A2ii Newsletter 02/22

Welcome! In this newsletter, we provide you with updates on the work of the A2ii, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Subscribe to our mailing list to receive our newsletter in your inbox.

Navigation

Recent Events | Upcoming Events | Publications | Partner Publications | Useful Tools on Our Website

Recent events

Financial Inclusion Forum | 25 January

On 25 January, the fourth plenary meeting of the IAIS Financial Inclusion Forum (FIF) took place. Tomás Soley, Superintendencia de Seguros Generales de Costa Rica (SUGESE) and Chair of the FIF, opened the meeting and welcomed the 34 participating members to the session focusing on “Financial Education: Supervisory approaches to distribution of need-based products”.

During the initial tour de table, supervisors presented their initiatives and approaches to financial education and shared emerging lessons from their jurisdictions. Some common themes from more than 10 jurisdictions included:

- The need for a multisectoral and collaborative approach with the industry in an active role

- Approaches targeted at specific population groups

- The increasing use of digital means and social media, as well as the integration of financial literacy into school curricula

The following peer exchange session was led by the FIF topic champion Yegna Priya Bharat, Chief General Manager (Non-life and communication) of the Insurance Regulatory and Development Authority (IRDAI). In this session, FIF members exchanged on financial inclusion from both supply – the availability, access and affordability of need-based products - and demand side – insurance education and the measurement of insurance literacy levels.

A2ii-IAIS Supervisory Dialogue on Climate-related Financial Disclosure and Implications for Supervisors | 27 January

On 27 January, the A2ii and IAIS hosted both a morning and afternoon Supervisory Dialogue on Climate-related Financial Disclosure and Implications for Supervisors.

The presenters included William Harding (Head of Implementation, SIF), Elias Omondi (Senior Manager – Risk Regulations, FSD Africa) and Andrew Stolfi (Insurance Commissioner and Agency Director, Oregon Department of Consumer and Business Services).

William Harding presented highlights and key messages from the IAIS-SIF Issues Paper on the Implementation of the Recommendations of the Task Force on Climate-Related Financial Disclosures as well as highlighting country case studies based on the SIF’s recent publication on Implementation of TCFD Recommendations by Insurance Supervisors and Regulators. He further touched on implementation by industry and the role of supervisors in the Taskforce for Climate-related Financial Disclosures (TCFD) implementation.

Elias Omondi spoke about Africa’s vulnerability to climate change and the need to expedite climate finance for the continent and further touched on ESG matters, specifically highlighting FSD Africa’s ESG integration project in Ghana, Kenya and Nigeria including the planned project outcomes.

Andrew Stolfi presented on the NAIC’s ongoing and future activities on climate risk disclosure – touching on the work of the Climate and Resiliency (EX) Task Force that is mandated to consider appropriate climate risk disclosures within the insurance sector, including the evaluation of the Climate Risk Disclosure Survey and evaluation of alignment with other sectors and international standards.

For more information on what came up in the dialogue, the presentations are available on our website, where you can also keep an eye out for information on future dialogues.

Upcoming events

How to raise insurance awareness for market development? Lessons from the second Inclusive Insurance Innovation Lab - Public Dialogue | 10 February

The second A2ii Inclusive Insurance Innovation Lab (iii-lab) took place from March 2020 – November 2021. Country teams from Argentina, India, Morocco and Rwanda worked on innovative approaches to develop their inclusive insurance markets. Recognising that vulnerable populations often do not know about insurance as a risk management tool and/or do not trust the formal insurance sector, the participants of the iii-lab designed and tested innovative insurance awareness campaigns. In addition, two teams worked on improving the supply of inclusive insurance in their markets.

Join us in discussing lessons from designing and testing these innovations and from working collaboratively across key stakeholders from public and private sector as well as civil society. In the A2ii-IAIS Public Webinar on How to raise insurance awareness for market development? Lessons from the second Inclusive Insurance Innovation Lab participants of the iii-lab from Argentina, India, Morocco and Rwanda will share their experience in designing and implementing different awareness raising campaigns and new products in their insurance market. In addition insurance supervisors will share how engaging in the iii-lab has led to new partnerships with actors in the private sector and civil society.

The Public Dialogue will take place on Thursday, 10 February 2022, from 12:00-13:30 CET, in English and will feature simultaneous interpretation into French and Spanish.

Registration for the Public Dialogue is open now. To learn more about the iii-lab methodology visit our iii-lab webpage.

