Switching between tabs: the virtual inclusive insurance innovation lab

Switching between tabs: the virtual inclusive insurance innovation lab

In tracking and documenting the iii-lab’s digital journey, I would like to thank my partners and colleagues Rachel Jones and Yiannis Chrysostomidis (Reos Partners) as well as Teresa Pelanda (A2ii) for their thoughtful comments and input.

To overcome the social distance in online workshops is hard, even with the right preconditions, such as engaging content and participants who are mostly well-adjusted to using digital tools.

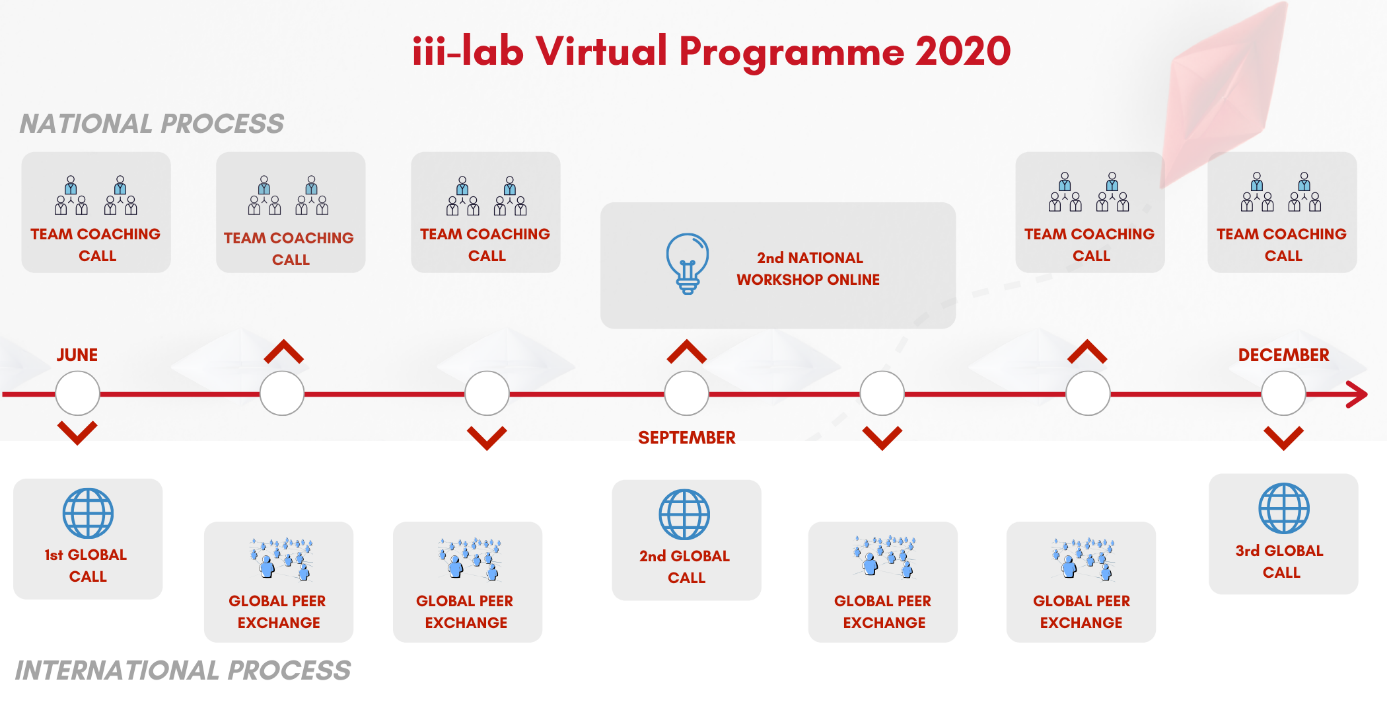

As Covid-19 brought the world to a standstill, we chose to reformat our Inclusive Insurance Innovation Lab (iii-lab) - initially envisaged as an 18-months programme of six in-person workshops – into a fully virtual programme and to make it work.

The Inclusive Insurance Innovation Lab (iii-lab) is a multi-stakeholder program bringing together 60 inclusive insurance leaders from Argentina, India, Morocco and Rwanda to work together to improve access to insurance in their countries.

Two of the physical workshops had already taken place (for Morocco and India) before the crisis hit, and we had to move forward with the other two teams and revisit our timeline.

Our task: changing the medium while ensuring content is delivered, and relationships are built

The content of our in-person workshops was interactive, enjoyable, and created a sense of team cohesion and purpose. The meetings that had already taken place in Morocco and India before the Covid-19 lockdowns brought regulators, insurers, banks, brokers and insurance associations to the table. Two intensive days of hands-on, highly interactive, fun and engaging exchanges and exercises led by the experienced Reos Partners facilitators Yiannis and Rachel resulted in the focus areas for both country teams for the rest of the programme. But not only. Participants came to understand each other’s perspectives better. ‘It is good to be able to talk as we all have our angles, all important for a bigger picture’, one lab participant from the Moroccan team said.

Before we knew it, we found ourselves juggling multiple open tabs of different platforms and tools, messaging and social apps.

The challenge was to translate this experience online for the Rwanda and Argentina teams and split the content into several smaller sessions across several weeks. The situation also presented a unique opportunity for everyone involved (including the organising team) to learn about digital transformation and the collaborative tools out there. The lab participants, especially those coming from the private sector, welcomed the transformation and found the lessons learned along the way very valuable.

