A2ii Newsletter October-November 2024

Welcome! In this newsletter, we provide you with updates on the work of the A2ii, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Subscribe to our mailing list to receive our newsletter in your inbox.

Navigation

iii-Lab Update | Publications | Upcoming Events | News | Recent Events | Blog | Staff Updates | Index Insurance Insights | ICP Tool | Trainings | Useful Tools on Our Website

iii-Lab Update

Armenia National Workshop | 9 October, Yerevan, Armenia

On 9 October, the final national workshop under the A2ii Inclusive Insurance Innovation Lab (iii-lab) took place in Yerevan.

This event focused on the implementation and roll-out of their innovative solution, the ARMAGRO platform. ARMAGRO is a digital platform designed to support Armenian farmers by providing timely information about climate conditions, agriculture insurance options, and best practices to reduce the risks to their crops and livelihoods.

During the workshop, the team organised a panel discussion on the main trends in climate change in Armenia and its impact on the agricultural sector, and presented their developed prototype to key stakeholders, including representatives from the government, agriculture associations, and the insurance sector. The team received feedback to fine-tune the platform and ensure its relevance and usability for the farmers who will benefit from it.

Senegal National Workshop | 29-31 October, Dakar, Senegal

On October 29th the iii-lab Senegal Country team convened again in person in Dakar for the Implementation Workshop, follow by a day and a half National Ecosystem Event.

During the preparation workshop, the country team sharpened the presentation of the prototype and made some last preparations for the Ecosystem Event and reflected on their iii-lab journey so far. As one of the country team members put it: Changing the paradigm is more than a sentence, it is an important message. We all managed to get out of our former clothes and tried to wear new ones during the iii-lab.

For the ecosystem event the country team had invited representatives of ministries, institutions for financial education, insurers, reinsurance companies and, bringing the strong voice of the beneficiaries to the table, several representatives from fishery associations. After the opening speech by the Director d’Assurance, Monsieur Mamadou Deme and a presentation of the prototype a day full of discussion, knowledge sharing, listening and good Senegalese food followed. With numerous presentations the country team created an informative and productive atmosphere, or as one ecosystem member that was not familiar with insurance prior to the meeting said “This workshop has allowed me to see how important inclusive insurance is”. After the ecosystem the country team had developed a clear prototype for a parametric micro-insurance product with clearly defined next steps. Apart from the important progress made with all stakeholders on this prototype, the success of the ecosystem event is underlined by one of the fisher’s representatives closing words: “We really feel we are being taken into consideration. Finally, the fishing sector is mentioned verbatim. How often the work was used struck me – we know we are ‘in’ and very proud of this workshop.

French Version/ Version française:

Le 29 octobre 2024, l'équipe pays du iii-lab Sénégal s'est réunie pour la deuxième fois en présentiel à Dakar pour l'atelier de mise en œuvre, suivi d'un jour et demi d'événement national sur l'écosystème à l'hôtel "Fleur des Lys", Dakar Plateau

Pour rappel, l’Equipe Pays du Sénégal est composée de plusieurs institutions (Ministère des Finances et du Budget, Ministère de l’Intérieur, Ministère de l’Agriculture et de l’Elevage, Ministère de la Famille et des Solidarités, Association des Assureurs du Sénégal, Association des Assureurs Conseils du Sénégal, Centre Professionnel de Formation à l'Assurance (CPFA), etc.)

Au cours de l'atelier de préparation, l'équipe nationale a affiné la présentation du prototype et a effectué les derniers préparatifs pour l'événement écosystémique sur leur parcours au sein du iii-lab jusqu'à présent. Comme l'a dit l'un des membres de l'équipe, "Changer le paradigme est plus qu'une phrase, c'est un message important.

Nous avons tous réussi à nous débarrasser de nos anciens vêtements et nous avons essayé d'en porter de nouveaux pendant le projet iii-lab.

Pour l'événement l'équipe nationale avait invité Sen Re (le réassureur national) et plusieurs représentants d'associations de pêche de Dakar pour faire entendre la voix forte des bénéficiaires. Après le discours de Monsieur Adama Ndiaye, directeur général de la SEN Ré et ancien Président de la FANAF, Monsieur Mamadou DEME Directeur des Assurances du Ministère des Finances & du Budget a procédé à l’ouverture de l’atelier.

