A2ii Newsletter 07/22

Welcome! In this newsletter, we provide you with updates on the work of the A2ii, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Subscribe to our mailing list to receive our newsletter in your inbox.

Navigation

iii-lab Update | Recent Events | Upcoming Events | Staffing Update | Publications | Useful Tools on Our Website

iii-lab Update

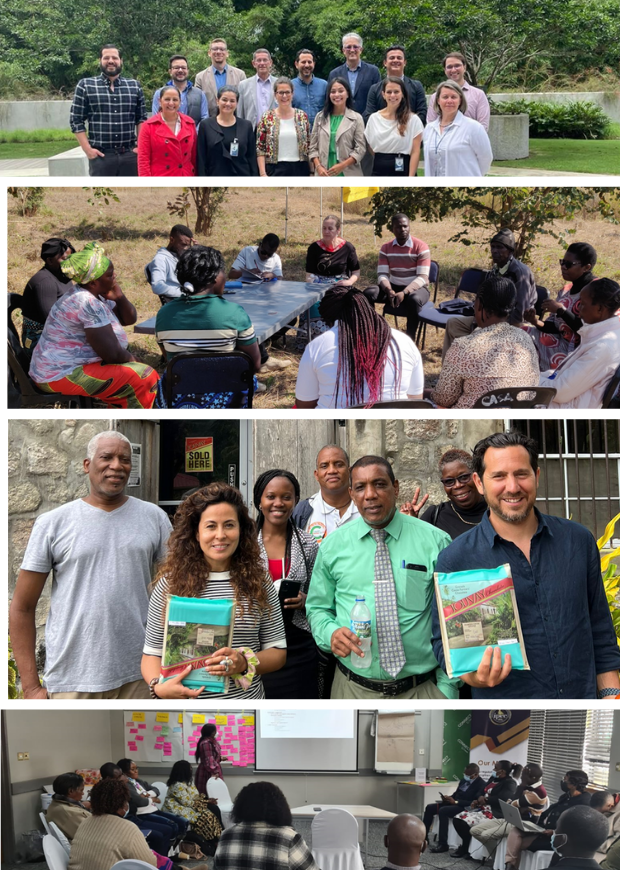

iii-lab country workshops | 8-29 June

The Inclusive Insurance Innovation Lab (iii-lab) is a 12-month-long process aimed at helping multi-stakeholder teams from four different countries to come up with innovations to increase resilience of the most vulnerable segments in their societies.

During the past nine months, the multi-stakeholder teams of iii-lab three, the ‘climate lab’, have worked collectively on innovative solutions to increase resilience of the most vulnerable segments in their societies against the impacts of climate change.

In June, the four iii-lab teams from Costa Rica, Grenada, Zambia and Zimbabwe gathered outside the virtual world for the first time. Each country team met for a two-and-a-half-day workshop to reflect on the journey they have embarked on since October 2021.

In the workshops, the country teams continued working on their initial prototypes and planned further steps to the implementation and institutionalisation of the process. In addition, the teams were able to present their work to external stakeholders to receive their feedback. The workshops ended with defining a road map for a sustainable continuation of the work once the iii-lab programme ends. The iii-lab hosting team passed on the ownership and responsibility of the lab to each team.

Costa Rica

The Costa Rica implementation workshop took place from 8 – 10 June in San José, Costa Rica and was hosted by the insurance supervisory authority SUGESE. Participants included representatives from SUGESE, insurance companies and the Ministry of Tourism. The team are developing a prototype for a climate web tool called Fu-Turismo that aims at building awareness of climate change in the tourism sector while at the same time promoting risk reduction and coverage solutions. Primary beneficiaries of this innovative tool are micro, small and medium entrepreneurs from the tourism sector, which are heavily affected by the impacts of natural and climate disasters. During the workshop external stakeholders gave feedback on the prototype the team developed.

