suggestions which the teams are now using to progress with the development of their prototypes.

· Costa Rica is working on a climate tool called Fu-Turismo that aims at building awareness of climate change in the tourism sector while at the same time promoting risk reduction and coverage solutions.

· Grenada’s prototype, The Grenada Pan Cooperative Resilience Fund, takes advantage of a strong and well-organised cooperative sector in the country. It is planned to develop a mutual risk pool that provides direct relief to farmers and fisherfolk after a declared climate-related disaster.

· Zambia’s prototype focuses on raising awareness of insurance, especially among the most vulnerable in the agricultural sector (youths and women). Their solution proposes engaging with community champions to disseminate relevant information.

· Zimbabwe is developing a bundled product that combines index insurance with other non-financial products and services like agronomic and weather advice. To address low financial education rates, this will be accompanied by an all-stakeholder awareness process.

Next, before entering the implementation phase in June, teams will complete the innovation phase with the development of a prototyping roadmap.

Join the conversation on LinkedIn!

Discovery phase completed

During the discovery phase, the four country teams agreed on the beneficiary groups they would like to serve with their innovations. These include smallholder farmers, fishing folk and small and medium sized enterprises (SMEs) in the tourism sector. In December and January, the teams then conducted interviews with representatives of each group to get a deeper understanding of challenges and needs they are facing when it comes to climate resilience. These interviews helped country teams to identify unmet, unarticulated needs that are crucial to know when creating compelling new solutions.

Participants then met in an international process to discuss the insights gathered from the interviews. Common learnings across countries are that often interview partners were not aware of (future) impacts of climate change, customer-centric products that meet real needs of farmers are not available and hence new partnerships and more proactive governments are needed.

Before teams are now going to start innovating and prototyping on the national level, they dedicated some time to enhancing their knowledge about recent innovations developed to increase resilience by working together in cross-country teams.

Third iii-lab focused on climate kicks off

Country teams from Costa Rica, Grenada, Zambia and Zimbabwe started the programme in October 2021. The members of the country teams include the insurance supervisor, policymakers, industry associations, insurers, brokers, service providers, farmers’ associations, NGOs and development partners.

At the beginning of the 12-month process, it is essential to understand the current reality of climate risk for vulnerable groups in each country. In October and November, the teams put their heads together (virtually) to analyse why so many people in their country remain largely unprotected against climate risk. Starting at the end of November, participants met in international workshops to forge networks across teams and learn about the context in other jurisdictions.

Two main challenges were identified within the country teams. First, vulnerable groups are usually unaware of climate risk finance and alternative means of addressing climate risk. Second, suitable insurance products are often missing, either because insurers do not have the necessary skills and knowledge to develop such products or because they lack data about climate risk for different target groups. When it comes to selecting the beneficiaries for whom teams will develop their innovations, the following have been chosen: smallholder farmers, fishing folk and small and medium sized enterprises (SMEs) in the tourism sector.

As one participant stated, “we still need to learn and understand… and so many things we found we have in common.”

In December and January, teams will continue their learning journeys by interviewing people from the beneficiaries identified, in order to learn more about their lives and how they deal with climate risks. With this input in mind, the teams will be ready to start innovating during the first quarter of 2022.

I really liked how the whole session was so engaging and required us to think out of the box. Interactions with the lab members from other countries was very good as it provided us with time to share challenges and opportunities for innovation.

Four countries selected

Congratulations to all four selected country-teams from: Costa Rica, Grenada, Zambia and Zimbabwe!

The four multistakeholder country teams are embarking on a one-year journey to develop innovative solutions to increase resilience of the most vulnerable segments in their societies against the impacts of climate change.

We are happy to partner again with Reos Partners, who will be facilitating the process, and particularly excited to have InsuResilience Global Partnership as our knowledge partner.

See the announcement on LinkedIn.