Par la suite, une présentation du prototype a été faite. La journée était pleine de discussions, de renforcement des capacités, d'échanges et de débats avec un excellent déjeuner sur le toit de l'hôtel 'Fleur des Lys' @Plateau Dakar.

Avec de nombreuses présentations, l'équipe nationale a créé une atmosphère informative et productive. ou comme l'a dit un membre de l'écosystème qui n'était pas familier avec l'assurance avant la réunion : Cet atelier m'a permis de voir à quel point l'assurance est une bonne chose.

Après la réunion de l'écosystème, l'équipe nationale a développé un prototype clair pour un produit de micro-assurance basé sur un indice pour les pêcheurs artisanaux avec des étapes clairement définies. Outre les progrès importants réalisés avec toutes les parties prenantes sur ce prototype, le succès de l'événement de l'écosystème est souligné par l'un des représentants des pêcheurs : "Nous avons vraiment l'impression d'être pris en considération. Enfin, le secteur de la pêche est mentionné mot pour mot: nous savons que nous sommes "dans le coup" et nous sommes très fiers de cet atelier.

Monsieur Mor Ngom, Commissaire-Contôleur à la Direction des Assurances et chef de l’équipe pays a procédé à la clôture des trois jours de travaux.

International Implementation Workshop | 12-14 November

The 4th Inclusive Insurance Innovation Lab (iii-lab) held its final Workshop from November 12–14 virtually, bringing together participants from the three country teams – Senegal, Armenia, and Nepal.

The workshop began with an engaging session where each country team presented their prototype solutions to peers and a panel of experts, including Manoj Pandey, Monica Odhiambo, and Bert Opdebeeck. The experts offered constructive feedback and highlighted critical considerations for the implementation of the prototypes. The prototypes aim to enhance climate resilience, with Armenia focusing on a platform tailored to provide climate risk information for farmers, Nepal developing an IVR system to support rural smallholder farmers, and Senegal creating an index insurance product for fishermen. To celebrate the teams’ efforts, awards were presented for the most innovative, most collaborative, and most impactful prototypes, which were won by Armenia, Nepal, and Senegal, respectively.

On the second day, participants connected with alumni from previous labs representing Mongolia, Zambia, Ghana, India, and Morocco. The alumni shared their experiences, outlining the challenges they faced during implementation and the strategies they used to overcome them. This exchange not only provided practical insights but also boosted the confidence of the current cohort, reinforcing the importance of multistakeholder collaboration in tackling complex issues.

The final day of the workshop centered on reflecting on each country team’s ‘hero’s journey.’ Teams revisited the key challenges and milestones they had navigated over the past year, drawing parallels to the archetypal story of a hero overcoming trials and returning transformed. These reflections underscored the growth and resilience of the teams throughout their journey.

In his closing remarks, A2ii’s Executive Director, Matthias Range, commended the teams for their dedication and collaborative efforts over the past year. With the workshop concluded, the country teams are now ready to embark on the next phase: piloting their innovative solutions and bringing their prototypes to life.

Upcoming events

A2ii at IAIS Annual Conference | 5-6 December, Cape Town, South Africa

Matthias Range, Executive Director of A2ii, will be a speaker at the Roundtable on "Non-life: what developments are we seeing in the property and casualty (P&C) markets and what do these mean for achieving the SDGs?" during the IAIS Annual Conference in Cape Town, South Africa, from 5-6 December.

On 6 December, Asmaa Jabri, Advisor at A2ii will represent A2ii at the Roundtable on Financial inclusion and fair treatment of diverse consumers, and Teresa Pelanda and Laura Moxter Morales will speak at the Roundtable on Capacity Building.

News

Inclusive Insurance Training 2024

The inclusive insurance training had its first kick-off session on 15 October, with 25 participants from 11 jurisdictions from Africa and the Caribbean. This training programme was offered in partnership with the Toronto Centre and IAIS. The training took place from the 18th to the 28th November, from 13:00 to 17:00 CET and it was conducted in English.

The trainers providing the live sessions were: Harry Krishan Mohith, Program Manager, Toronto Centre, Michael Kofi Andoh, Program Leader, Toronto Centre, and Manoj Pandey, Lead Trainer, A2ii.

