Why data matters: presenting A2ii’s FeMa Meter, a tool for collecting sex-disaggregated data

Why data matters: presenting A2ii’s FeMa Meter, a tool for collecting sex-disaggregated data

Today, on International Women's Day, A2ii is launching the FeMa-Meter, a tool for collecting sex-disaggregated data across two categories: access to and use of insurance, and organisational diversity. The tool helps collect key insurance indicators and provides immediately a quick analysis. The tool is targeted at insurance supervisors and regulators, policymakers, and insurance companies.

Read on to find out why data matters.

When designing a product or policy, the initial phases revolve around defining the target demographic. Both policymakers and companies conceptualise personas according to the characteristics they envision, often resulting in personas that lean towards male characteristics. Research shows that when focus groups are asked to illustrate a generic 'person,' around 80% of participants depict a male figure (Criado Perez, 2020). Even when efforts are made to intentionally create gender-neutral characters, persistent gender biases remain.

Gender is embedded in the way people think, often leading to unacknowledged biases that favour male traits, even in supposedly neutral contexts. This contradicts the idea that gender-neutral approaches are sufficient to address the needs of everyone. On the contrary, gender-neutral approaches maintain biases by making women's needs invisible and perpetuating the problem. How can we address the needs of women if we don’t acknowledge and understand them?

Furthermore, how can effective solutions be developed if tools and methodologies are not suited to recognising and addressing women's specific needs? It is essential to acknowledge and challenge these prejudices in the design and implementation of policies and products to ensure inclusivity and equality for all genders.

Why is sex-disaggregated data important?

Women’s access to insurance continues to be difficult due to various socio-cultural barriers, limited generational wealth and asset ownership, digital access, and low financial literacy, among other factors. These challenges are exacerbated by the absence of comprehensive sex-disaggregated data in the insurance industry.

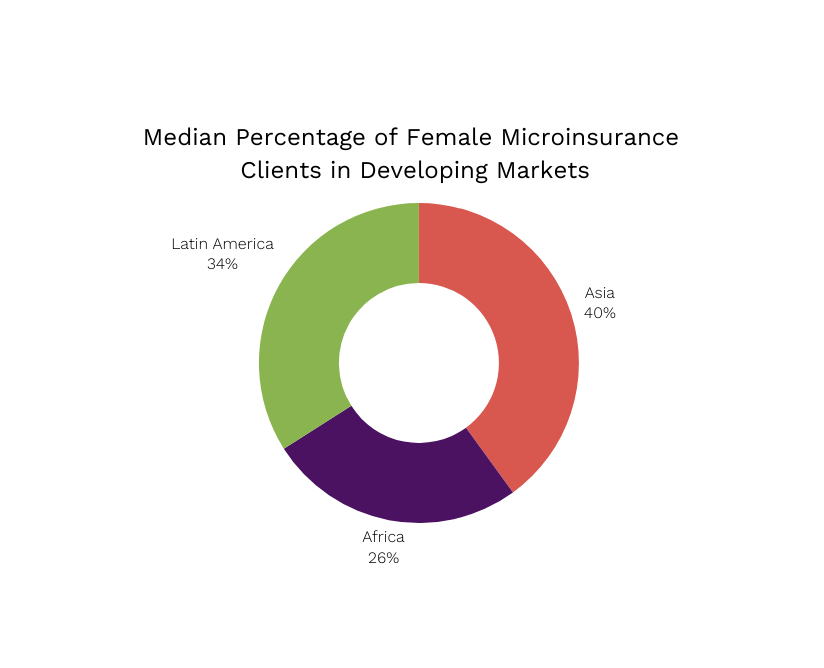

According to the Microinsurance Network’s 2022 landscape study, insurers did not provide data on gender for 58% of products, up from 50% in 2019. The severe lack of gendered data not only hinders the development of adequate insurance products but also hampers innovation within the industry. Without comprehensive sex-disaggregated data, insurance providers struggle to identify and understand the unique characteristics, needs and preferences of both men and women, leading to a limited range of insurance products and services tailored to their requirements. Moreover, this data gap significantly affects the monitoring of regional and country developments, hindering efforts to track progress towards gender equality and other key Sustainable Development Goals (UN Women, 2018).