Grenada

The Grenada implementation workshop took place from 27 - 29 June in St. George’s, Grenada and was hosted by the insurance supervisory authority GARFIN. Participants included representatives from GARFIN, the Grenada Development Bank, farmers cooperatives and the Ministries of Finance and Agriculture. The team continued working on their initial prototype, a mutual risk pool that provides direct relief to farmers and fisherfolk after a declared climate-related disaster.

Zambia

The implementation workshop for the Zambia team was held from 14 - 16 June in Lusaka, Zambia and was hosted by the Pensions and Insurance Authority (PIA), Zambia. The workshop had representatives from all stakeholders of the lab team including PIA Zambia, Ministry of Finance - Zambia, FSD Zambia, Microinsurance TAG, Farmer support organisations such as Musika, ZAFWEB and Mulimi and insurance industry representatives like the Insurance Association of Zambia, Insurance Broker’s Association of Zambia.

This workshop was an opportunity for the team to refine their prototype idea of developing an insurance awareness campaign aimed at promoting greater awareness and trust in climate risk insurance amongst small holder farmers in Zambia, leveraging the social capital of trusted figures like agriculture insurance officers and community leaders.

During the previous phases of the workshop, the team has identified the critical gaps of information and awareness that smallholder farmers in Zambia face, they tested these assumptions in a focused group discussion with smallholder farmers just outside Lusaka. The insights received from the discussions with farmers helped the team further tighten their idea on their information campaign prototype which was shared with a wider set of representatives from the insurance industry on Day 3.

The refined prototype idea consists of developing an information campaign that works at a generic level for generic index insurance solutions, the content would be provided for the various insurance players in the Zambian market. This information would then be taken to the farmers via mobile phones, local input providers and other entities with a last mile connectivity, including extension offices and local leaders.

Zimbabwe

The Zimbabwe implementation workshop took place from 21 – 23 June in Harare, Zimbabwe and was co-hosted by the Insurance and Pensions Commission of Zimbabwe (IPEC). Participants included representatives from IPEC, the Insurance Council of Zimbabwe, the Insurance Brokers Association of Zimbabwe, the Zimbabwe Farmers’ Union, AFC Holdings, Women Farmers Land Association Trust, Champions Insurance, Pivot Africa, World Food Programme, and the Ministry of Finance.

The team worked on developing a prototype product called “Farmer’s Basket” that aims to strengthen resilience and provide protection from climate and disaster events for smallholder farmers in rural areas of Zimbabwe. As part of the workshop, they went on a field visit to the Goromonzi area and met with local farmers to discuss the prototype and receive feedback.

The Farmer’s Basket is intended to be a bundle of services. This includes area yield insurance with riders for life and funeral risks, information services on weather and market rates, insurance for farm inputs, and finally, linking these efforts to other infrastructure level efforts being undertaken by the government, which includes digging 35,000 boreholes for irrigation services.

The workshop ended with the team defining its workplan for the next 3 months. The group formed multiple small teams to address different areas of coordination and work as part of their plan. A robust proposal to be further tested should be ready by the end of the lab in September this year.

For more photos, see the photo gallery.

Recent events

New format: Q&A Special on the Implementation of IFRS 17 | 9 June

About 50 supervisors joined this very first A2ii Q&A Special. This one-hour session followed our recent Supervisory Dialogue Reflection on the Implementation of IFRS 17, where time was too short to address the significant number of questions.

Building on the content of the May dialogue, Peter Windsor, International Monetary Fund (IMF), as well as Zine Mshengu, Nonhlanhla Ndlovu and Stian Smit from the Prudential Authority within the South Africa Reserve Bank first addressed a collection of pre-submitted questions along four major themes: (1) the impact of IFRS 17 on solvency, regulatory adjustments and reporting, (2) adoption and application of IFRS 17, (3) training of supervisors and (4) the role of actuaries. This was followed by an open Q&A with participants.

A2ii Q&A Specials are designed as focused 1-hour long sessions that extend and deepen the exchange between supervisors and experts on important topics. We welcome supervisors’ suggestions on potential topics.

