A2ii Newsletter 02/23

Welcome! In this newsletter, we provide you with updates on the work of the A2ii, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Subscribe to our mailing list to receive our newsletter in your inbox.

Navigation

Connect.A2ii | Recent Events | Upcoming Events | Blog | Partner Opportunities | Useful Tools on Our Website

Connect.A2ii

New learning resource available on Conduct and Culture

For financial inclusion and inclusive insurance, good conduct and culture have far-reaching implications because the alternative is financial exclusion. Vulnerable and underserved communities must trust their insurance products and the financial institutions that serve them. The IAIS defines corporate culture as ‘the set of norms, values, attitudes and behaviours of an insurer that characterises how the insurer conducts its activities,’ but how does culture shape firm behaviour in treating vulnerable customers fairly? And how can firms see the purpose and benefits of inclusive insurance approaches?

These and other questions were addressed on 21 July 2022 during the A2ii-IAIS Supervisory Dialogue on the topic of Conduct and Culture. This dialogue is now available on Connect.A2ii in English, French and Spanish as a learning module for all supervisors.

If you are already a member of Connect A2ii, you will find this learning resource in your catalogue. Otherwise, we encourage supervisors to create an account.

Recent events

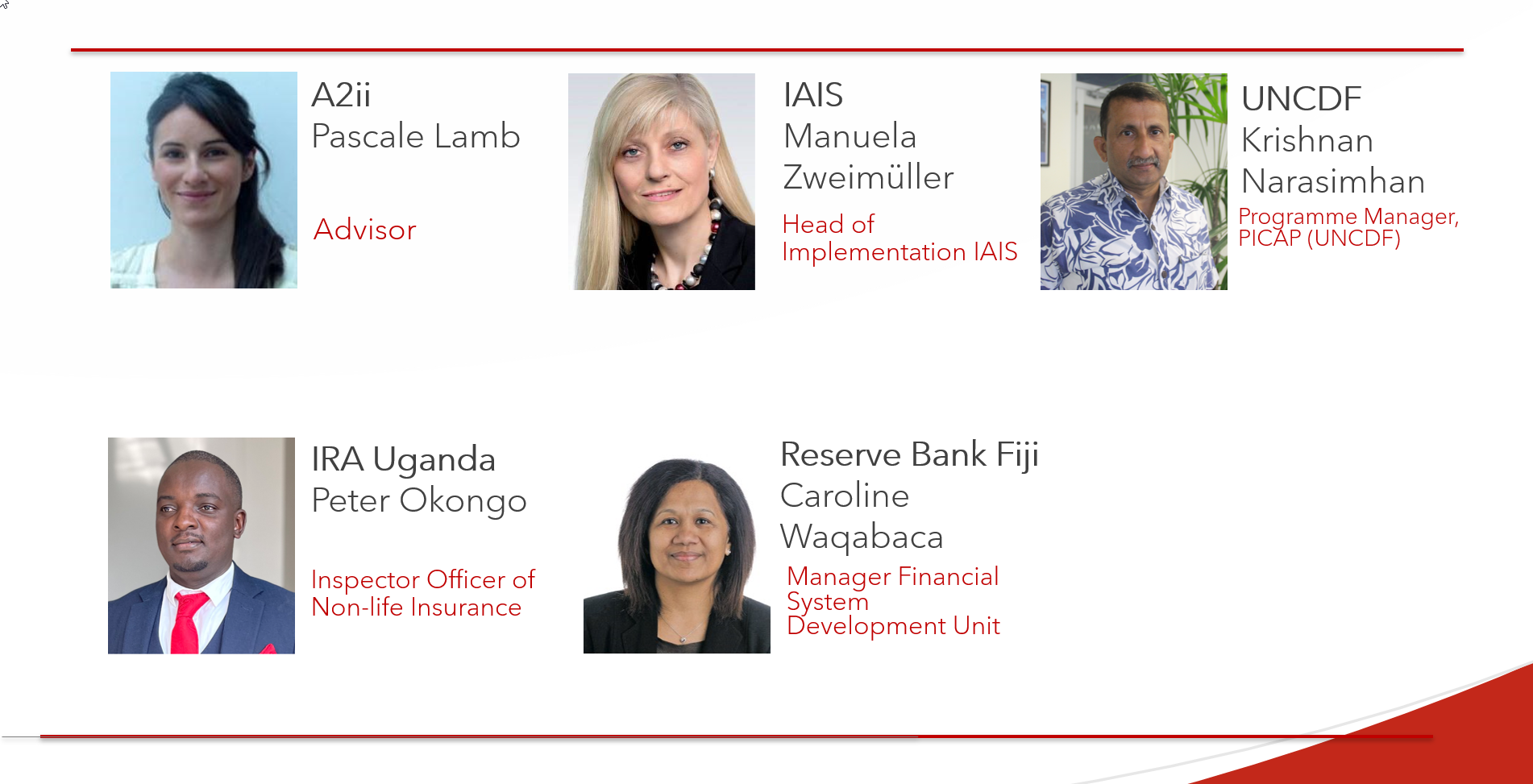

Index Insurance Best Practices – A2ii-IAIS-UNCDF Public Dialogue | 28 February

On 28 February, the Public Dialogue on Index Insurance Best Practices took place. This dialogue was based on the key insights from the joint A2ii-UNCDF paper on 'Index Insurance best practices for insurance regulators and practitioners in the Pacific Island Countries’.

Pascale Lamb, A2ii, opened the call with a presentation on the previous work that has been done by A2ii and IAIS on the topic, as well as the basic concepts of index insurance. Krishnan Narasimhan, Programme Manager of the Pacific Insurance and Climate Adaptation Programme (PICAP), UNCDF, presented the background and workstreams of the PICAP, as well as the relevance of index insurance for the Pacific. He highlighted the vulnerability of Pacific Small Island Developing States to the impacts of climate change and natural hazards, given their exposure and limited capacity to manage such risks and overcome large economic losses. The initial pilot product of parametric insurance in the region was introduced in Fiji, and this initiative became especially relevant after the heavy rains that occurred between December 2022 and January 2023, which has so far triggered payments for 535 individuals.

This was followed by a presentation by Caroline Waqabaca from the Reserve Bank of Fiji. Despite Fiji’s high exposure to climate risks, the capacity to manage these risks is limited, and the cost of climate financing is high. She explained how parametric insurance was introduced in the jurisdiction in collaboration with various stakeholders, and being the first one of this kind in the region, she also covered the sandboxing process that the product went through.