“Quality gender statistics, sex-disaggregated data and other relevant knowledge are key to achieving gender equality” UN Women, 2022.

The absence of sex-disaggregated data exacerbates existing inequalities by perpetuating a one-size-fits-all approach to insurance provision. This approach fails to account for the diverse needs and vulnerabilities of women across different demographic groups, including those in rural areas, informal sectors, and marginalised communities. Consequently, women are often underserved or excluded from insurance schemes, leaving them financially vulnerable in the face of various risks such as health emergencies, natural disasters, or economic downturns.

To address this issue, concerted efforts are needed to collect comprehensive gender data that captures the nuanced realities of both men’s and women's lives and experiences. Only then can insurance providers develop tailored solutions that promote financial inclusion and resilience, thereby advancing gender equality and the sustainable development goals. A2ii is committed to contribute advancing these goals by placing a gender lens as an essential element of all its workstreams.

“Sex-disaggregated data is essential to achieve financial inclusion for women. It can provide information on the current status of financial inclusion of women, inform evidence based financial inclusion policy making and enable the effectiveness of efforts to address barriers facing women to be tracked” AFI, 2017.

How is A2ii working to increase women’s access to inclusive insurance?

A2ii works with insurance supervisors to build their capacity towards making insurance more inclusive, and to do so, we have developed several resources that address the gender gap in inclusive insurance. These resources include publications such as:

• Gender Equity Survey of the Argentinian Insurance Market (2023)

• Case Study: Innovating for inclusive insurance targeting women customers - involving insurance supervisors in the process (2022)

• Case Study: Women Leaders in Insurance Supervisory Organisations – Catalysts for Women’s Access to Insurance (2022)

• The Role of Insurance Supervisors in Boosting Women’s Access to Insurance (2021)

A2ii has also made publicly available two self-paced trainings:

• Applying a gender lens to inclusive insurance

• How to conduct a rapid gender diversity assessment

A2ii has also organised in 2021 a public dialogue in English, Spanish and French that discussed how insurance sector and regulatory approaches can help women’s access to insurance and how gender-diverse leadership in insurance companies can improve performance. The recording is available here.