It was targeted to entry- to mid- level insurance supervisors and held via a blend of online learning modules on the Connect.A2ii learning platform and live sessions on MS Teams.

A2ii Awards Scholarships for the 2025 Microinsurance Master Accelerator Program

A2ii is pleased to share that two partial scholarships are being awarded to insurance supervisors for the 2025 Microinsurance Master Accelerator Program.

This two-week immersive program, set to take place in Kenya starting in March 2025, focuses on equipping participants with practical strategies for scaling microinsurance. Participants will learn directly from APA Insurance’s experience, gain hands-on insights, and benefit from a three-month mentorship with an expert in inclusive insurance.

With a 98% recommendation rate, the Microinsurance Master Accelerator has trained 113 leaders from 39 countries, including supervisors from Nigeria, Vietnam, and Uganda. A2ii is proud to support insurance supervisors in advancing their expertise through this impactful initiative.

Publications

2023 Annual Report

The A2ii has published the 2023 Annual Report. A few highlights: we organized 13 events, with participants from 139 countries (90 ODA recipients). We counted at least 39 jurisdictions with inclusive insurance regulation on our map, with another 17 more under development. To read the report, click on this link.

Recent events

A2ii at Sustainable Insurance Forum | 1 December, Cape Town, South Africa

The Sustainable Insurance Forum met in Cape Town on the 1 December. During this meeting, recent and upcoming publications were discussed, as well as the strategic plan for the upcoming year, and Laura Moxter Morales was representing A2ii.

A2ii attends workshop on fostering financial inclusion through open finance | 20 - 21 November | Basel, Switzerland

On 20-21 November, Asmaa Jabri, Advisor and Matthias Range, Executive Director of A2ii were attending a workshop on "Fostering financial inclusion through open finance" in Basel, organised by the Financial Stability Institte of the Bank for International Settlements (BIS), CGAP and the World Bank.

On the second day, A2ii was also invited to participate as a stakeholder in a meeting between (BIS), global standard-setting bodies and financial inclusion organisations, where they discussed potential fields of cooperation, protection gaps and financial inclusion-linked changes in FATF standards.

A2ii attends conference "Impulsando Seguros para Riesgos Climáticos" | 20-21 November, Quito, Ecuador

Organised by the Innovation Fund of the GADER-ALC network (GIZ), “Impulsando Seguros para Riesgos Climáticos” is a regional event aimed at advisors and representatives from the insurance industry. Its objective is to foster dialogue, enhance understanding, and identify challenges and opportunities in developing climate risk insurance. The event seeks to facilitate the collaborative creation of a Regional Roadmap to promote experience-sharing, innovation, and development of climate insurance across Latin America.

A2ii was represented at the event by Laura Moxter Morales, Climate Portfolio Lead, who on the first day of the event moderated a panel discussion with Jorge Alfaro Figueroa, from Superintendencia de Seguros de Costa Rica (SUGESE), Jennifer Pérez Garrido, from Superintendencia de Bancos (SIB) Guatemala, and Catalina Pazos Chimbo, from Junta de Política y Regulación Financiera (JPRF) Ecuador, where speakers exchanged on the challenges and trends on climate insurance in their respective jurisdictions.

On the second day, she delivered a session on regulatory guidelines and best practices for climate-related insurance supervision, emphasising the different layers of climate risks and discusseing how these risks can be effectively addressed from a regulatory perspective.

Regional Training Seminar for Insurance Supervisors of Latin America ASSAL – IAIS| 20-21 November, La Antigua, Guatemala

The Regional Training Seminar for Insurance Supervisors of Latin America ASSAL – IAIS was held in the beautiful city of La Antigua, Guatemala on November 20 and 21, 2024. It was jointly organized by the Association of Latin American Insurance Supervisors (ASSAL), the International Association of Insurance Supervisors (IAIS) and the Superintendency of Banks (SIB) of Guatemala, the host, who provided all participants with a wonderful welcome.

