Unlocking Resilience: The Role of Climate-Related Data in Insurance Supervision - A2ii-IAIS Public Dialogue Report

Unlocking Resilience: The Role of Climate-Related Data in Insurance Supervision - A2ii-IAIS Public Dialogue Report

The insurance industry and insurance regulators are increasingly recognising the importance of climate-related data in assessing and managing risks associated with climate change.

In the landscape of risk management, the impact of climate change is becoming increasingly evident. The insurance industry and regulators alike are now turning their attention to a vital tool in navigating this reality—climate-related data.

Climate-related data encompasses an array of information that aids insurers and regulators in grasping the potential ramifications of climate change on insured assets, liabilities, and the overall stability of the industry. From historical climate patterns to projections of future scenarios, and from analysing physical risks to understanding transition risks, this data forms the backbone of informed decision-making in the face of climate uncertainty.

One reason behind the surge in collecting and utilising climate-related data is the escalating recognition of the financial risks posed by climate change. With extreme weather events becoming both more frequent and severe, insurers have to deal with heightened claims costs and increased volatility. However, by delving into climate-related data, they can gain a deeper understanding of these risks, enabling them to better assess and price them.

In response to the raising concerns on this topic, on 14 September, the Access to Insurance Initiative (A2ii) together with the International Association of Insurance Supervisors (IAIS) hosted a Public Dialogue on Climate Change and Data. The session kicked off with Hanne van Voorden, Head of Supervisory Practices and Operations at IAIS, presenting on the IAIS's work in climate risk analysis. One of the focus areas of work for the IAIS is equipping supervisors to heighten their focus on the accelerating transition and physical risks, as well as ensuring that insurers take appropriate action in response to these risks.

Van Voorden outlined IAIS's work on climate risk, divided into three pillars:

Undertaking analysis to understand how climate change impacts the insurance sector and financial stability.

Promoting a globally consistent supervisory response to climate change.

Assisting in capacity-building initiatives, in cooperation with partners.

In terms of promoting a supervisory response, the IAIS has published several papers in recent years and conducted a gap analysis where the Insurance Core Principles (ICPs) and their inclusion of climate risk for supervisors were studied, which has resulted in some updates to the ICPs and application papers.

