A2ii Newsletter 10/21

Welcome! In this newsletter, we provide you with updates on the work of the A2ii, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Subscribe to our mailing list to receive our newsletter in your inbox.

Navigation

Recent Events | Upcoming Events | Recommended Reading | Staffing Update | Useful Tools on Our Website

The A2ii taking precautionary measures related to Covid-19

To safeguard the well-being of the A2ii staff and its partners, the A2ii is currently conducting all its activities through virtual formats. As soon as it is possible, we will announce a return to physical events. The A2ii will continue to communicate any changes pertaining to our events on our website, social media channels and through our newsletter.

Recent events

Capacity Building for Insurance Supervisors - Leveraging Actuarial Skills Training Ends | 16 September

After four weeks, the actuarial training for insurance supervisors wrapped up on 16 September. About 40 supervisors from over 20 jurisdictions worked on a set of self-paced online modules and participated in eight live webinars.

A team of 11 experienced trainers introduced the participants to the principles of actuarial concepts and provided them with the tools for effective insurance supervision and regulation. Topics covered included risk management, valuation reports, reinsurance, risk-based capital, as well as key performance indicators to monitor for risk-based solvency.

The trainers were: Jeff Blacker as the lead trainer, Craig Thorburn (World Bank), Elias Omondi (FSD Africa), Janice Angove and Eamon Kelly, as well as the IAA volunteers Fred Rowley, Britta Hay, Simone Brathwaite, Stuart Wason, Jules Gribble, and Alex Kühnast.

It was the first time that the IAA-IAIS-A2ii training was rolled out as a fully virtual event and supervisors’ feedback reflects its success:

‘I have joined many virtual trainings already but I must say that this is the best one. Kudos to the whole team!’

‘I really appreciate that the training was made available virtually. One of the positive things that Covid-19 pandemic has caused, is that courses, trainings, webinars, etc. are virtually organised now, which is economical and many of the staff may attend it.’

The IAA, IAIS and A2ii are now looking forward to rolling the training out in Spanish early 2022.

A2ii-ASSAL-IAIS Regional Dialogue on Insurance and the Sustainable Development Goal | 16 September

A2ii, the Asociación de Supervisores de Seguros de América Latina (ASSAL), and the IAIS jointly organised on 16 September the Regional Dialogue on Insurance and the Sustainable Development Goals. About 140 attendees represented both the public and private sectors, most of them from Latin America.

The event was opened by Tomás Soley, President of ASSAL and Superintendent of SUGESE, and Manuela Zweimueller, Head of Implementation of the IAIS. In the first session, Pascale Lamb (A2ii) presented on why insurance matters to the SDGs and its role in reaching them, followed by an online survey and an interactive discussion, moderated by Regina Simões (A2ii).

In the second session, in the framework of her presentation on SDGs KPIs, Hui Lin Chiew (A2ii) clarified why data is essential to ensure that insurance gains a fixed place as a development tool. Veronica López Quesada (SSN) offered an overview of the joint efforts of Argentina's public and private sectors to gather data for the design of insurance products and business models centred on the needs of women entrepreneurs and domestic workers.

In her closing speech, Hannah Grant, head of the A2ii Secretariat, highlighted once again that insurance remains key to achievement of the SDGs, especially in a post-pandemic scenario, which is why it is also a key focus and the theme of the year for A2ii.

The complete recording of the regional dialogue, both in Spanish and in English, is available on the A2ii website and can be accessed here.

Regional Conference on Inclusive Insurance in the CEET region | 1-2 September

A2ii, together with Munich Re Foundation, Microinsurance Network, the IAIS and the Insurance Supervisory Agency from Slovenia (AZN) organised the two-day digital conference on ‘Inclusive insurance in the CEET region – challenges and opportunities’.

Teresa Pelanda (A2ii) was among the panellists on inclusive insurance fundamentals. A2ii also organised a session on digitalisation. Recordings of the four sessions and a full summary of the event are available on our website.

In addition, in the context of the conference, A2ii officially launched a report on the Inclusive Insurance Regulatory Landscape in the CEET Region. This landmark study seeks to better define the current stage of the market and to address potential growth opportunities.