Saulo De León Durán, Superintendent at the SIB, Tomás Soley, President of ASSAL and General Superintendent of Insurance at SUSEGE, and Conor Donaldson, Head of Implementation of the IAIS, opened the Seminar which was attended by 82 people from 18 countries, of which 37 were insurance supervisors. The keynote speech was given by Kobi Bendelak, CEO of InsurTech Israel, who masterfully presented on “Artificial Intelligence and existing and emerging technologies in the insurance sector”.

The seminar agenda included a series of panels on trending topics and key issues for insurance supervision, such as: the impact of technological innovation on regulation and supervision, cybersecurity, climate change and insurance challenges, the importance of the actuarial function, and the experience and progress in Ibero-America in implementing risk-based capital. A session on mandatory insurance in Latin America was also presented.

A2ii organized a panel on "Inclusive insurance: gaps, challenges, and opportunities to encourage the use of insurance for excluded and underserved segments”, moderated by the A2ii Regional Coordinator Regina Simões. During the session, Letícia Gontijo Furst Gonçalves (World Food Programme), José Guillermo López (Aseguradora Rural) and Óscar Armando Del Cid Mayén (SIB) presented Guatemala’s success story in promoting inclusive insurance, highlighting the role of each stakeholder in this process, which included SIB’s effort to implement the FeMa Meter tool in search of a more detailed view of women’s inclusion. In this context, Alejandro Rodríguez (SUGESE) also presented the results obtained in Costa Rica with the implementation of the FeMa Meter.

European Microfinance Week | 13-15 November, Luxemburg

A2ii participated in the European Microfinance Week (EMW) held in Luxembourg from 13-15 November, an important event that brought together global financial inclusion professionals. This year’s principal focus was advancing financial inclusion for refugees and forcibly displaced persons (FDPs), with sessions addressing the challenges and opportunities for their integration. A2ii contributed to the session “Protecting Migrant Workers: Insurance Solutions for Remittance Stability,” where the organisation represented the regulatory perspective on remittance-linked insurance. Asmaa Jabri, speaking on behalf of A2ii, discussed key regulatory considerations, including the challenges of cross-border regulation, balancing financial inclusion with other supervisory mandates, and the need for an enabling regulatory environment to support innovative solutions. The session emphasised the importance of multistakeholder collaboration in addressing these complex issues, bringing together representatives from the insurance industry, refugee community, and international organisations.

A2ii at the International Conference on Inclusive Insurance | 21 and 23 October, Kathmandu, Nepal

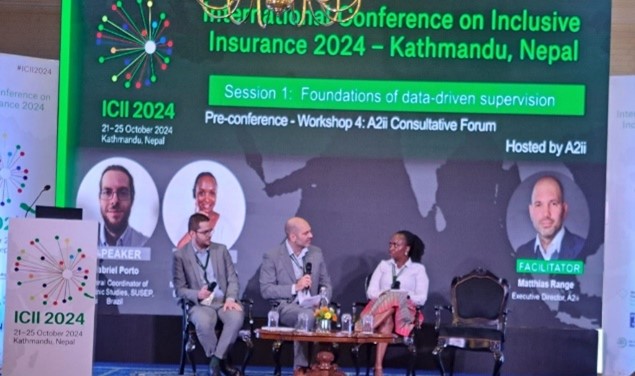

19th Consultative Forum – Enhancing Data-Driven Supervision

The 19th Consultative Forum, titled “Enhancing Data-Driven Insurance Supervision,” was held on October 21, 2024, alongs

ide the International Conference on Inclusive Insurance in Kathmandu, Nepal. Jointly organised by A2ii, IAIS, and the Microinsurance Network, the forum brought together 120 representatives from international organisations, supervisors, and the insurance industry to explore the critical role of data in shaping inclusive insurance practices.

The event began with opening remarks by Surya Prasad Silwal, Chairman of the Nepal Insurance Authority, followed by sessions on key topics. In the first session, A2ii Executive Director Matthias Range moderated a debate between Gabriel Porto (SUSEP, Brazil) and Barbara Chesire (AB Entheos Ltd.), discussing the foundations of data-driven supervision. They emphasized the importance of reliable, innovation-driven data collection to enhance consumer protection.

