A2ii Newsletter November 2023

Welcome! In this newsletter, we provide you with updates on the work of the A2ii, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Subscribe to our mailing list to receive our newsletter in your inbox.

Navigation

Connect.A2ii | Recent Events | Upcoming Events | Regulatory Update | Useful Tools on Our Website

Connect.A2ii

Access to Insurance Initiative (A2ii) and United Nations Capital Development Fund (UNCDF) launch training on Index Insurance

The two trainings, targeting insurance supervisors and other stakeholders, represent a significant step forward in advancing index insurance expertise and contributing to the broader mission of fostering financial inclusion and resilience. The trainings are based on the paper "Index Insurance Best Practices for Insurance Regulators and Practitioners in the Pacific Island Countries," co-published by A2ii and the UNCDF in 2022.

The certified training for supervisors offers a comprehensive and structured curriculum covering a range of topics, from understanding product categories and testing to prudential supervision and best practices in operations. The training is hosted on A2ii’s learning and exchange platform exclusive for supervisors Connect.A2ii.

The training for other stakeholders covers best practice considerations that could be relevant to their perspectives and in working collaboratively with supervisors. This training is open to all interested stakeholders in A2ii’s public training catalogue.

The two trainings form part of the A2ii-UNCDF agreement to drive access to insurance and pension for migrants, including climate disaster risk insurance.

Recent events

Inclusive Insurance Training | 7 - 16 November

The Inclusive Insurance Training programme was organised by A2ii in partnership with the Toronto Centre, AITRI, and IAIS. The main sessions took place over 4 days from 7-16 November 2023. There were 24 supervisors from 14 jurisdictions in Asia-Pacific participating in interactive case studies and sharing their experiences and ideas on inclusive insurance.

Lawrie Savage was the program me leader, and we welcomed special guests Manoj Pandey, A2ii, for an interactive session on gender, Atty. Gideon Joseph Operiano, Insurance Commission of the Philippines, on their experience with microinsurance, Pujan Dhungel Adhikari, Nepal Insurance Authority, on their experience with index insurance, and Tyson Grootjans, Reserve Bank of New Zealand, on the Central Bank Network for Indigenous Inclusion.

At the end of the training, participants completed and presented action plans to address an issue in their jurisdiction. Their priorities included increasing access to insurance products for low-income or underserved populations, inclusive insurance regulatory frameworks, insurance education and awareness, internal capacity building programmes, data collection on women’s access to insurance, mobile insurance, index insurance, and addressing disaster and climate risks.

Capacity Building for Insurance Supervisors: Leveraging Actuarial Skills | 21-30 November

The training took place from 21 to 30 November 2023, with a combination of online self-paced modules and live sessions, which include a range of lecture-based sessions, case studies, breakout sessions and quizzes. Around 30 supervisors from Sub-Saharan Africa and the Caribbean attended. The training aims at strengthening the understanding and implementation of the actuarial concepts and tools necessary to support effective insurance supervision and regulation.

Topics covered included risk management, valuation reports, reinsurance, risk-based capital, as well as key performance indicators to monitor for risk-based solvency.

The sessions were taught by Jeff Blacker, Norma A. Rosas, Eamon Kelly, Christiaan Ahlers, Britta Hay and Elias Omondi. Participants were also joined by Peter Windsor, who gave a presentation on IFRS 17 and Jooste Steynberg, who presented on the activities of the Risk Based Solvency Implementation Forum.

2023 IAIS Annual Conference | 9-10 November | Tokyo, Japan

As part of the IAIS Annual Conference 2023, the IAIS hosted a series of roundtables that the A2ii supported or participated in. The main sessions included:

Financial Inclusion Roundtable: This proved to be one of the most popular topics during the roundtable sessions. Roundtable participants acknowledged the IAIS’s and the A2ii’s crucial role in promoting inclusive insurance practices and supporting the development of effective regulatory frameworks. During the roundtable, which was moderated by Tomás Soley, Chair of the IAIS-A2ii Financial Inclusion Forum and Superintendent of the General Superintendence of Insurance od Costa Rica (SUGESE), there was a discussion of future work for the IAIS that included the following:

- Enhancing regulatory frameworks to facilitate the development of innovative insurance products and distribution channels tailored to underserved segments.