IAIS-A2ii-SARB-FSI Regional Meeting for Sub-Saharan African Supervisors | 24-25 February

The upcoming regional meeting for Sub-Saharan Africa insurance supervisors will be organised virtually and hosted by the International Association of Insurance Supervisors (IAIS), the Prudential Authority within the South African Reserve Bank, the Financial Stability Institute and the Access to Insurance Initiative.

As a representative of an insurance supervisor in Sub-Saharan Africa, your participation in this workshop will be valuable. We hope that you will be able to join us.

The regional meeting will take the format of 3-hour sessions over two days (24 and 25 February 2022) and will be hosted virtually from 9:00 am to 12:00 pm.

Click here to register.

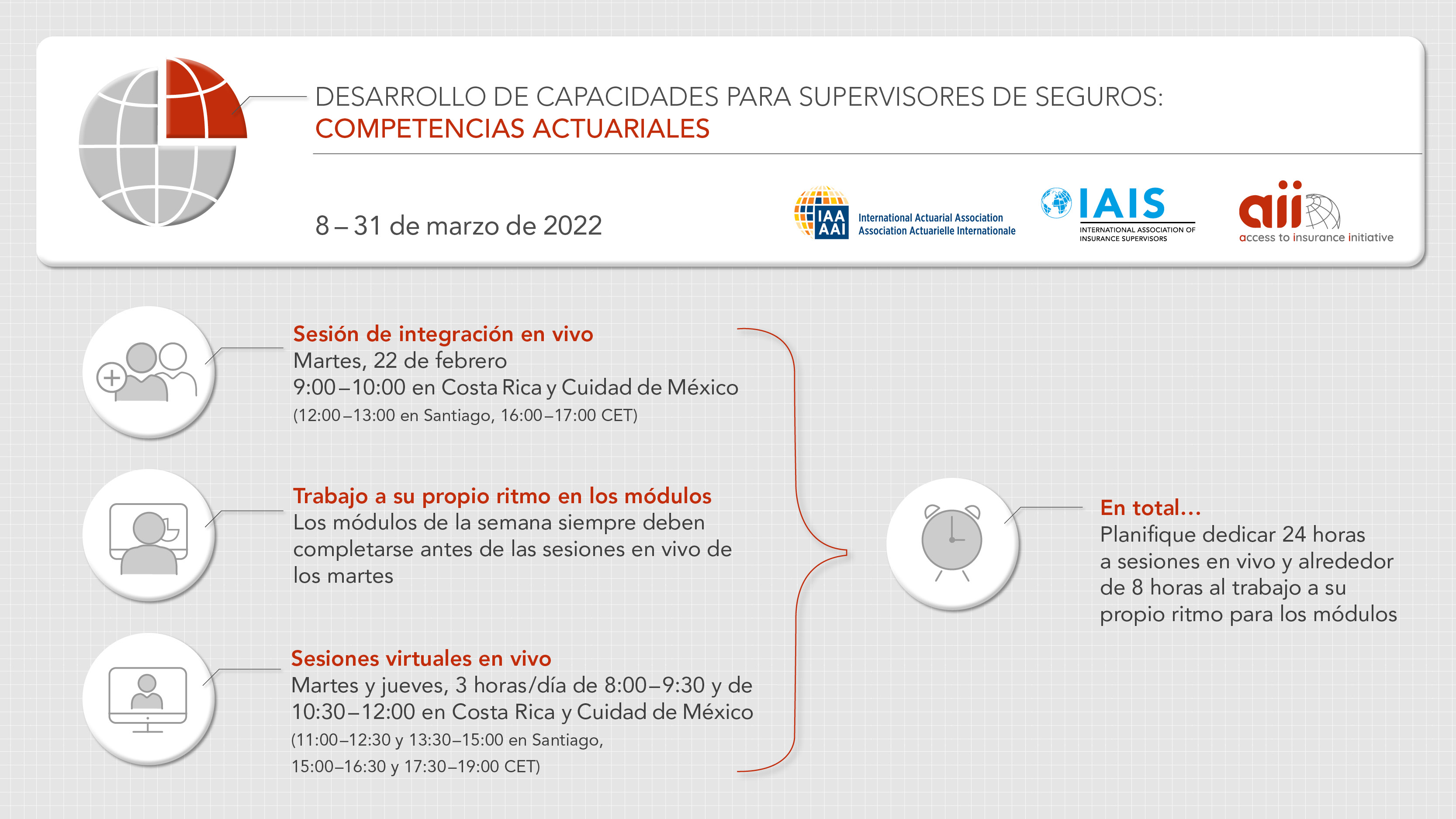

Desarrollo de capacidades para supervisores de seguros: competencias actuariales | 8-31 de marzo de 2022

Nos complace invitarlo a la capacitación virtual “Desarrollo de capacidades para supervisores de seguros: competencias actuariales”, organizada por la Asociación Actuarial Internacional (IAA), la Asociación Internacional de Supervisores de Seguros (IAIS) y la Iniciativa de Acceso a Seguros (A2ii).