Subsequent workgroup discussions, led by experts including Alastair Norris (IDF Risk Modelling Steering Group) and Moustafa Khalil (FRA Egypt), delved into data analytics, holistic risk modelling, and supervisory perspectives. Participants highlighted the need for broad stakeholder collaboration to build trust in data and its applications. The final panel, moderated by Pedro Pinheiro (Microinsurance Network), featured insights from Blue Marble, CelsiusPro, and SUSEP, focusing on Open Insurance and leveraging customer feedback data.

The forum underscored data’s potential to drive innovation while safeguarding consumer trust, signaling the need for continued dialogue and collaboration to navigate the complexities of data-driven supervision.

ICII Lab Session – Advancing Innovation Ecosystems

During the ICII 2024, A2ii also hosted the Inclusive Insurance Innovation Lab (iii-lab) session. This 12-month program has united stakeholders across 15 countries to co-develop innovative solutions that expand insurance access. Through interactive discussions, iii-lab alumni shared how multi-stakeholder collaboration fosters adaptable, scalable solutions like Nepal’s Interactive Voice Response system, which enhances accessibility for underserved populations.

Both events highlighted the transformative power of collaboration in addressing challenges and advancing inclusive insurance practices worldwide.

Workshop "Climate Microinsurance: a tool to strengthen the adaptive capacity of the most vulnerable population" | 15-16 October, Quito, Ecuador

The Workshop "Climate Microinsurance: a tool to strengthen the adaptive capacity of the most vulnerable population" took place in Quito, Ecuador, on October 15-16, 2024. The event was jointly organised by the World Food Programme (WFP) and the Ministry of Agriculture and Livestock of Ecuador (MAG) and supported by the Japan International Cooperation Agency (JICA). Its general objective was to strengthen the technical capacities of the institutions that make up the National Financial and Insurance System, of the WFP technical team in Ecuador, as well as of other key actors in the country, to develop agricultural insurance as a measure for adaptation to climate change.

Tatiana Paredes, Director of Agricultural Risks and Insurance/MAG, and Letícia Gonçalves, Risk Finance Consultant of the Regional Bureau for Latin America and the Caribbean/WFP, opened the Workshop. Among the 35 participants were also representatives of the Ministry of Environment, Water and Ecological Transition, the Superintendence of Companies, Securities and Insurance (SCVS), Provincial Governments, the Ecuadorian Federation of Insurers (FEDESEG), the Deposit Insurance Corporation, Liquidity Fund and Private Insurance Fund (COSEDE) and BanEcuador.

Also attending the event were members of the Financial Policy and Regulatory Board (JPRF), María Paulina Vela Zambrano, chair, Catalina Pazos and Iván Velástegui, who presented the guidelines of the new microinsurance regulation, which aims to promote, through innovation, the development of microinsurance products that reduce the insurance gap, improve access and distribution, satisfy the needs of the population and generate value for the insurance sector.

A2ii was represented by Regina Simões, Regional Coordinator for Latin America, who gave presentations on microinsurance and inclusive insurance and on index-based insurance - regulatory status and barriers. The workshop included a series of panels and interactive sessions that provided great discussions and fruitful debates on potential solutions, including the identification of opportunities in the context of smallholder farming as input for the development of microinsurance products.

Global Asia Insurance Partnership Summit 2024 | 14-15 October

The GAIP 2024 Summit took place on the 14 and 15 October. Matthias Range, Executive Director of A2ii participated in a panel discussion on health, retirement, and insurance protection gaps in Asia.

The panel highlighted the need to strive for insurance inclusiveness in the face of growing gaps and challenges such as the aging population, rising healthcare costs, and scalability issues, and the role that technology can play in creating inclusive insurance solutions that target the needs of diverse populations.

Blogs

Laying the Groundwork for Climate Risk Insurance in the Solomon Islands: Insights from CBSI's Learning Experience at the Inclusive Insurance Training

The Solomon Islands, one of the countries most at risk from natural disasters, is stepping up efforts to protect its coastal communities. Eddie Maek from the Central Bank of Solomon Islands (CBSI) recently completed the 2023 Inclusive Insurance Training (IIT), a program designed to help regulators create practical solutions for vulnerable populations.

The training emphasized parametric insurance, an innovative solution designed to provide rapid payouts following disasters such as cyclones and floods. Eddie Maek reported that the program equipped him with the skills needed to develop a structured and actionable plan while fostering connections with international experts in inclusive insurance. Building on this foundation, the Central Bank of Solomon Islands (CBSI) is now actively working to implement these strategies, aiming to deliver effective protections for the nation’s most vulnerable communities.

