Photo & Video, Presentations, Reports, InsurTech and Mobile Insurance, Asia-Pacific, Global | 2018

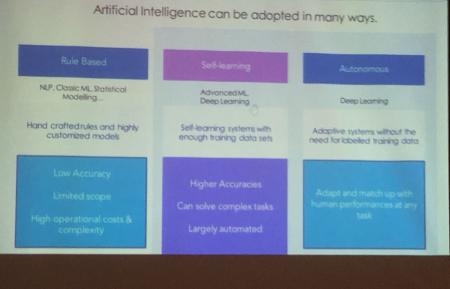

InsurTech — the variety of emerging technologies and innovative business models that have the potential to transform the insurance business — holds vast potential for improvements in insurance product

Partner Publications: MEFIN RFPI, Reports, Country Assessments, Asia-Pacific | 2018

This study highlights the different risks faced by low-income households in Nepal and their approaches to mitigating these risks, including their familiarity with and use of insurance. It highlights

Reports, Regulatory Impact Assessment, Country Assessments, Asia-Pacific, Latin America & the Caribbean | 2017

The Access to Insurance Initiative (A2ii) and the International Labour Organization (ILO) through its Impact Insurance Facility (IIF) have commissioned this study to assess the impact of

Reports, Proportionate Regulation, Africa, Asia-Pacific, Latin America & the Caribbean | 2017

Drawing on the experiences of Ghana, Mexico and the Philippines, the report “Proportionality in practice: Distribution" examines the practical aspects of distribution where insurance supervisors are

Reports, Disclosure of Information, Latin America & the Caribbean, MENA | 2017

The report “Proportionality in practice: disclosure of information” draws on the experiences of Brazil, Pakistan, Peru and El Salvador and examines the practical aspects of the disclosure in which

Reports, InsurTech and Mobile Insurance, Africa | 2017

From 23-24 February 2017, the International Association of Insurance Supervisors (IAIS), the Access to Insurance Initiative (A2ii) and Inter-African Conference on Insurance Markets (CIMA) hosted the