A2ii-IAIS Dialogues

Diálogo A2ii-IAIS sobre la Importancia de los Datos desglosados por Género en el Sector asegurador

The English version is available below.

A nivel mundial, solo el 13 % de los países asigna fondos presupuestarios a las estadísticas de género. Sin embargo, esta información es vital para elaborar políticas basadas en evidencia que promuevan la equidad de género y garanticen el cumplimiento de los Objetivos de Desarrollo Sostenible para 2030. En este contexto, los supervisores de seguros desempeñan un papel importante al mejorar el acceso de las mujeres al seguro mediante la inclusión de perspectivas de género en las áreas pertinentes de regulación y supervisión.

Para ayudar a los supervisores a recopilar datos desglosados por género y, lo que es más importante, para conocer mejor sus mercados, A2ii ha estado promoviendo el uso del FeMa-Meter, una herramienta basada en MS Excel para recopilar y analizar datos desglosados por género que compara diferencias entre hombres y mujeres en varios indicadores.

¡Y los primeros resultados ya están disponibles! Para presentarlos, y a petición de los supervisores latinoamericanos, A2ii y la IAIS están organizando conjuntamente el evento virtual: "Diálogo A2ii-IAIS sobre la importancia de los datos desglosados por género en el sector asegurador", con estudios de caso del SIB (Guatemala) y de la SUGESE (Costa Rica), quienes compartirán sus hallazgos y las lecciones aprendidas del uso de la herramienta FeMa-Meter en sus respectivos mercados.

El evento tendrá lugar el 22 de mayo a las 9:00 (hora de Ciudad de México) / 17:00 (CEST) y estará abierto a todas las partes interesadas (supervisores, reguladores, responsables de políticas públicas, industria y corredores, academia y organizaciones internacionales).

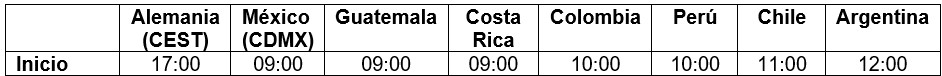

Los horarios del evento para las diferentes zonas horarias se detallan en la tabla a continuación. Haz clic aquí para verlo en tu zona horaria local.

The English version:

Globally, only 13% of countries allocate budget funding to gender statistics. However, this information is vital for drafting evidence-based policies that pursue gender equity and ensure compliance with Sustainable Development Goals by 2030. In this context, insurance supervisors play an important role in enhancing women's access to insurance by including gender perspectives in relevant regulation and supervision areas.

To help supervisors collect gender-disaggregated data and, most importantly, to gain an insight into their markets, A2ii has been encouraging the use of the FeMa-Meter, an MS Excel-based toolkit for collecting and reviewing gender-disaggregated data that compares differences between men and women on various indicators.

And the initial outcomes are already available! To present them and at the request of Latin American supervisors, A2ii and IAIS are jointly organizing the virtual event - "A2ii-IAIS Dialogue on the Importance of Gender-Disaggregated Insurance Data", with case studies from SIB (Guatemala) and SUGESE (Costa Rica) who will report the findings and lessons learned from the use of the FeMa Meter tool in their markets.

The event will take place on 22 May, at 9:00 (México City time) / 17:00 (CEST) and will be open for all stakeholders (supervisors, regulators, policymakers, industry and brokers, academia and international organizations).

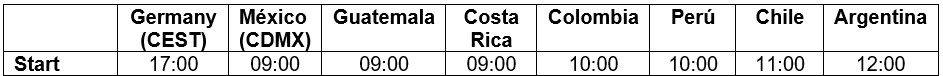

The event times for the different time zones are detailed in the table below. Click here to see it in your local time zone.

Please note that this Dialogue will be entirely in Spanish and no simultaneous interpretation will be provided.