If you are interested to learn more about the topic, we invite you to read the full blog on our website.

Staff Updates

Nuriya Erden, originally from Almaty, Kazakhstan, joined A2ii as an Intern in November 2024, where she supports the work of Inclusive Insurance Fundamentals and Gender portfolios.

She is pursuing a master’s degree in Human Geography: Globalisation, Media, and Culture at Johannes Gutenberg University Mainz. Her academic journey has been marked by a strong focus on international politics, economic policy, and globalisation. Before joining A2ii, she gained valuable experience working with organizations like KPMG Caucasus and Central Asia and Delegation der Deutschen Wirtschaft in Zentralasien, where she focused on event management, data analysis, and administrative support. Nuriya speaks Kazakh, Russian, English, and German.

FeMa-Meter Tool

Globally, women constitute the majority of the uninsured population and are underrepresented in insurance policymaking and supervision, which exacerbates their access challenges. To address these issues, A2ii launched the FeMa-Meter on 8 March.

This toolkit collects and reviews sex-disaggregated data to analyse gender differences in insurance indicators. Piloted in Argentina, Lesotho, Pakistan, and Zambia, it has proven to be an effective tool for collecting sex-disaggregated data.

With an intuitive interface, users can input data and generate insights swiftly. To access the FeMa-Meter, visit its dedicated website and its accompanying training module. Join us in advancing gender equality and improving insurance access through data-driven approaches.

Index Insurance Insights

Learn about index insurance in our free training and obtain the A2ii-UNCDF Certificate on Index Insurance for Supervisors. Exclusively designed for insurance supervisors, this certification offers comprehensive insights into index insurance mechanisms. Ready to take the next step? Enrol now on A2ii’s learning platform, Connect.A2ii.

For all other stakeholders not in supervisory roles, access our open version of the training on our website.

Insurance Core Principles Self-Assessment Tool

Have you tried the SAT tool yet? The Insurance Core Principles Self-Assessment Tool is a joint initiative of the IAIS and the A2ii designed to facilitate the assessment of the level of observance of the ICPs. Leveraging the analytical framework of the Peer Review Process, it empowers supervisors to evaluate adherence to these essential principles.

How it works:

Supervisors can access the tool through the dedicated platform. Once on the platform, they can navigate through a series of questionnaires tailored to each ICP.

The questionnaires are crafted to cover various aspects of each principle, providing a comprehensive evaluation framework. Supervisors can respond to these questions based on their assessment of their jurisdiction’s practices and policies.

Upon completing a questionnaire, supervisors receive immediate feedback. These results offer insights into the level of observance of the assessed ICP, enabling supervisors to identify strengths, weaknesses, and areas for improvement.

We encourage all supervisors to explore this resource and its potential to drive positive change within the insurance landscape.

Trainings

Self-directed training

Supervision of climate-related risks in the insurance sector

Applying a gender lens to inclusive insurance

How to conduct a rapid gender diversity assessment

Index Insurance Training for All Stakeholders

Are you an insurance supervisor? Then join Connect.A2ii - our learning platform restricted to supervisors offering free and certified courses and an opportunity to learn from peers.

Useful Tools on Our Website

Inclusive Insurance Regulations Map

The interactive map incorporates data about existing inclusive insurance regulation and regulation which supports inclusive insurance sourced through A2ii's research, work and interaction with supervisory authorities worldwide.

ICP Self-assessment Tool

The tool is intended to help supervisors assess the level of observance of the Insurance Core Principles (ICPs).

Supervisory KPIs Lexicon

Interactive, searchable directory of KPIs for insurance supervisors across four pillars: prudential soundness, market conduct, insurance market development and the Sustainable Development Goals.

Insurance and the Sustainable Development Goals (SDGs)

The SDG pages include resources on the importance and the role of insurance across nine SDGs: 01 No Poverty, 10 Reduced Inequalities, 02 Zero Hunger, 03 Good Health and Well-being, 05 Gender Equality, 08 Decent Work and Economic Growth, 09 Industry Innovation and Infrastructure, 13 Climate Change and 17 Partnerships for the Goals.