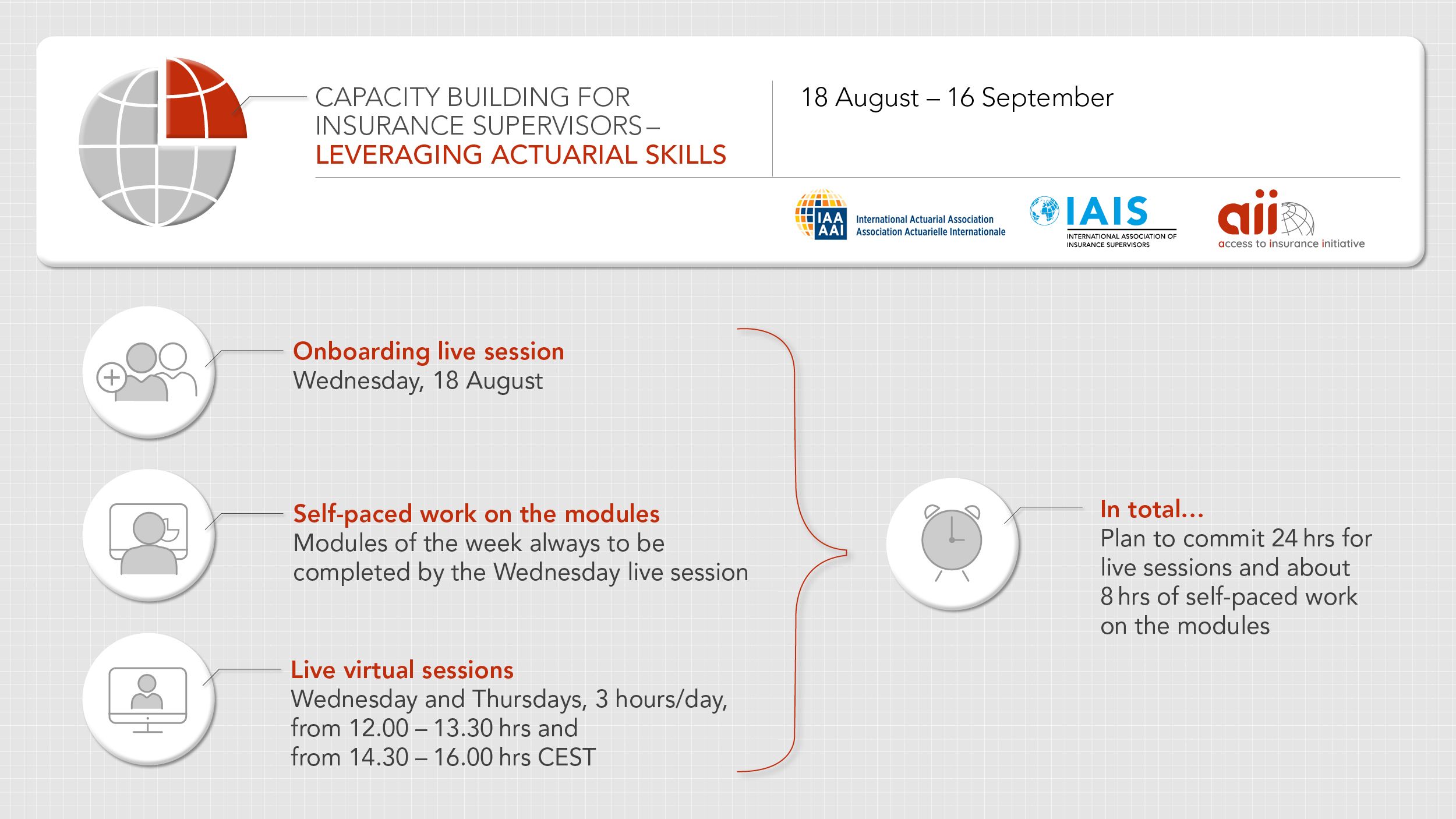

Capacity Building for Insurance Supervisors - Leveraging Actuarial Skills

Virtual Training

18 August – 16 September 2021

We are pleased to invite you to the virtual training “Capacity Building for Insurance Supervisors - Leveraging Actuarial Skills” organised by the International Actuarial Association, the International Association of Insurance Supervisors, and the Access to Insurance Initiative.

The training targets supervisors from the Sub-Sahara Africa region. It aims at strengthening the understanding and application of the actuarial concepts and tools needed to support effective insurance supervision and regulation.

The focus and approach of the training will be on teaching principles, while making the training as practical and simple as possible. The training takes place from 18 August to 16 September with a combination of self-paced learning modules and live virtual sessions, involving a range of lecture-based sessions, case studies, breakout sessions and quizzes. Over the four weeks, live sessions take place on Wednesdays and Thursdays from 12 - 1.30 pm and 2.30 - 4 pm CEST.

The syllabus is broken down into the following components:

Week 1 – Risk Management and Insurer Distress

Week 2 – Valuation and Actuarial Reports

Week 3 – Risk-based Capital and Reinsurance

Week 4 – Supervisory Frameworks and KPIs

The course will be held in English.

There are no tuition fees to attend the training.

Registration deadline: 6 August

Learning objectives

Risk Management and Insurer Distress

- What are the typical reasons why insurers get into financial distress and what are the lessons for a supervisor of past insurer failures?

- From ICP 8 understand the key objectives around risk management and the practical issues to implementation

- From ICP 16 understand the key objectives around enterprise risk management for solvency purposes

- What is solvency management and how does an ORSA fit within that?

Valuation and Actuarial Reports

- From ICP 14 understand the key objectives around valuation(s) for solvency purposes

- Valuation key concepts and techniques

- As a supervisor, what are the key focus areas when reviewing an actuarial valuation report

Risk Based Capital and Reinsurance

- From ICP 17 understand the key objectives around regulatory capital requirements, capital resources and triggers

- Understand the range of solvency regimes and proportionality

- What are the risks we try to capture with Risk Based Capital (RBC) and how do we calculate a simple capital coverage ratio (CCR)?

- From ICP 13 understand the key objectives around reinsurance and how reinsurance fits within an ERM Framework

Reinsurance, Regulatory Frameworks, and KPI’s

- Regulatory and supervisory frameworks

- Applying Key Performance Indicators (KPIs) in insurance supervision

Target audience

The course targets middle to senior technical staff from regulatory and supervisory agencies in the Sub-Sahara Africa region, ideally with a minimum of three years of working experience in the insurance industry. The course does not target qualified actuaries, however, participants should have a reasonable level of mathematical skills.

We invite two representatives from each jurisdiction. This is intended to ensure that there is shared learning within a single supervisor and some peer support at the country level during and after the training.

Participants are expected to commit to the training program, consisting of the self-paced modules as well as live online sessions in August and September. A mandatory onboarding will be held on Wednesday 18 August from 12 - 1.30 pm CEST.

Please note that places are limited and will be allocated on a first-come, first-serve basis.

As this is a virtual training, for supervisors wishing to participate from other regions, please register your interest and we will contact you depending on available spaces.

Participants will receive a certificate upon completion of the course.

Click here to register.