The current status of women’s access to insurance - an interview

The current status of women’s access to insurance - an interview

Katherine Miles and Manoj Pandey are the authors of the recent A2ii report The Role of Insurance Supervisors in Boosting Women’s Access to Insurance (also available in French and Spanish). The report outlines the potential of women’s insurance and the regulatory and supervisory approaches that have the potential to facilitate women's access to inclusive insurance, improving financial resilience and advancing the cause of gender equality.

While it is generally understood that women's access to insurance is low in emerging markets, the precise situation is unclear due to insufficient sex-disaggregated data at the national, regional or international level. Importantly, insurance supervisors can play a crucial role in boosting women's access to insurance through collecting and using sex-disaggregated supply and demand-side insurance data.

The report was published as part of the project 'Empowering supervisors to improve women’s access to insurance’, a funding partnership with the Swiss Agency for Development and Cooperation (SDC).

The original interview took place on Twitter.

A2ii: What is this report about?

K.M.: The report is a high-level situation assessment by A2ii to inform its next steps towards promoting women's access to insurance. It sets out the current status of women's access to insurance; the supply-side developments of the women's insurance market, including the effect of the Covid-19 pandemic on the risks faced by women with implications for insurance; and the role of insurance supervisors in boosting women's access to insurance.

It also explores what A2ii can to do facilitate better access to high-quality insurance for women and provide insurance supervisors with the knowledge and tools they need to promote inclusive and responsible insurance for women.

M.P.: We analyse challenges that are hindering women's access to insurance and explore regulatory and supervisory approaches can be taken to facilitate women's access to inclusive insurance and hence, improve their financial resilience and advance gender equality.

A2ii: Why is it important to promote women-centric insurance solutions?

K.M.: Women are increasingly recognised as an under- and unserved market for inclusive insurance with high growth potential, yet low levels of women's access to insurance persist. There are gender-diverse constraints in insurance access and usage - women face different insurable health risks than men.

Customer-centric products that address specific protection needs, related to the risks, vulnerabilities and access constraints women face, have proven successful in increasing insurance penetration.

M.P.: Women experience a persistent financial access gap of 7-11 % worldwide (ed.: see page 6 of the report). The digital access gap is even larger. With inclusive finance and Insurance substantially going digital, this gap may become insurmountable. Hence, there is a need to act now and be more gender-centric when we design the next inclusive insurance solutions.

Being gender-centric means being conscious of how the regulations, the products and distribution touchpoints impact men and women differently and then adapting our responses so that women, owing their socio-economic constraints, aren't left behind or underserved.

A2ii: What is the current status of women's access to insurance in emerging markets?

K.M.: There is a lack of comprehensive sex-disaggregated global or regional data on women's access to insurance. Various proponents have advocated for a range of sex-disaggregated indicators for insurers to better identify and service the women's market.

M.P.: Unfortunately, not enough comprehensive data sets exist to reliably inform us about the true status of women's access to insurance in emerging markets, especially with little gender-disaggregated data available. A few available data sets indicate that women are currently underserved by the insurance sector. This very much reflects the wider context of the persistent financial inclusion gender gap.

A2ii: Why is collecting and using sex-disaggregated or gender-disaggregated data important?

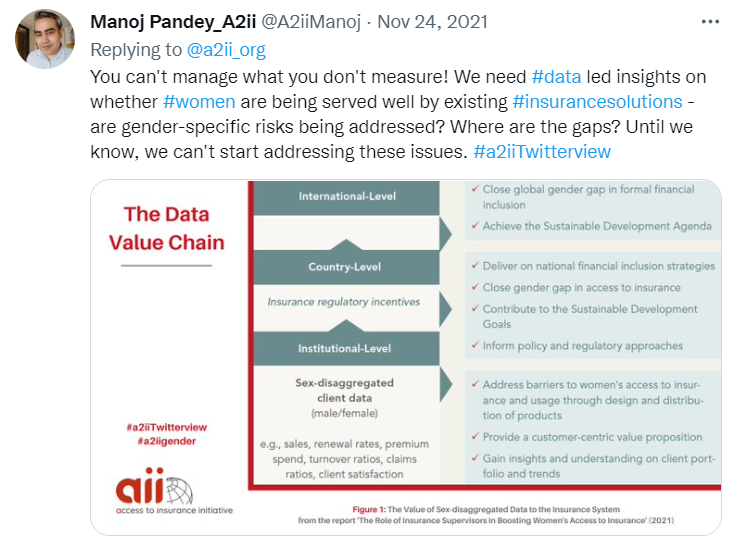

M.P.: You can't manage what you don't measure! We need data led insights on whether women are being served well by existing insurance solutions - are gender-specific risks being addressed? Where are the gaps? Until we know, we can't start addressing these issues.

There is no overview list of countries that require or incentivise the breakdown of insurance data by males and females, but we do have a few examples, such as Colombia and Peru which collect demand-side data.

Supervisors can require sex-disaggregated insurance data in reporting - there is an indication that a growing number of countries have mandated this in their prudential reporting and/or that they gather sex-disaggregated demand-side insurance data. For example, in 2020, the Reserve Bank of Fiji introduced a requirement for sex-disaggregated data.

Editor’s note: for more on this, see pages 23-24 of the report.

A2ii: What impact has the Covid-19 pandemic had on women's access to insurance?