- Promoting the adoption of financial literacy initiatives and insurance awareness campaigns.

- Encouraging the use of digital technologies to expand insurance access and improve operational efficiency.

- Supporting the development of risk-based capital requirements and supervisory practices that align with inclusive insurance principles.

Participants were keen to express that unlocking inclusive insurance is not just about expanding access to insurance products; it is about empowering individuals and communities to build resilience against financial shocks and navigate a rapidly changing world. By fostering collaboration, innovation, and evidence-based policymaking, we can collectively unlock the transformative potential of inclusive insurance for a more resilient and sustainable future.

Protection Gaps Roundtable: Participants in a recent roundtable on protection gaps, held during the IAIS Annual Conference 2023, underscored the need for a multi-stakeholder approach to tackle this issue. Natural catastrophes (NatCats) remain a significant concern, but other types of protection gaps also warrant attention. Addressing these gaps requires a concerted effort from various stakeholders, including supervisors, governments, and the insurance industry. In particular, supervisors can play a crucial role by advocating for the importance of protection gaps, serving as a bridge between the government and the industry, and advising the government on protection gaps. Overall, participants reiterated that addressing protection gaps requires a comprehensive approach that involves all stakeholders. Supervisors, governments, and the insurance industry must work together to ensure that individuals, businesses, and communities have adequate protection against a wide range of risks. The exchange also focused on the recent publication by the IAIS on Natural Catastrophe protection gaps where participants expressed support for ongoing work by the IAIS.

Emerging Markets and Developing Economies (EMDEs) Breakfast: The IAIS also hosted a breakfast with representatives from emerging markets and developing economies (EMDEs) to address climate-related risks, protection gaps, and resource limitations. The breakfast was moderated by Siham Ramli, IAIS ExCo Vice Chair for EMDE and Director of Communication and International Relations at the Autorité de Contrôle des Assurances et de la Prévoyance Sociale (ACAPS). During the session, she was joined by Hanne van Voorden, IAIS Head of Supervisory Practices and Operations, Janina Voss, Interim Head of Secretariat, Access to Insurance Initiative (A2ii), and Juan-Carlos Crisanto, Deputy Chair, Bank for International Settlements – BIS’s Financial Stability Institute. During this session, EMDE member countries heard about capacity-building opportunities available on the topic of Climate risks from the IAIS, A2ii, and FSI. Representatives from over 30 EMDE member countries also discussed the challenges and opportunities in fostering resilience and sustainability on the topic. The discussion highlighted the importance of capacity building, data availability, and cooperation among stakeholders in addressing these critical issues. In particular, EMDEs emphasised the need for enhanced capacity-building initiatives to equip supervisors with the knowledge and skills to effectively assess and manage climate risks. Data availability remains a critical challenge and embedding climate risk considerations into insurance supervision is hindered by data limitations. Supervisors highlighted that addressing this challenge requires concerted efforts to improve data collection, analysis, and sharing.

Launch of the Guide of Recommendations for Gender Equality in the Argentinian Insurance Market | 16 November

On 16 November, the National Insurance Superintendence of Argentina (SSN) presented the Guide of Recommendations for Gender Equality in the Insurance Market. The guide contains a set of recommendations to implement the gender and diversity perspective in the daily activities of companies in the insurance sector, aiming to achieve more inclusive workplaces free of violence. In addition to public inclusion policies, the recommendations are based on the results of SSN initiatives related to Gender and Diversity, which include the Gender Equity Survey whose findings were analysed with support from A2ii and can be found in the “A2ii-SSN Report on the Gender Equity Survey of the Argentinian Insurance Market”.

The presentation was made within the scope of the SSN Roundtable on Policies with a Gender and Diversity Perspective, on the launch of the General Conditions for Women's Insurance, specifically designed to cover risks inherent to the female gender.

Virtual Workshop on Risk Modelling | 29 November

In this workshop, organised as a follow-up from the 18th Consultative Forum that took place on 23 October in Ghana, participants received an overview of how risk modelling capabilities have advanced dramatically over the past few years, as the quantity and quality of data has increased exponentially, and data analytical capabilities and timely access to relevant data has improved. This has led to more innovative risk financing and risk mitigation programs.

The workshop provided a deep dive into modelling, including how these models are built, how they can be used, what their limitations are and what resources are available to help supervisors regulate and use such models. Around 100 supervisors attended this event.

