Extended Deadline - Call for applications for the 4th Inclusive Insurance Innovation Lab (iii-lab)

The Access to Insurance Initiative, supported by Reos Partners, is calling for applications for the 4th Inclusive Insurance Innovation Lab (iii-lab).

What is it about?

The 4th iii-lab (2023-2024) is a 12-month journey where 3-4 teams from different countries, consisting of key stakeholders from the insurance sector, will collaborate on innovative insurance solutions to increase resilience against the impact of climate change. The project aims to benefit the most vulnerable segments of the population and is the 2nd iii-lab that addresses the widening climate protection gap. The project will be guided by the following question:

How can you innovate for achieving climate resilience in your jurisdiction?

In addition to developing innovative solutions, the iii-lab supports participants' role in the following areas:

-

Dialogue: Trust among participants increases and participants establish new networks.

-

Leadership: Participants gain expertise in inclusive insurance and shape discussions and advocate for inclusive insurance.

-

Action: Participants start new projects using customer-centric and experimental methods.

Why participate?

Supervisors can enhance their skills and learn about international climate risk insurance solutions through peer exchange with other country teams and international experts. They will also receive guidance from an experienced change facilitator, develop their leadership skills and learn how to build alliances and collective capacity to act that is needed to lead multi-stakeholder cross-sectoral teams.

Watch the video to hear from iii-lab 1-3 participants about their experiences.