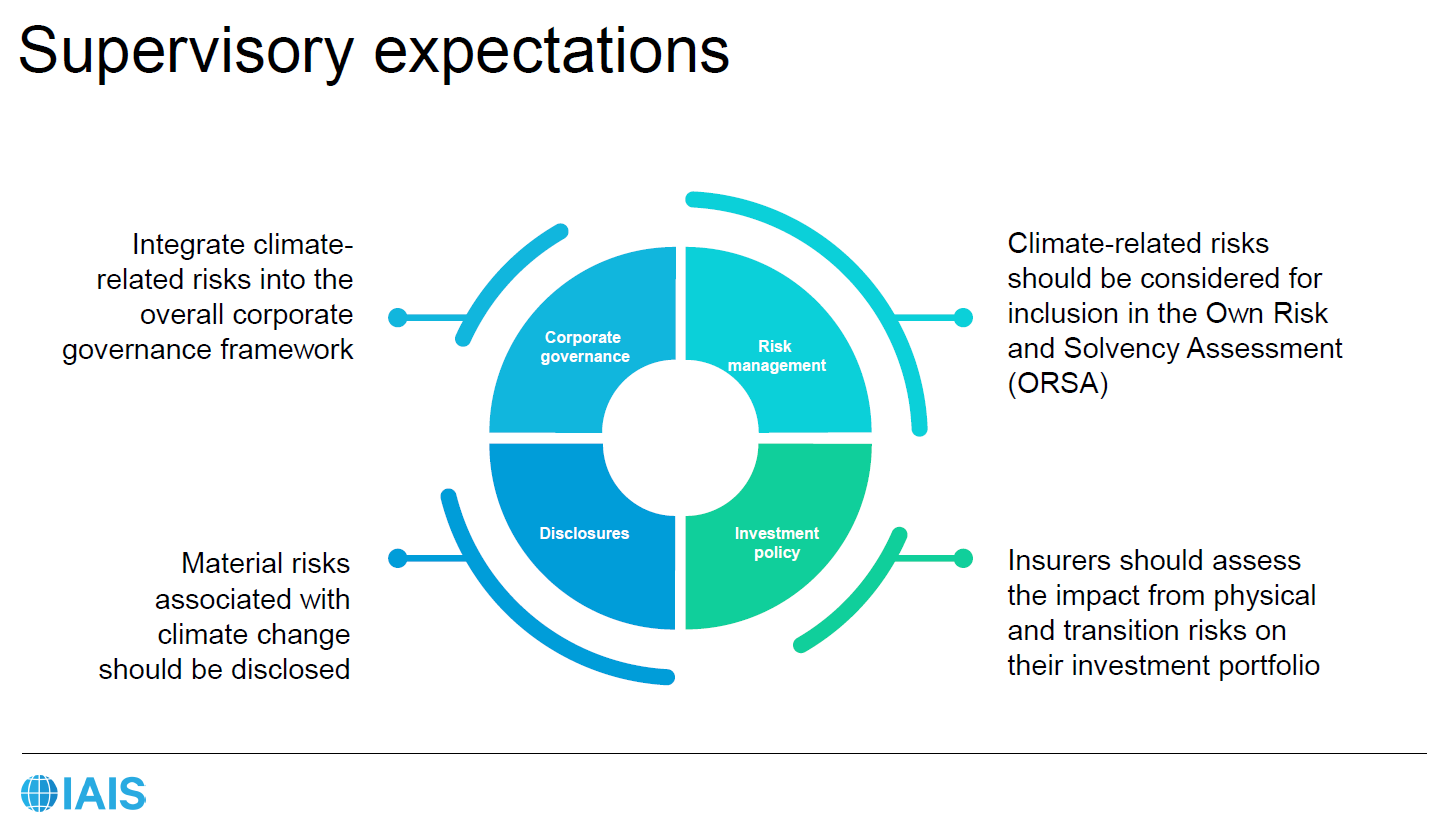

In terms of supervisory expectations, supervisors are expected to require insurers to integrate climate-related risks into the overall corporate governance framework, as well as into their risk management and considered for inclusion in the Own Risk and Solvency Assessment (ORSA), as well as other requirements that are related to disclosures, as in, material risks associated with climate change should be disclosed, and well as investment policy, where insurers should assess the impact from physical and transition risks on their investment portfolio.

Van Voorden highlighted the need for climate risk data, as it helps monitor insurers' exposures to potential risks for climate change, both transition and physical risks. Responding to this, the IAIS has included climate data elements in their annual Global Monitoring Exercise (GME) and the outcomes are annually reported in the IAIS Global Insurance Market Report (GIMAR).

Following van Voorden's presentation, a panel discussion moderated by Miroslav Petkov, Senior Policy Advisor at IAIS took place.

The panellists brought diverse perspectives to the session, representing a cross-section of the global insurance landscape.

In exploring the latest advancements in natural catastrophe modelling and the impact of climate change, Nick Moody, Coordinator of the IDF Risk Modelling Steering Group, underscored the strides made in data collection. Through satellites and ground surface observations, data collection has intensified, leading to a higher volume of data points. Moreover, technological advancements like artificial intelligence and machine learning aid in interpreting this wealth of information. Moody emphasized how these developments mitigate uncertainty, fostering the creation of more accurate projections and trends. Furthermore, the adoption of open data standards enhances accessibility, while unified exposure standards facilitate more accurate vulnerability and loss assessments.

Jerry Skees, Founder and Executive Director of Global Parametrics, highlighted the industry's leverage of these advancements, particularly in expanding data collection globally. He emphasised how these developments are vital for making insurance-based solutions viable in developing economies. For instance, access to data from the European Centre for Medium-Range Weather Forecasts has been instrumental for companies like Global Parametrics. These advancements enable precise matching between exposure data and hazards, enhancing the accuracy of weather variable predictions. Skees also noted how this benefits supervisors in ensuring that premiums align with risks. Additionally, he discussed the importance of tailoring insurance solutions to the needs of vulnerable populations, advocating for business interruption insurance over property damage coverage.

In discussing the utilisation of NatCat data, Kara Voss, Climate Finance Specialist in the California Department of Insurance emphasised the significance of publicly available data, especially as private investors enter the market. Despite the abundance of data in California and the USA, challenges persist, particularly in accessing financial data related to natural catastrophes. Voss highlighted the California Department of Insurance’s focus on wildfires and collaborative efforts to collect data on vulnerability factors. She also noted the sector's learning from Emerging Markets and Developing Economies (EMDE) on index insurance. Erickson Balmes, Deputy Commissioner at the Insurance Commission of the Philippines, shared how the Insurance Commission is utilizing data through initiatives like the GeoRisk Philippines Initiative. This government-led initiative provides essential information on natural hazards and risk assessment, supporting the underwriting of non-life companies.

Addressing challenges faced by the industry, Nick Moody stressed the importance of understanding climate change's broader impact on the insurance sector, beyond property damage. He advocated for collaboration with sectors like development and humanitarian aid to support vulnerable communities. Jerry Skees highlighted the importance of leveraging available data and encouraged supervisors to engage in the topic, emphasising the ease of understanding risk due to data organization advancements.

Regarding collaboration opportunities, Erickson Balmes cited the Philippine Catastrophe Insurance Facility (PCIF) as an example. This initiative establishes rates based on modelling and hazard maps, validated by various stakeholders. Kara Voss discussed the California Insurance Commission's efforts to address the lack of data on nature-based solutions through symposiums and the establishment of a Climate Risk Insurance Working Group. Pujan Dhungel, Director of Microinsurance at the Nepal Insurance Authority highlighted Nepal's collaboration between government stakeholders and the insurance industry to develop flood modelling, despite data challenges in the region.

To wrap up the Dialogue, the speakers stressed the importance of utilising global data and fostering collaboration between stakeholders to improve modelling and address the protection gap. Their insights underscored the collaborative nature of catastrophe risk modelling and the critical role of supervisors in facilitating market growth and innovation, and the latest developments in technology and data collection, particularly through satellite-collected data can be very beneficial for EMDE jurisdictions that might not have the resources to collect data globally. These advancements make creating models more accessible without compromising on accuracy.

Watch the recording of this session:

Share this article

Also in Blog

Authors

Posts by Author

Topics Cloud

Subscribe to our list

Receive notifications when we publish new blog entries

Subscribe here