After the welcoming remarks on behalf of Ekhosuehi Iyahen, Secretary General of the Insurance Development Forum and Janina Voss, Interim Head of the A2ii Secretariat, Miroslav Petkov, Senior Policy Advisor at the IAIS and Bill Marcoux, Chair of the Law, Regulation and Resilience Policies Working Group at IDF presented on the value of understanding climate and disaster risk relating to supervisors’ roles in development of markets and addressing the protection gap.

Afterwards, a presentation on the perspective of supervisors on using climate and disaster risk analytics was given by Tomás Soley, from the Superintendencia General de Seguros de Costa Rica (SUGESE)

Lastly, a discussion on the key aspects of catastrophe risk models, including best practice uses, which was presented by Emma Watkins, Head of Exposure Management at Lloyds, and Marie Scholer, Expert on Policy Sustainable Finance, European Insurance and Occupational Pensions Authority (EIOPA).

This event will continue with part two on 7 December.

Upcoming Events

Virtual Workshop on Risk Modelling | 7 December

The second part of this series will build on the previous workshop.

The session will be welcomed by Janina Voss, Interim Head of Secretariat at A2ii, and Hannah Grant, Senior Advisor at Global Shield and Co-chair of the Law, Regulation and Resilience Policies Working Group at IDF.

It will then start with an introduction to risk analytics principles and approaches by Stuart Fraser, Technical Lead, Risk Modelling Steering Group at IDF, followed by a presentation on the examples of risk modelling for supervisory purposes by Dickie Whitaker, Chief Executive at Oasis Loss Modelling Framework, Dr. Nihar Jangle, Advisor, Climate Risk Insurance (GIZ) and Andrew Dhesi, Group Head of Property Modelling, Renaissance Re. Lastly, the session will end with an open forum moderated by Pascale Lamb, Advisor at the A2ii, and Miroslav Petkov, Senior Policy Advisor at the IAIS.

More information on the event and registration available on our website.

Regulatory Update

Bangladesh (IDRA) issued Regulatory Sandbox guidelines to allow new insurance products and services to be tested while still ensuring that consumers remained protected. The goal is to foster innovation and increase access to insurance, as the current insurance penetration rate stands at less than 3%. Companies can use the sandbox to test innovations in product development and marketing, claim settlements and underwriting, among others.

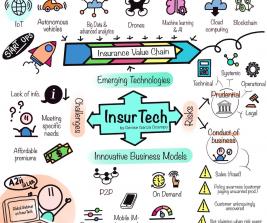

Saudi Arabia approved InsurTech rules in July 2023. The Rules intend to enable InsurTechs to perform flexibly within an innovative regulatory framework. InsurTech activities are “any solutions or services fully provided or designed by the use of technology within the scope of the insurance activities.” It also includes a code of conduct which stipulates that companies should not discriminate based on race, gender, or other characteristics.

These two countries join a list of several others who have implemented a regulatory sandbox designed to allow for innovation in their jurisdictions. We invite you to browse our Inclusive Insurance Regulations Map for more information, where you can filter by region and type of intervention (such as sandboxes, dedicated licencing, gendered aspects, and index insurance).

Do you have any regulatory updates to share? Please email secretariat@a2ii.org.

Useful Tools on Our Website

Inclusive Insurance Regulations Map

The interactive map incorporates data about existing inclusive insurance regulation and regulation which supports inclusive insurance sourced through A2ii's research, work and interaction with supervisory authorities worldwide.

ICP Self-assessment Tool

The tool is intended to help supervisors assess the level of observance of the Insurance Core Principles (ICPs).

Supervisory KPIs Lexicon

Interactive, searchable directory of KPIs for insurance supervisors across four pillars: prudential soundness, market conduct, insurance market development and the Sustainable Development Goals.

Insurance and the Sustainable Development Goals (SDGs)

The SDG pages include resources on the importance and the role of insurance across nine SDGs: 01 No Poverty, 10 Reduced Inequalities, 02 Zero Hunger, 03 Good Health and Well-being, 05 Gender Equality, 08 Decent Work and Economic Growth, 09 Industry Innovation and Infrastructure, 13 Climate Change and 17 Partnerships for the Goals.