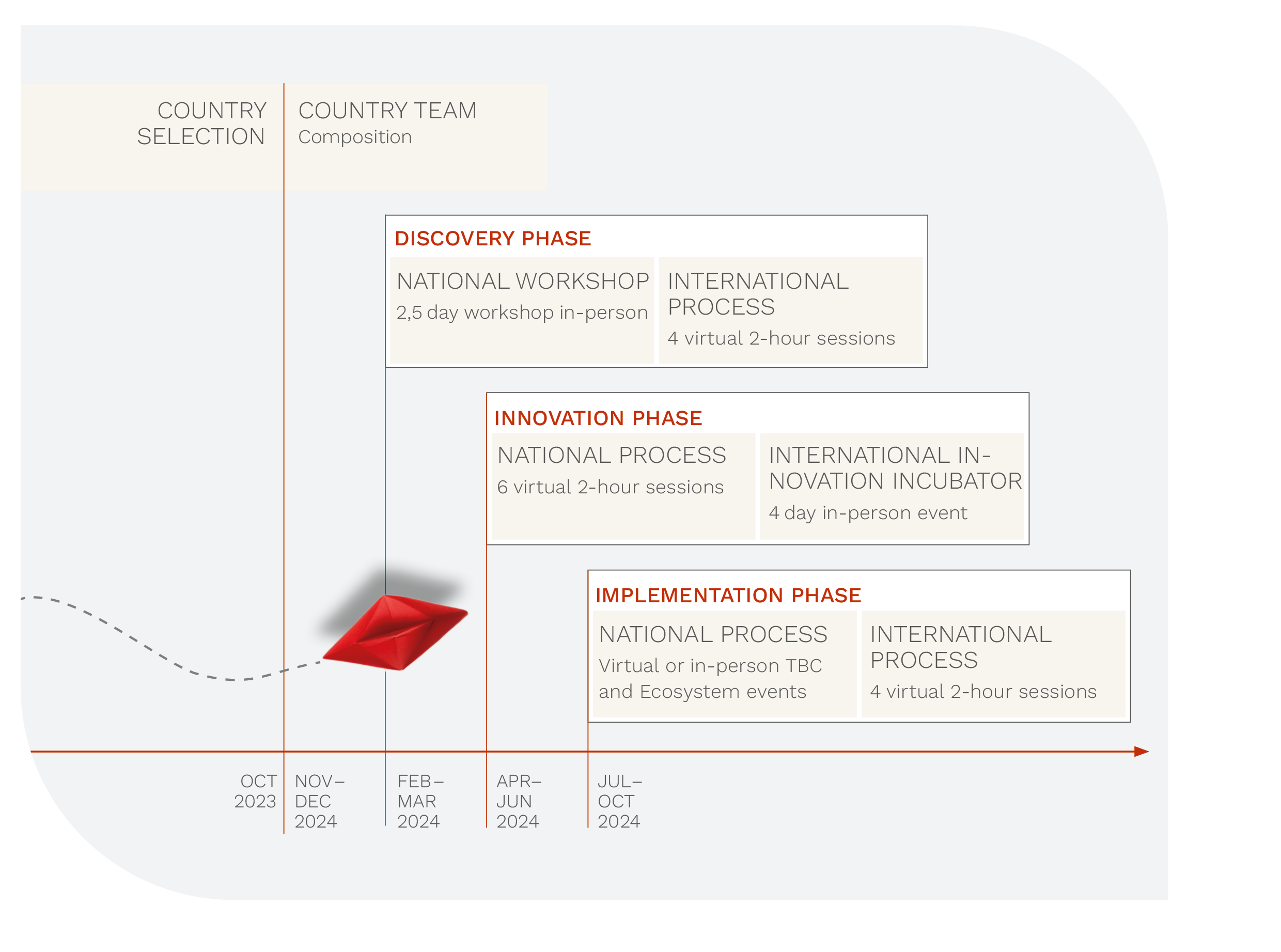

When and where?

The iii-lab will take place from October 2023 to October 2024. Participants must attend all planned meetings and workshops (starting in February 2024), both virtual and in-person, which will be held in various countries that are selected. They will need to dedicate approximately 25 days to attend workshops, exchange within their country team and actively participate in the design and implementation of insurance innovations for building climate risk resilience.

What is the supervisor’s role in the iii-lab process?

Insurance supervisors apply to the iii-lab on behalf of their teams and lead country teams throughout the process. A2ii and Reos Partners assist supervisors in forming country teams after selecting jurisdictions. The supervisor's team must include at least one executive/decision-making level and one mid-level representative.

For more information, download the Information sheet for supervisors from the iii-lab 4 website.

How should country teams be put together?

Representatives from approximately eight local institutions, including the insurance industry, policymakers, and consumer representatives, will form teams to address the challenge. These might include:

-

Insurance supervisor and regulator

-

Insurance associations

-

Industry representatives (brokers/intermediaries, MFIs etc.)

-

Policymakers (Ministry of Agriculture, Ministry of Finance, Ministry of Environment/Climate etc.)

-

Tech representatives (satellite data, MNO, etc.)

-

Consumer representatives (women’s association, farmers’ associations, etc.)

-

Environmental organisations

-

Other stakeholders perceived to be essential in the jurisdiction.

For each institution, up to two representatives can participate: at least one at executive-level and possibly one high-potential mid-level staff member. A gender balance should be aimed for the country teams.

Please note: supervisors do not need to have the country team ready at the time of the application. A2ii will accompany selected insurance supervisors in putting together the country teams.

How to apply?

To apply, insurance supervisors should send:

1. A letter of endorsement from the Head of Authority (i.e. Insurance Commissioner)

2. A one-page letter of motivation guided by the following questions:

-

What keeps you up at night when you think about climate change impacting your country?

-

What is working well and what not so well in the insurance sector when it comes to managing climate risks and building resilience?

-

What is in it for you? What motivated you to apply to join the iii-lab?

-

If there was one innovation or change that would come out of the iii-lab for your country what would you like that to be? (i.e. What are you expecting to get out of the iii-lab?)

-

We have a limited number of seats - why your country and not someone else? What do you think you have to offer to the international work of the iii-lab?

3. Download and sign the Consent form in relation to the processing of personal data during the application and participation in the programme.

The deadline has been extended. Please send these documents to iii-lab@a2ii.org before 27 September 2023. Short-listed supervisors will be invited to a video interview.

The following selection criteria will guide the selection process:

-

Motivation to actively participate in the iii-lab, is committed and has the support of the Head of Authority;

-

Openness to search for new solutions collaboratively with other stakeholders;

-

Commitment and demonstration of ability that the country team can sustain the initiated processes after the one-year lab comes to an end; and

-

Strong potential for the country lab to act as a role model and catalyst in the region.

Please try to address these points in your motivation letter responses.

Costs

Participation in the iii-lab is free, but country teams are responsible for paying for their own flights and accommodations for in-person meetings and the international workshop. A limited number of scholarships is available for team members who cannot cover the full costs of attending. The A2ii will cover all other costs related to the outlined process.

Contact

Teresa Pelanda, A2ii Project Manager at teresa.pelanda@a2ii.org

Further information

Visit the iii-lab 4 website

Watch the video to hear from iii-lab 1-3 participants about their experiences participating in the iii-lab.

Supported by: