A2ii Newsletter March 2024

Welcome! In this newsletter, we provide you with updates on the work of the A2ii, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Subscribe to our mailing list to receive our newsletter in your inbox.

Navigation

A2ii is hiring | iii-Lab Update | Recent Events | Scholarships | FeMa Meter | Index Insurance | ICP Tool | Partner Opportunities | Trainings | Useful Tools on Our Website

A2ii is hiring

A2ii is looking for a new technical advisor to be a consultant for the Inclusive Insurance Fundamentals portfolio, with a deadline of 15 April 2024.

We are also hiring for a regional coordinator for Sub-Saharan Africa, with a deadline of 10 May 2024.

Click here for more information.

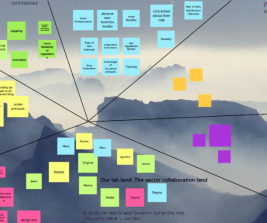

iii-Lab 4 Update

Armenia National Workshop | 13-14 March

The A2ii Inclusive Insurance Innovation Lab (iii-lab) held the first national workshop in Armenia over two days, 13 and 14 March, hosted at the Central Bank in Yerevan. Speakers including Mr Hovhannes Khachatryan, Deputy Governor of the Central Bank of Armenia, Katrin Buder-Pelz, Head of German Development Cooperation at the German Embassy, and Madeleine Rauschenberger, Country Director for GIZ Armenia, marked the opening with insightful remarks.

The workshop brought together a diverse multi-stakeholder team from the Central Bank of Armenia, various ministries, the industry sector, academia, and civil society. The participants engaged in fruitful discussions about the current landscape of inclusive insurance in Armenia and explored innovative opportunities for enhancing climate resilience through the lab process.

In response to the pressing challenges posed by climate change, the country team pinpointed the agricultural sector and low-income populations as critical areas of focus. The team committed to raising insurance awareness and capitalising on Armenia's advanced digital landscape. They also underscored the vital role of incorporating feedback from the demand side into the innovation process.

The 4th iii-lab is a 12-month journey where teams from Armenia, Nepal and Senegal, consisting of key stakeholders from the insurance sector, are collaborating on innovative insurance solutions to increase resilience against the impact of climate change. For more information on the iii-lab, click here.

Recent events

Global Partnership for Financial Inclusion First Plenary Meeting | 15 March, Brasilia

The GPFI's First Plenary meeting was hosted by the new Brazilian Presidency in Brasília on 15 March. The meeting was focused on the presidency's financial inclusion priorities around "Building a just world and a sustainable planet." In addition to outlined deliverables in its Financial Inclusion Action Plan for 2024, the GPFI aims to develop a conceptual framework and measurement tools for financial well-being. Welcoming remarks were provided by the Brazilian Central Bank and Her Majesty Queen Máxima of the Netherlands, UN Secretary General's Special Advocate for Inclusive Finance for Development (UNSGSA). The meeting highlighted key initiatives, including:

New G20 Action Plan on MSME Finance: Discussion revolved around a proposal to enhance MSME access to finance, led by IFC, SME Finance Forum, OECD, and World Bank.

Financial Well-Being: Emphasising broadening financial inclusion discussions towards enhancing financial well-being and resilience.

Last Mile and Quality Inclusion: Focus on improving access and quality of financial services through digital public infrastructure (DPI), consumer protection, and other strategies.

Regina Simoes, A2ii's Regional Coordinator for Latin America, emphasized the role of insurance in enhancing resilience for consumers and MSMEs. Insurance's critical role across these workstreams underscores A2ii's commitment to collaborate with GPFI for effective representation and support in delivering on these priorities. The preceding Seminar on Finance for MSMEs on 14 March discussed topics such as global MSME financing trends, policies for digital transformation, and financial inclusion for disadvantaged segments like women, youth, and people from rural areas.

10th Inclusive Green Finance Working Group (IGFWG) Meeting | 4-7 March, Fiji

The 10th AFI Inclusive Green Finance Working Group (IGFWG), co-hosted by AFI and the Reserve Bank of Fiji, coincided with the Consumer Empowerment and Market Conduct Working Group (CEMCWG), aimed at boosting the visibility of Working Group knowledge products and promoting IGF-related policy implementation. Governor Ariff Ali of the Reserve Bank of Fiji inaugurated the plenary session.

Highlights of the IGFWG meeting included updates on knowledge products, presentations, and panel discussions on member countries’ sustainable finance journeys, with a focus on MSMEs and women's initiatives. A special panel on "Parametric Insurance for Resilient MSMEs and MFIs" on 7 March facilitated knowledge sharing among members interested in parametric insurance. A2ii's Ronnie Limbago participated in a panel along with UNCDF and PCRIC, where they discussed best practices and experiences. Mr Limbago outlined A2ii's support for climate and disaster risk insurance for insurance supervisors, citing key best practices and recent IAIS findings. UNCDF highlighted the Pacific Insurance and Climate Adaptation Programme, while PCRIC shared its journey in offering parametric insurance coverage for Pacific Island countries. A Market Place session, where Mr Limbago addressed insurance-related queries, was also held on 8 March.

The 4-day event concluded with recognition and awards for outstanding IGFWG and CEMCWG members, followed by closing remarks from Governor Ariff Ali, marking the formal end of the event.

UNSGSA High Level Meeting on Financial Inclusion with SSBs | 12 March, Basel

The seventh high-level meeting on financial inclusion, co-chaired by Mr Agustín Carstens and Her Majesty Queen Máxima of the Netherlands, UNSGSA, focused on the theme of open finance. Mr Carstens provided an overview, highlighting the importance of inclusive financial systems in promoting the financial health of individuals. The meeting discussed how open finance frameworks could support households and small businesses by providing access to affordable digital financial services.

Key takeaways included recognition from central banks of open finance's potential to enhance competition and financial inclusion, along with challenges such as cost management and data security.

The standard-setting bodies (SSBs) They emphasised the need for regulatory guidance while balancing risks and opportunities.

Oportunidad de Beca

A2ii ofrece una beca completa para supervisores de seguros para el curso en línea Seguros para el desarrollo que se impartirá en español del 27 de mayo al 28 de junio de 2024. La beca cubrirá la matrícula del curso y se otorgará mediante un proceso de solicitud competitivo.

La fecha límite para las solicitudes de becas es el 14 de abril de 2024.

Para más información, ver nuestra página web.

FeMa Meter Tool

Globally, women constitute the majority of the uninsured population and are underrepresented in insurance policymaking and supervision, which exacerbates their access challenges. A2ii has responded to these issues by launching FeMa-Meter on 8 March.

This toolkit collects and reviews sex-disaggregated data to analyse gender differences in insurance indicators. Piloted in Argentina, Lesotho, Pakistan, and Zambia, it has proven to be an effective tool for collecting sex-disaggregated data.

With an intuitive interface, users can input data and generate insights swiftly. To access the FeMa-Meter, visit its dedicated website and its accompanying training module. Join us in advancing gender equality and improving insurance access through data-driven approaches.

Index Insurance Insights

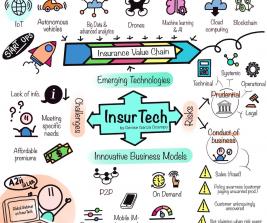

One of the advantages of index insurance, more hazard is reduced since claims payouts are automatically triggered by a predetermined index.

Are you familiar with index insurance? Also called parametric insurance, it’s an insurance scheme that makes payments to the insured when a pre-determined index is triggered. This expedited process holds potential in providing effective and affordable insurance protection for low-income and vulnerable groups.

Continue learning about index insurance in our free training and obtain the A2ii-UNCDF Certificate on Index Insurance for Supervisors. Exclusively designed for insurance supervisors, this certification offers comprehensive insights into index insurance mechanisms. Ready to take the next step? Enrol now on A2ii’s learning platform, Connect.A2ii.