Recordings of both the May dialogue as well as the Q&A Special are available to supervisors on Connect.A2ii.

A2ii participation in the IAIS Global Seminar | 16-17 June

The A2ii participated in the IAIS’ annual Global Seminar, which took place in Dubrovnik, Croatia, on June 16 and 17 hosted by the Croatian Financial Services Supervisory Agency (HANFA).

The focus of this year’s Global Seminar was resilience in the insurance sector.

With hundreds of attendees from the insurance sector, including industry, supervisors and non-governmental organisations, the Global Seminar provides a platform for open dialogue on key supervisory issues for the insurance sector – supervisory practices in climate risk scenario analysis and addressing operational and cyber risks. The Seminar also provided an opportunity for the IAIS’ Executive Committee to engage directly with stakeholders. During the Seminar, Hannah Grant, Head of Secretariat at the A2ii, participated in a panel to discuss the role of inclusive insurance in addressing inequality and promoting sustainable development. The panel, entitled “Addressing social challenges of the day – How inclusive insurance can support sustainable development”, was also joined by Tomás Soley, General Superintendent of Insurance of Costa Rica, Ilijana Jeleč, Deputy President of the Board, Croatian Financial Services Supervisory Agency, and Shari Spiegel, Chief of Policy Analysis and Development, Financing for Sustainable Development Office, United Nations. The panel discussed obstacles and opportunities for innovative solutions to increase uptake of inclusive insurance, including technological innovation, public/private risk-sharing initiatives to address protection gaps and adapting product offerings to meet customer needs in a post-pandemic world. Recordings will soon be available on the IAIS website.

Extension of A2ii-IAA-IAIS partnership agreement | 17 June

The A2ii is pleased to renew the partnership agreement with the IAIS, and International Actuarial Association (IAA) for an additional five years. The partnership agreement will ensure continued capacity-building training in actuarial skills for insurance supervisors. The training is designed to strengthen the understanding and application of actuarial concepts and tools needed to support effective insurance supervision and regulation.

Victoria Saporta, Chair of the IAIS Executive Committee, Peter Braumüller, Chair of the Executive Committee and Governing Council of the A2ii, and Roseanne Harris, President of the IAA, signed the renewal of the agreement, which will become effective on 1 November 2022.

Almost 200 supervisors participated in the five regional training courses since 2019, and demand from the supervisory community keeps growing.

The A2ii is looking forward to continuing this partnership for another five years and the work on some exciting new ideas and projects coming up.

Financial Inclusion Forum – 6th Plenary | 30 June

The 6th Financial Inclusion Forum (FIF) plenary took place on 30 June. Members of the FIF gathered virtually to reflect on the Application Paper on Regulation and Supervision Supporting Inclusive Insurance Markets. In the first half of the meeting, FIF members shared the most recent inclusive insurance developments and challenges in their jurisdictions, including reviews of micro-insurance frameworks and recommendations.

This was followed by a peer exchange led by Craig Thorburn, Lead Financial Sector Specialist from the World Bank, based on the Application Paper and reflecting on further developments since its publication. During the exchange, participants sought to identify trends and opportunities.

Forty participants from across seven regions attended the session. The next FIF meeting will take place in October in Costa Rica and will address the topic of climate risk and the protection gap, as well as a workshop on disaster preparedness.

Presentation at Into Indochina Insurance Virtual Summit | 25 May

The A2ii participated in the 3rd edition of the ‘Into IndoChina Insurance Virtual Summit, 2022’ on 25 - 26 May. The summit’s focus was on how the insurance markets of Cambodia, Laos, Myanmar, Thailand & Vietnam are poised for growth and how the economies in Indochina are on a recovery trajectory with tremendous potential for growth & investment.

The session was moderator by Arup Chatterjee, Principal Financial Sector Specialist, Asian Development Bank (ADB).