Finally, Peter Okongo, Inspection Officer of non-life insurance at the Regulatory Authority of Uganda presented Uganda’s experience in introducing Index Insurance. Peter shared the progress made since 2011, when the idea was first introduced, and the role that the IRA played in the public-private partnership that implemented agriculture index-based insurance.

The recording is available on A2ii’s website.

Financial Inclusion Forum Plenary | 9 February

On 9 February 2023, the IAIS and A2ii held the 8th Financial Inclusion Forum (FIF) plenary meeting. Tomás Soley, Superintendencia de Seguros Generales de Costa Rica (SUGESE) and Chair of the FIF, opened the meeting and welcomed the participating members to the session on 'The Role of Insurance Supervisors inNatural Catastrophe Protection Gaps'. The meeting was structured with two panel discussions.

Alma Gomez, Supervisor of Insurance, Belize, opened the first panel on the role of insurance supervisors. She presented Belize’s involvement in insurance-based programs for natural catastrophes (NatCat), including collaboration with government ministries and public-private partnerships. Carlos Izaguirre, Deputy Superintendent of Insurance, Peru, presented his authority's work on addressing NatCat protection gaps within their regulatory framework. Sibongile Siwela, Director of Insurance and Microinsurance, Zimbabwe, Director of Insurance and Microinsurance, Zimbabwe, elaborated on how their regulatory mandate created a role for the supervisor in the design and implementation of NatCat insurance-based programmes. This included the ability of the supervisory authority to provide advice to the government, including participation in the formulation of the country's National Risk Financing Strategy.

The second panel covered practical cases of insurance-based programmes to address natural catastrophe-related risks and measures to increase resilience. Ralf Kuerzdoerfer, Deputy Director of Insurance Supervision in Bermuda, presented on reinsurance in their jurisdiction. Re(insurers) are required to have a sophisticated approach to NatCat management, using models for exposure management, pricing and risk capital purposes. He also mentioned the priority that Bermuda places on innovation, with a comprehensive framework for sandboxes, an innovation hub, and innovative insurer classes. Next, Charles Ansong Dankyi, Senior Manager, Supervision Department, Ghana, discussed the measures Ghana has taken to address the NatCap protection gap – especially participation in the African Risk Capacity Pool, and the Ghana Agricultural Insurance Pool (GAIP). Finally, Jennifer Gardner, Manager at the National Association of Insurance Commissioners (NAIC), USA, presented the federal and state programmes that address natural catastrophes, including crop insurance, flood, wind, and earthquakes. She also presented the NAIC Catastrophe Modeling Center of Excellence which provides state insurance regulators with the necessary technical expertise, tools, and information to effectively regulate their markets.