For all other stakeholders not in supervisory roles, access our open version of the training on our website.

Insurance Core Principles Self-Assessment Tool

Have you tried the SAT tool yet? The Insurance Core Principles Self-Assessment Tool is a joint initiative of the IAIS and the A2ii designed to facilitate the assessment of the level of observance of the ICPs. Leveraging the analytical framework of the Peer Review Process, it empowers supervisors to evaluate adherence to these essential principles.

How it works:

Supervisors can access the tool through the dedicated platform. Once on the platform, they can navigate through a series of questionnaires tailored to each ICP.

The questionnaires are crafted to cover various aspects of each principle, providing a comprehensive evaluation framework. Supervisors can respond to these questions based on their assessment of their jurisdiction’s practices and policies.

Upon completing a questionnaire, supervisors receive immediate feedback. These results offer insights into the level of observance of the assessed ICP, enabling supervisors to identify strengths, weaknesses, and areas for improvement.

We encourage all supervisors to explore this resource and its potential to drive positive change within the insurance landscape.

Partner Opportunities

IAIS Graduate Recruitment

The International Association of Insurance Supervisors (IAIS) is looking for recent graduates to join the 2024 Bank for International Settlements (BIS) Graduate Internship Programme. This is an 11-month internship that will allow you to implement the knowledge you gained during your studies in a professional environment. Joining us is not just about launching your international career, it is about doing meaningful work for the public good and serving the global community.

The deadline for applications is 15 April. For more information on how to apply, click here.

NAIC International Fellows VIRTUAL Programme

The National Association of Insurance Commissioners (NAIC) invites insurance supervisors to apply for the NAIC International Fellows VIRTUAL Programme, to be held 29 April - 10 May 2024. The programme will feature recorded lectures by NAIC technical experts on all aspects of U.S. state-based insurance regulation, with opportunities for participants to exchange with NAIC staff during Q&A sessions and gain deeper insights into U.S. insurance regulation and the role of the NAIC in supporting state-based regulation.

Applications will be accepted until 12 April. Participation is free for selected applicants - more information is available on the NAIC website.

Call for Applications for the International Conference on Inclusive Insurance

The International Conference on Inclusive Insurance 2024 will take place from 21-25 October 2024 in Kathmandu, Nepal. Experts from more than 50 countries will discuss and identify ways of accelerating growth and economic viability for households in inclusive insurance for emerging markets. The conference will be hosted by the Nepal Insurance Authority, Nepal Insurers' Association, and the Life Insurance Association in cooperation with Munich Re Foundation and the Microinsurance Network.

For more information, visit the ICII website.

Trainings

Self-directed training

Supervision of climate-related risks in the insurance sector

Applying a gender lens to inclusive insurance

How to conduct a rapid gender diversity assessment

Index Insurance Training for All Stakeholders

Are you an insurance supervisor? Then join Connect.A2ii - our learning platform restricted to supervisors offering free and certified courses and an opportunity to learn from peers.

Useful Tools on Our Website

Inclusive Insurance Regulations Map

The interactive map incorporates data about existing inclusive insurance regulation and regulation which supports inclusive insurance sourced through A2ii's research, work and interaction with supervisory authorities worldwide.

ICP Self-assessment Tool

The tool is intended to help supervisors assess the level of observance of the Insurance Core Principles (ICPs).

Supervisory KPIs Lexicon

Interactive, searchable directory of KPIs for insurance supervisors across four pillars: prudential soundness, market conduct, insurance market development and the Sustainable Development Goals.

Insurance and the Sustainable Development Goals (SDGs)

The SDG pages include resources on the importance and the role of insurance across nine SDGs: 01 No Poverty, 10 Reduced Inequalities, 02 Zero Hunger, 03 Good Health and Well-being, 05 Gender Equality, 08 Decent Work and Economic Growth, 09 Industry Innovation and Infrastructure, 13 Climate Change and 17 Partnerships for the Goals.