K.M.: The economic fallout of the global pandemic has disproportionally affected women and enhanced existing barriers to women's access to insurance - e.g., the transition to online platforms for training and other operational processes due to the pandemic has been a barrier to many smallholder women farmers in some geographies that do not have smartphones, and social distancing measures have had implications for alternative distribution channels, such as self-help groups (SHGs) used to build awareness of and distribution of insurance among women.

M.P.: While we have not seen many studies that have looked at the impact of the pandemic on women's access to insurance, we have seen some studies from emerging markets on the general effects on women. These tell us that women, who are mostly employed in the informal sector, lost their jobs and their incomes, while the burden of caregiving and household chores increased. In addition, they lost almost all access to financial information such as self-help group meetings, engagements with MFI loan officers, etc. Hence, it’s a safe assumption that women's access to insurance has been negatively impacted due to less income and lowered access to information.

A2ii: How have insurance supervisors responded to the pandemic in the context of women's access to insurance?

K.M.: Insurance supervisory pandemic responses have not explicitly accounted for gender differential impacts. To date, there is no indication that insurance supervisors have integrated gender considerations into their supervisory response so far to the impact of the Covid crisis.

M.P.: This is an opportunity for regulators to appreciate that women access information differently, - mostly through other women - or with touch points that they trust over time. Such insights can help regulators to encourage the industry to develop women-friendly sales and servicing touch points.

A2ii: What can the insurance industry do to increase women's access to insurance?

K.M.: Gender-diverse leadership in insurance companies can improve performance. The insurance sector needs more women leaders to better serve women clients. Yet, there remains a low representation of women in the insurance sector at a global level.

M.P.: Insurers need to listen to specific needs that women have with respect to their health, life-cycle risks, etc. while designing their insurance solutions. In addition to this, social and cultural norms limit sales touchpoints that women can access with confidence. More gender aware sales and marketing approaches by insurers would enable more women to access insurance solutions.

A2ii: What are some examples of insurance products designed for women in emerging markets?

K.M.: Green Delta Insurance Company (GDIC) in Bangladesh has a tiered women-centric personal accident insurance product called Nibedita. It includes a mobile telephone app with a panic button and compensates women for trauma resulting from harassment. The IFC has a detailed case study on their offering.

M.P.: I would point to AXA Mansard Nigeria's SHERO initiative, Vimo SEWA in India, and Women’s World Banking (WWB) care giver insurance solutions as good examples.

A2ii: What can insurance supervisors do to enable greater access to high-quality insurance for women?

K.M.: Insurance policy and regulation are not gender neutral. Insurance supervisors can create an enabling regulatory environment for women's access to insurance - regulatory incentives are needed to encourage sex-disaggregated data collection. There is also the opportunity to integrate gender considerations into the insurance component of National Financial Inclusion Strategies (NFIS) in the same way it has been done for credit and savings products.

M.P.: Approaches for assessing risk and implementing customer due diligence requirements during the onboarding process can constrain women's access to insurance. From a supervisory perspective, there is an opportunity for gender considerations to be integrated into AML/CFT risk assessments and into each step of the customer due diligence (CDD) process required by global AML/CFT standards.

A2ii: What can insurance supervisors do to ensure more women participate in the insurance sector?

K.M.: Build the women's leadership pipeline in regulatory organisations. A2ii and InsuResilience Global Partnership provided scholarships for senior insurance supervisors and high potential women from their authorities, to participate in a Leadership and Diversity Programme for Regulators run by the Women's World Banking (WBB).

Supervisors also need to drive improvements in women's participation in the governance and workforce of the insurance sector. This can support insurers in their own business and governance but also enhance gender equality.

Editor’s note: for more on the impact of the Women’s World Banking Leadership Diversity Programme, see our interview with a senior insurance supervisor participant, Alma Gomez from Belize on the A2ii blog.

"Through the rural finance project, many women in Belize have been able to access finance and, in most cases have started their own businesses through women's groups."

Alma D. Gomez

A2ii: What are the six key action points outlined in the report for insurance stakeholders to increase access to insurance for women?

K.M.:

1. Addressing differences in access to identification documents in AML/CFT and Customer Due Diligence (CDD) regulations

2. Help close the sex-disaggregated insurance data gap

3. Encourage the use of sex-disaggregated insurance data.

4. Adapt consumer protection measures to address gender-differential risks.

5. Integrate gender dimensions into national financial inclusion strategies (NFIS) and other national financial and insurance literacy strategies.

6. Promoting market and product development tailored to the needs of different client groups.

Editor's note: see page 29 of the report.

A2ii: Thank you so much for taking part in this interview. One last question for both of you: what is your final takeaway after authoring this report?

K.M.: Insurance supervisors have a clear role and potential to facilitate better access to high-quality insurance for women, improve their financial resilience and contribute to progress on gender equality

M.P. Mainstreaming gender in inclusive insurance needs a leg up from the regulators. They need to champion the idea that gender- and women-centric solutions need not be a siloed, specialised effort but has to be integrated in all aspects - be it regulations, representation in the insurance industry, in insurance solutions and their processes, or through sales and distribution approaches.

See also

- Modules on Connect.A2ii

- Mainstreaming gender in inclusive insurance – the time is now! - blog

- The recording of the A2ii-IAIS Public Dialogue on Women’s Access to Insurance, available in French, Spanish, and English.

- The page on SDG 5: Gender Equality within the Insurance and SDGs section of our website

- The Supervisory KPIs Lexicon with a pillar on Sustainable Development indicators, including SDG 5: Gender Equality

Share this article

Also in Blog

Authors

Posts by Author

Topics Cloud

Subscribe to our list

Receive notifications when we publish new blog entries

Subscribe here