The opening session on ‘Unlocking Market Opportunities – Digitalisation, Partnership and Collaboration’ was kicked off by Conor Donaldson, CEO, Global-Asia Insurance Partnership (GAIP) who introduced the partnership and its role in addressing today’s emerging risks in the Asian market, as well as how regulators have a key role in developing inclusive insurance markets.

Showing how the regulators in the region are taking steps to create an enabling environment for insurance to be more inclusive through leveraging technology, Dr Sovathana Hor, Deputy Director General, Insurance Regulator of Cambodia (IRC) talked about the latest regulatory initiatives undertaken in Cambodia, which are giving a push to digitally driven insurance models in the country. This was followed by U Thant Zin, Deputy Director General, Financial Regulatory Department, Ministry of Planning and Finance (MoPF), Myanmar who shared the state of digitalization of the insurance market in Myanmar.

Microinsurance Network’s Asia coordinator, Kim Am presented on the landscape of inclusive insurance in Southeast Asia.

One key question that came up during the discussions was, what can insurance supervisors do to effectively regulate the rising use of technology and digitalisation of the insurance markets in the region?

Addressing these questions, A2ii’s Manoj Pandey presented on the supervisory responses to digital insurance models, greater usage of RegTech and SupTech and also touched upon the emergent discussions on how insurance supervisors need to ensure the human touch remains in the rapid rise of big data analytics and AI driven models.

Upcoming events

Conduct and Culture - Supervisory Dialogue | 21 July

Matters related to conduct and culture are of growing importance to both conduct and prudential supervisors, especially in the context of rapidly changing financial markets driven by innovation, changes in consumer expectations and broader societal changes.

The IAIS defines corporate culture as “the set of norms, values, attitudes and behaviors of an insurer that characterises the way in which the insurer conducts its activities” (IAIS, 2021).

How does culture shape firm behavior in treating vulnerable customers fairly? How can firms to see purpose in inclusive insurance approaches?

These and other questions will be addressed on 21 July, at the A2ii - IAIS Supervisory Dialogue on Conduct and Culture. Lauren Eckermann, Senior Policy Advisor at the IAIS, will be presenting the Issues Paper on Insurer Culture, published in November 2021.

The presentation will be followed by a Panel discussion moderated by Charlotte Cross, Chair of the IAIS Market Conduct Working Group and Financial Conduct Authority UK and sharing of supervisory examples on the topic. The panel discussion will be joined by speakers from Malaysia, Costa Rica, and South Africa.

This webinar is restricted to insurance supervisors. It will take place at 10:00 CEST (with French interpretation), and at 16:00 CEST (with Spanish interpretation).

Link to 10:00 registration

Link to 16:00 registration

Visit our website version.

If you have any questions or comments, please send them to dialogues@a2ii.org

Inclusive Insurance Training Programme | 23 August – 15 September

This training programme is offered in partnership with the Toronto Centre and IAIS. It will be offered to supervisors from all regions in English. Live sessions with trainers will take place virtually over 8 days, Tuesdays and Thursdays from 23 August to 15 September 2022, from 13:00 to 17:00 CEST on MS Teams. Participants will also be required to complete online modules on the Connect.A2ii platform.

The training is targeted to entry- to mid- level insurance supervisors.

Topics covered in the training include:

-

Regulation and Supervision Supporting Inclusive Insurance Markets

-

The Role of the Supervisor

-

Gender Aspects

-

Prudential Aspects in Inclusive Insurance Supervision

-

Climate and Environmental Risks

-

Understanding the Market and the Environment

-

Uses of Technology in Inclusive Insurance

-

Key Performance Indicators

-

Sustainable Development Goals and Insurance

Places will be limited – if interested, please register on our website.

Geneva Association webinar on Insurance Development in Emerging Markets: The role of public policy and regulation | 6 July

A2ii will participate in the webinar on a new, joint report by The Geneva Association and Insurance Development Forum (IDF), examining how regulation and broader government policies can promote thriving insurance markets in emerging countries – ultimately helping to close critical protection gaps.