Streamlining the conversation: the choice of tools

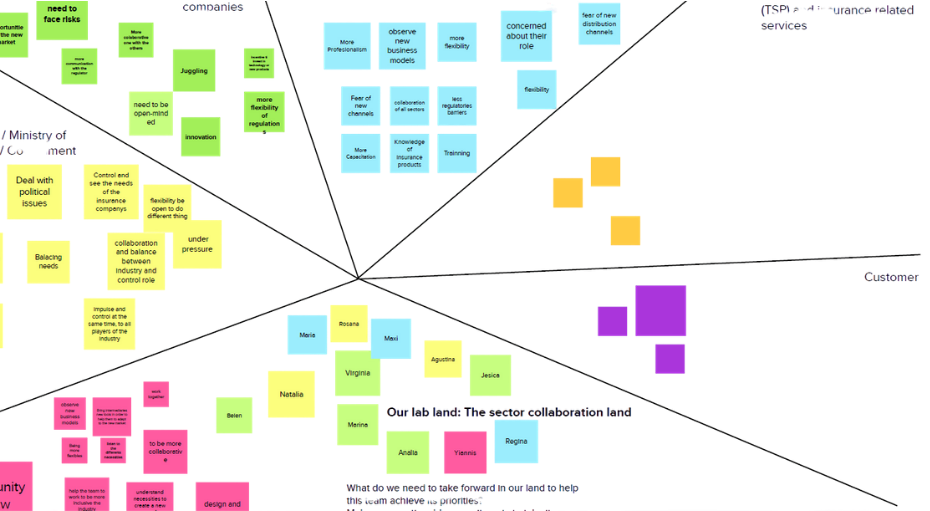

Before we knew it, we found ourselves juggling multiple open tabs of different platforms and tools, messaging and social apps. It was a steep learning curve about the emerging considerations such as the use of bandwidth, perceived security and data privacy, features and usability. One that led us to the videoconferencing tool of choice for the workshops in combination with Mural, which we use as our whiteboard. The whiteboard allows the participants to brainstorm, share ideas, through post-its or annotations in real-time. While it was challenging for us to switch between the tools during a session, the value-added was key for our workshop success.

It was important, however, to allow for flexibility in the online work and use of alternative tools and channels to the participants due to differing online security standards of their organisations.

Technical aspects: overprepare and do not take anything for granted

Before starting the online workshops, each team did a technology onboarding session where we introduced them to the videoconferencing tool and the online whiteboard. While the participants were generally familiar with the former, most had no previous experience with visual collaborative tools.

In addition to the group tech onboarding, we offered one-on-one sessions. Despite being resource-intensive, they helped strengthen our relationships with participants. It was also a paradigm shift for the team to see what was possible in the virtual space and build their confidence to try something new.

We also found that internet connection created a bottleneck in times of Covid-19 when everyone is working from home and over-using private internet connection.

This process taught us not to take any prior knowledge about online tools for granted. It is important to maintain patience and an open ear for any types of difficulties that can arise.

Without a tech support team to rely on, in addition to the facilitator, we introduced one dedicated tech person to the workshops to help the participants with accessibility.

Social aspects: adapt the process to participants’ realities and needs

While the country teams’ motivation to keep the lab alive was there, the pandemic also meant a serious blow to people’s lives, both professionally (higher workload) and in their personal lives (managing household & care work in parallel). Sometimes this translated into participants having to drop off from the calls. At times teams had trouble imagining how to move the lab process forward if they could not meet each other or the customer target group any time soon.

This process taught us not to take any prior knowledge about online tools for granted. It is important to maintain patience and an open ear for any types of difficulties that can arise.

To mitigate this, we shared notes and results of the workshops with those who could not attend. We also adapted the meeting rhythm to the teams’ preferences; some were meeting weekly, while others preferred to have more time between the two workshops. We also learnt to be open to participants’ individual situations and check with them individually to see if we can help them to stay engaged. Messaging groups for each country team helped with communication and contributed to community building outside of sessions.

Finally, in terms of keeping motivation up, empowered and robust leadership from within the team (e.g. the insurance supervisor who initiated the team’s participation in the program or other individuals with leadership capacities) was catalysing.

Process aspects: invest in the process to make up for missing physical encounters

We were curious as to the participants’ perception of our program design, so we set up individual calls with all of them (sixty in total) to understand their motivation, ideas and advice on how to improve the lab process. We also regularly spoke with insurance supervisors leading the teams to catch up with how the team is doing. These calls were crucial for us to gain a better understanding of participants’ motivation for the lab as well as team dynamics.

We learnt that the international exposure and opportunity to learn from other teams and experts was one of the primary motivations for participants to join the iii-lab. With this in mind, we set up regular calls with all lab teams every month until we can all meet again. Besides, we introduced webinars with expert input for all teams on topics of their interest, e.g. effective business models for inclusive insurance or SME insurance.

To reinforce the sense of community and facilitate exchange and peer-learning outside the virtual training room, we set up a closed LinkedIn iii-lab group.

Reflections

An online multi-stakeholder process requires more human resources than organising a series of physical workshops. This is due to the fact that meeting in-person motivates teams as they interact with each other, achieve goals together, connect outside of the workshop and create relationships.

We learnt that an online iii-lab is possible from a technical and content angle. However, it is a lot more difficult to account for the psychological factors that may affect motivation, presence and productivity.

The quick shift to virtual training room has not been the smoothest, but we learned a lot. The country teams of Argentina, India, Morocco and Rwanda are doing a fantastic job in keeping up with the new workflow and together, we are on the right track to find innovative solutions to expand insurance markets for those who need it most.

Share this article

Also in Blog

Authors

Posts by Author

Topics Cloud

Subscribe to our list

Receive notifications when we publish new blog entries

Subscribe here