The FeMa Meter

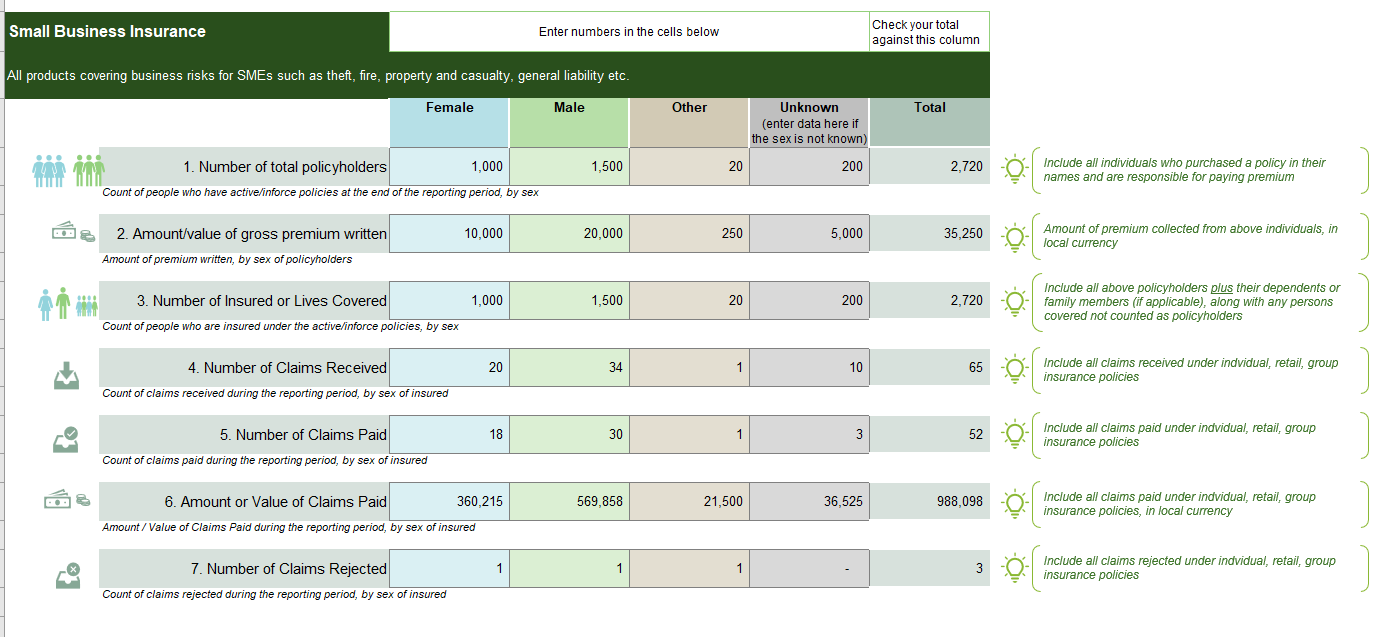

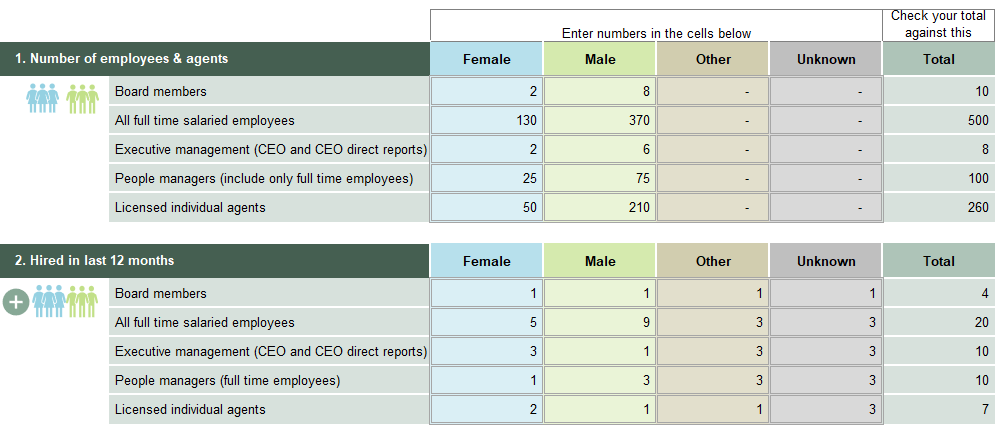

Today, A2ii launches the FeMa-Meter, a tool for collecting sex-disaggregated data across two categories: access to and use of insurance, and organisational diversity. The tool helps collect key insurance indicators and provides immediately a quick analysis. The tool is targeted at insurance supervisors and regulators, policymakers, and insurance companies. Designed for ease of use, the FeMa-Meter can be filled out by insurers in less than 30 minutes, after which it provides an immediate output of simple calculations. Insurance supervisors can aggregate data from insurers in just few clicks, no need for manual data entry.

The FeMa-Meter represents a significant milestone in advancing gender equality and ensuring a more evidence based and inclusive approach within the insurance industry. By facilitating the collection of sex-disaggregated data, the FeMa-Meter is pivotal in fostering a more gender-sensitive approach to insurance policies and regulation, helping to plug the gaps in data to work toward the unique needs and preferences of diverse gender groups.

We hope that the FeMa Meter can lead organisations to take further steps to gather sex-disaggregated data. For any questions, comments, or requests, please email gender@a2ii.org.

Learn more and access the FeMa Meter here.

The toolkit was evaluated in 2023 in collaboration with insurance regulators and industry representatives in selected jurisdictions and has proven to be an effective tool for sex-disaggregated data collection and an important starting point for a more gender-sensitive approach.

It was developed with support from the Swiss Development Cooperation (SDC) as part of the 2021-2022 project 'Empowering supervisors to improve women's access to insurance'.

For more on our work on gender, see our SDG 5 page.

References

Criado, C. (2020). Invisible Women: Exposing Data Bias in a World Designed for Men. Abrams Press.

Share this article

Also in Blog

Authors

Posts by Author

Topics Cloud

Subscribe to our list

Receive notifications when we publish new blog entries

Subscribe here