This discussion will expound some of the best practices identified, through research and expert interviews in 14 emerging countries, for tackling barriers to boosting re/insurance markets and expanding insurance coverage in emerging markets.

Click here to register for the webinar.

Staffing Update

We are pleased to welcome Laura Moxter Morales to the A2ii team as a Junior Advisor.

In her role at the A2ii, she will work on A2ii-IAIS Supervisory and Public Dialogues, will have a thematic focus on remittances, and will provide support to on-going A2ii projects, trainings, and events.

She first joined the A2ii team as an intern in January 2022. Her background is in academic research on migration and remittances. She holds a bachelor’s degree in Anthropology by the Autonomous University of Madrid and a master’s degree in Latin American Studies by the Freie University of Berlin. She is fluent in English, Spanish and German.

Publications

The A2ii has released two of its reports in French: 'Index Insurance: 2020: Status and Regulatory Challenges' and 'The Role of Insurance Supervisors in Boosting Women’s Access to Insurance'.

Details in French below:

Assurance indicielle : État des lieux et défis réglementaires (2020)

Le rapport intitulé « Assurance indicielle : Etat des lieux et défis réglementaire (2020) » fournit une vue d'ensemble de la façon dont les contrôleurs ont traité les défis liés à l'assurance indicielle au cours des dernières années. Il est basé sur les résultats de l'enquête 2020 sur l'assurance indicielle qui comportaient les réponses de 27 pays différents, ainsi que des représentants du secteur.

Cliquez ici pour lire le rapport

Le rôle des contrôleurs d’assurance dans l’amélioration de l’accès des femmes à l’assurance

Le rapport « Le rôle des contrôleurs d’assurance dans l’amélioration de l’accès des femmes à l’assurance » constitue une évaluation de haut niveau de la situation par A2ii , sur la base de laquelle elle définira les prochaines étapes pour promouvoir l'accès des femmes à l'assurance. Basée sur des recherches documentaires et des entretiens avec des informateurs clés sélectionnés, elle présente un aperçu de haut niveau sur : le statut actuel de l'accès des femmes à l'assurance; les développements du côté de l'offre du marché de l'assurance pour les femmes, y compris l'effet de la pandémie de la Covid-19 sur les risques encourus par les femmes avec des implications pour l'assurance ; et le rôle des contrôleurs d'assurance pour stimuler l'accès des femmes à l'assurance. Six actions clés sont qui peuvent être entreprises par les contrôleurs d'assurance pour permettre un meilleur accès des femmes à une assurance de haute qualité sont décrites dans le rapports, entre autre un engagement en faveur de la collecte et l'utilisation de données d'assurance ventilées par sexe ou l’intégration de la dimension de genre de l'assurance inclusive dans les SNIF et les diagnostics du secteur de l'assurance.

Cliquez ici pour lire le rapport

Nous souhaitons remercier le Groupe des Contrôleurs d’Assurance Francophone (GCAF) pour leur soutien précieux pour la relecture des traductions.

Useful Tools on Our Website

Insurance and the Sustainable Development Goals (SDGs)

The SDG pages include resources on the importance and the role of insurance across nine SDGs: 01 No Poverty, 10 Reduced Inequalities, 02 Zero Hunger, 03 Good Health and Well-being, 05 Gender Equality, 08 Decent Work and Economic Growth, 09 Industry Innovation and Infrastructure, 13 Climate Change and 17 Partnerships for the Goals.

Supervisory KPIs Lexicon

Interactive, searchable directory of KPIs for insurance supervisors across four pillars: prudential soundness, market conduct, insurance market development and the Sustainable Development Goals, with four accompanying handbooks.

Inclusive Insurance Regulations Map

The interactive map incorporates data about existing inclusive insurance regulation and regulation which supports inclusive insurance sourced through A2ii's research, work and interaction with supervisory authorities worldwide.

ICP Self-assessment Tool

The tool is intended to help supervisors assess the level of observance of the Insurance Core Principles (ICPs).