Welcome to the market development pillar! On this page you will find:

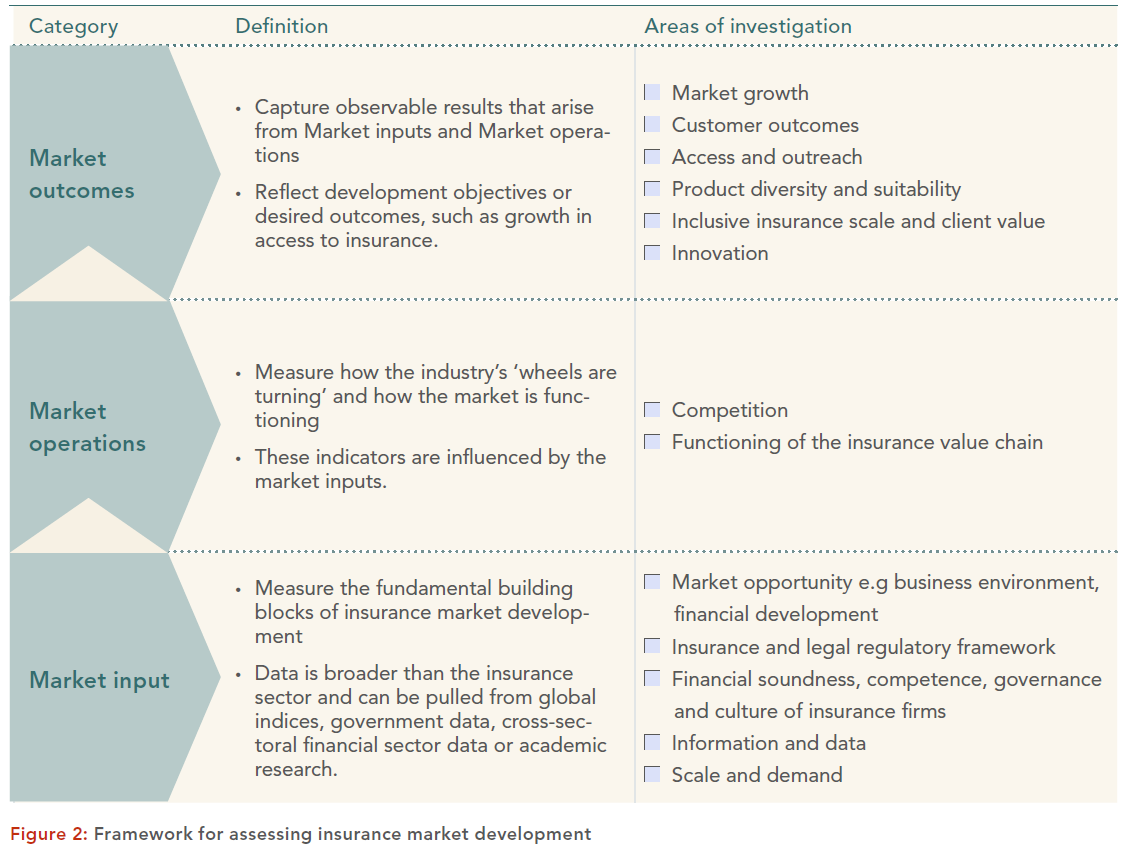

- A comprehensive list of insurance market development indicators, their formulas or descriptions, and reference notes. The KPIs are grouped by three categories: market inputs, market operations and market outcomes, and sub-grouped by areas of investigation under each category (see figure below).

“The definition of ‘market development’ is …understood here to mean actively growing the insurance market, both in terms of breadth and depth, in a manner that will increase access to insurance and better serve the risk transfer and risk management needs of the economy.”

- The accompanying Market Development KPI Handbook, which covers: a framework for assessing market development in a holistic way, guidance on selecting and tracking fit-for-purpose KPIs, case studies on analysing the KPIs and finally, acting on the insights.

The material is designed to be useful for supervisors who wish to track the development of their insurance markets, as well as supervisors involved in the planning and implementing of development initiatives. Supervisors can select the most relevant components and indicators to their jurisdiction and assemble a core set of indicators that best captures their market development priorities and goals.

Click on the grey bars below to filter the table according to the respective category, area of investigation (see figure below), indicator name or formula. You can also print out the list by clicking on the three dots to the right of the grey bars and selecting ‘print‘.