La capacitación está dirigida a supervisores de América Latina. Su objetivo es fortalecer la comprensión y la aplicación de los conceptos y herramientas actuariales necesarios para respaldar una supervisión y regulación de seguros efectivas.

El enfoque y el abordaje de la capacitación se centrarán en principios de enseñanza, al mismo tiempo que será lo más práctica y simple posible.

La capacitación se lleva a cabo durante ocho días entre el 8 al 31 de marzo de 2022 con una combinación de módulos de aprendizaje adaptada al ritmo de cada uno y sesiones virtuales en vivo, que incluyen una variedad de sesiones basadas en conferencias, estudios de casos, sesiones grupales y cuestionarios.

Haga clic aquí para ver más.

Publications

Prudential and Market KPI Handbooks Published

The A2ii has published two KPI Handbooks, Prudential and Market Conduct, respectively, as part of the KPI Reporting Toolkit for Insurance Supervisors project. Supervisors can use the Handbooks to understand what data they should need and how to collect, analyse, and use data, in line with ICP 9.

The Prudential KPI Handbook covers a framework for assessing the prudential risk of insurers, an approach to gathering data, selection and analysis of KPIs, benchmarks and assessment checklists, how to compile findings, links to interventions, and implementation considerations

The Market Conduct KPI Handbook covers a framework for assessing the conduct risk of insurers (ICP19, the customer journey and customer outcomes), an approach to gathering data, selection and analysis of KPIs, a list and explanation of each KPI, how to compile findings, links to interventions, and implementation considerations

About the KPI Reporting Toolkit Project

The outputs of the KPI Reporting Toolkit for Insurance Supervisors project span four pillars: prudential soundness, market conduct, insurance market development and the SDGs.

They include:

-

Background paper ‘Evolving insurance supervisory mandates in Sub-Saharan Africa – implications for data practices’, available in English, French and Spanish

-

Supervisory KPIs Lexicon – interactive, searchable directory of KPIs

-

In conjunction with the Lexicon, the four KPI Handbooks: Prudential, Market Conduct, Market Development (coming soon) and SDGs (coming soon).

In this video, Hui Lin Chiew, A2ii, summarises the use case for the Handbooks in more detail.

Partner Publications

Unlocking the potential of responsible mobile insurance: Emerging practices for insurance supervisors and the industry

Mobile phone penetration and mobile services have unlocked various opportunities to overcome traditional constraints in financial inclusion, including insurance. Despite this, there is a wide range of supervisory concerns and risks associated to mobile insurance.

GIZ commissioned a project to analyse the regulatory frameworks in Egypt, Morocco and other jurisdictions, and to assess the impact of the mobile insurance regulatory framework in Ghana.

This whitepaper presents the identified challenges, emerging practices and lessons learned in order to promote the adoption of proportionate approaches to mobile insurance regulation. It ultimately aims at inspiring supervisors and the industry to increase access to insurance while ensuring the stability of the market and protecting consumers. The A2ii provided support during the drafting process, drawing from previous A2ii and IAIS materials – the report can be accessed here.

Useful Tools on Our Website

Insurance and the Sustainable Development Goals (SDGs)

The SDG pages include resources on the importance and the role of insurance across nine SDGs: 01 No Poverty, 10 Reduced Inequalities, 02 Zero Hunger, 03 Good Health and Well-being, 05 Gender Equality, 08 Decent Work and Economic Growth, 09 Industry Innovation and Infrastructure, 13 Climate Change and 17 Partnerships for the Goals.

Supervisory KPIs Lexicon

Interactive, searchable directory of KPIs for insurance supervisors across four pillars: prudential soundness, market conduct, insurance market development and the Sustainable Development Goals.

Inclusive Insurance Regulations Map

The interactive map incorporates data about existing inclusive insurance regulation and regulation which supports inclusive insurance sourced through A2ii's research, work and interaction with supervisory authorities worldwide.

ICP Self-assessment Tool

The tool is intended to help supervisors assess the level of observance of the Insurance Core Principles (ICPs).