Upcoming events

A2ii-IAIS Supervisory Dialogue on Diversity, Equity and Inclusion | 25 May

DEI is particularly relevant to governance, culture and conduct, but also to financial inclusion and sustainable economic development as well as innovation and social responsibility.

To make insurance more inclusive to all population groups, reducing inequalities and bringing awareness to the disparities that still occur is crucial. A2ii’s work has focused on making insurance an accessible resource to those excluded from traditional insurance products since the beginning. One example of this has been the work done on making insurance gender aware, such as the gender disaggregated data toolkit that is being developed. The topic of Diversity, Equity and Inclusion is therefore central to our work.

The IAIS has committed to deepening and strengthening its work on DEI in a number of ways, including exploring the insurance sector's efforts and steps taken by supervisors in support of DEI, incorporating relevant DEI aspects into ongoing IAIS projects and activities, and considering opportunities for cooperation on DEI with other international organisations and partners.

On 25 May, a Supervisory Dialogue on Diversity, Equity and Inclusion will take place. This dialogue will focus on the key insights from the IAIS's Stocktake on diversity, equity and inclusion in the insurance sector published in December 2022. It will also feature supervisors from jurisdictions who have been implementing relevant measures in support of DEI.

This webinar will be open to supervisors only. It will take place on 25 May at 14:00 CEST via Webex and will last 1 hour and 15 minutes. The webinar will have simultaneous interpretation to French and Spanish.

Registration is available here. Stay tuned! Soon we will announce the speakers.

Blog

Envisioning Responsible Finance in the Context of Climate Change – the Role of Insurance Supervision

By Dunja Latinovic

The impacts of climate change are diverse and wide-ranging. Its most immediate manifestations amplify the hardships on developing economies which are often more vulnerable to damage and have fewer resources available to support the recovery.

Insurance can strengthen the resilience of vulnerable communities and help them adapt to the climatic changes impacting their lives. If leveraged systematically for both transition and physical risks, it can contribute to the health of the entire financial sector. Supervisors are in a position to contribute to financial literacy efforts, establish standards and expectations for financial institutions, remove regulatory barriers for new or innovative solutions, assess risk management practices, support the efforts of the government bodies, and convene forward-looking multistakeholder initiatives. Read more…

Partner Opportunities

Apply to the NAIC International Fellows Program | 7 April

The National Association of Insurance Commissioners (NAIC) invites insurance supervisors to apply for the NAIC International Fellows VIRTUAL Program, taking place 24-28 April 2023. The program will feature recorded lectures by NAIC technical experts covering all aspects of U.S. state-based insurance regulation, with opportunities for participants to engage with NAIC staff in order to gain deeper insights into how insurance is regulated in the U.S. and the role of the NAIC in supporting state-based regulation.

Applications are open until 7 April. Participation is free for selected applicants – find out more information here.

Useful Tools on Our Website

Insurance and the Sustainable Development Goals (SDGs)

The SDG pages include resources on the importance and the role of insurance across nine SDGs: 01 No Poverty, 10 Reduced Inequalities, 02 Zero Hunger, 03 Good Health and Well-being, 05 Gender Equality, 08 Decent Work and Economic Growth, 09 Industry Innovation and Infrastructure, 13 Climate Change and 17 Partnerships for the Goals.

Supervisory KPIs Lexicon

Interactive, searchable directory of KPIs for insurance supervisors across four pillars: prudential soundness, market conduct, insurance market development and the Sustainable Development Goals, with four accompanying handbooks.

Inclusive Insurance Regulations Map

The interactive map incorporates data about regulation and regulation which supports inclusive insurance sourced through A2ii's research, work and interaction with supervisory authorities worldwide. The map is by no means exhaustive and the information within is continuously updated to the best of A2ii's knowledge. A2ii welcomes supervisory input to the map; please send your comments, questions or interventions to secretariat@a2ii.org.

ICP Self-assessment Tool

The tool is intended to help supervisors assess the level of observance of the Insurance Core Principles (ICPs).