Risk-based Capital and Supervision - A2ii-IAIS Supervisory Dialogue Report

Risk-based Capital and Supervision - A2ii-IAIS Supervisory Dialogue Report

Supervisors have been increasingly refining their solvency standards and moving towards risk-based regimes. This shift to risk-based capital (RBC) approaches has many benefits for stakeholders in the insurance sector including consumers, industry players and supervisors. Not only does it support the development of the insurance market by providing flexibility and encouraging innovation, but it is also more efficient, allocating capital more appropriately to risk and reducing the amount of dormant capital. Additionally, RBC gives supervisors improved measures of financial soundness, insights into insurers’ risk management practises and corporate governance structures, comparability and proportionate ladders of intervention, leading to better supervision.

However, implementing RBC is not without challenges. It has substantial resource implications and requires preparation and planning, with more advanced and complex risk-based approaches having higher requirements for actuaries, skills and technical resources, within both the industry and regulatory bodies.

On 1 December 2022, the A2ii together with the IAIS hosted a Supervisory Dialogue on risk-based supervision. This webinar built on the previous Dialogue that took place in 2020 on risk-based capital regimes in emerging markets. During this discussion, the spectrum of risk-based capital regimes was explored, providing examples of where a sample of countries across Sub-Sahara Africa, Asia and the Caribbean sit along this spectrum.

To shed light on the key drivers and success factors for jurisdictions transitioning towards risk-based supervision, Peter Windsor, Senior Financial Sector Expert (IMF) shared insights from a workshop that took place at the IAIS Annual Conference in November 2022 (the workshop recording is available to Connect.A2ii members). He presented the key takeaways from three jurisdictions that have already implemented RBS: South Africa, Kenya and Mexico.

The key drivers for moving towards RBS that were highlighted were:

- Meeting the requirements of the IAIS’s Insurance Core Principles and being at international best practice levels.

- As part of a larger project of moving to risk-based supervision, risk-based solvency provides the quantitative and qualitative requirements that link to the risk profile of insurers, enhances governance and risk management requirements, and enables supervisors to have a more forward looking and proactive approach to supervision.

Critical success factors for jurisdictions looking to adopt RBS include having clarity on the reasons and objectives for the change, obtaining acceptance and support from the government and industry at the outset, careful planning and resource allocation, learning from existing frameworks, and tailoring them to the specific market circumstances of the jurisdiction. Additionally, documentation, consultation, testing, and refinement of decisions, change management processes, upskilling of supervisors and industry, and continuous communication with the industry before, during, and after the transition are also essential.

Panellists Asmaa Jabri, Director of Insurance Supervision and RBS Project Manager at ACAPS (Morocco), Alma Gomez, Supervisor of Insurance, International Insurance and Pensions at Supervisor of Insurance and Pensions Belize, and Edith Apoo, Senior Risk and Actuarial Officer at IRA Uganda provided further insight into the challenges and opportunities presented by RBS implementation in their jurisdictions covering incentives, objectives and the current status of their implementation journey. The presentations are available below.

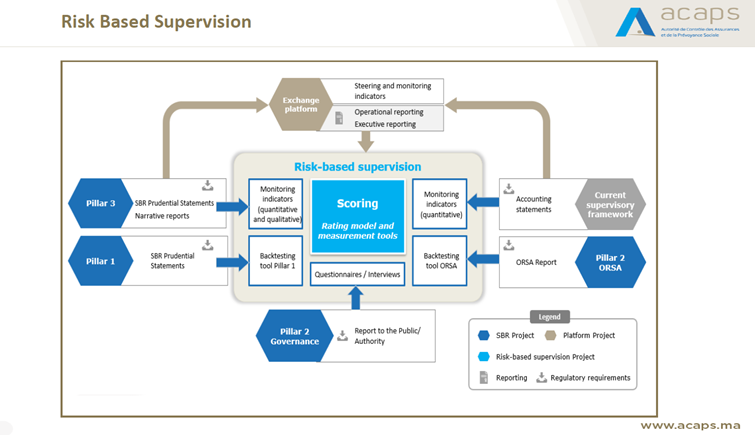

During the Dialogue, ACAPS shared the graphic below that illustrates the system that uses to score insurers, applying a risk-based approach by taking into account different elements.

During the panel discussion moderated by Peter Windsor, the speakers shared their experience in three main areas: the main challenges experienced by the supervisors and industry during this process, the key lessons learned, and the advice they would give to other jurisdictions that are looking into implementing RBS.

The panellists emphasized the importance of transparent relationships with industry and stakeholders, gradually introducing risk-based reports, and engaging technical staff and boards of directors in training sessions. They also suggested taking small steps, continuously engaging with the industry, as well as having actuaries consult on the topic when speaking to auditors.

While RBS offers significant benefits for all stakeholders in the insurance sector, the implementation process requires careful planning, preparation, and engagement from all parties involved. By learning from the experiences of those who have already transitioned to RBS, jurisdictions can successfully navigate the challenges and reap the rewards of a more efficient and effective approach to supervision.

If you’d like to learn more about the topic, visit:

- Recording of the IAIS IMF Round Table on Risk-based Solvency Frameworks available on Connect.A2ii.

- Risk-based Supervision in Inclusive Insurance Consultation Call Report.

- Blog on the landscape of risk-based capital regimes in emerging markets.

Share this article

Also in Supervisory Dialogue

Authors

Posts by Author

Topics Cloud

Subscribe to our list

Receive notifications when we publish new blog entries

Subscribe here