A2ii-IAIS Public Dialogue on ‘Closing the Health Financial Protection Gap: Expanding Access to Health Insurance in Times of Crisis and Beyond’ | 30 September

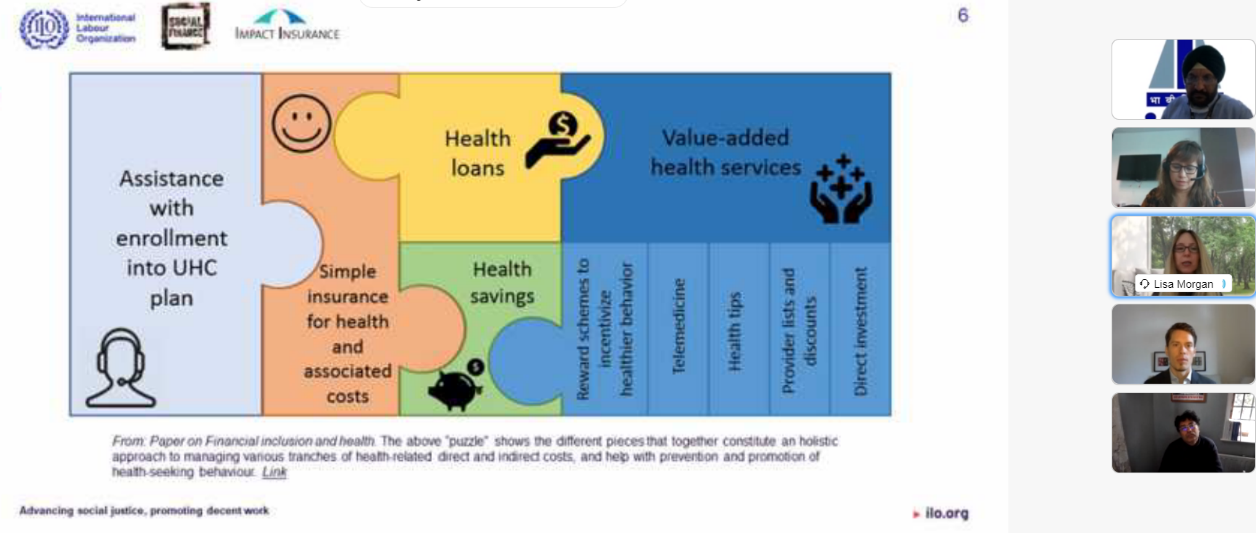

The dialogue entailed a panel discussion with Lisa Morgan from ILO’s Impact Insurance Facility, Asitha Rodrigo from MILVIK BIMA, and Randip Singh Jagpal from the Insurance Regulatory and Development Authority of India (IRDAI). The discussion explored the role of private and voluntary health insurance in strengthening financial protection in health in developing and emerging markets. The panellists addressed the role of innovation in the private sector and the role of regulators and development practitioners in ensuring that the corresponding products offer value and complement compulsory public systems, especially in the context of Covid-19. Lisa Morgan spoke about different models of healthcare financing, highlighting examples from Ghana and Egypt and stressing that private insurance options need to be always designed with public offerings in mind. She also provided arguments for why hospital cash products are a particularly successful health financial protection tool in many emerging and developing markets.

The dialogue further explored examples of successful collaboration between health insurance providers, policymakers, and regulators in select jurisdictions. BIMA provided an overview of their health and health insurance offerings, highlighting that a key factor for their success in developing and emerging markets is its focus on client realities, in addition to its emphasis on digital delivery models. BIMA also brought up regulatory barriers to successfully launching and expanding health and health insurance products and how these can be overcome. The critical role of the regulator in ensuring private health insurance options can deliver value to low-income customers was further emphasised by IRDAI. Randip Singh Jagpal spoke about actions the authority has been taking to ensure complementarity between public and private health insurance options and how IRDAI has responded to the Covid-19 crisis.

The recordings in English, Spanish, and French and presentations are available on the A2ii website.

The next dialogue will be a public dialogue that will take place on 25 November on the topic of "Pandemic Risk: Opportunities to improve insurability." Please click here to find out more and to register.

If you have any questions or comments, please send them to dialogues@a2ii.org

Upcoming events

Session at the International Conference on Inclusive Insurance (ICII) | 26 October

A2ii is moderating session 7 organised by the IAIS Financial Inclusion Forum (FIF) during the second day of the International Conference on Inclusive Insurance (ICII). The topic is ‘Will insurance be more inclusive in a post-pandemic world? Supervisory and policy perspectives’.

During the session, the work of the FIF focusing on Covid-19 will be built upon by the contributions of other stakeholders. This will be an opportunity for the panellists to highlight some of the developments we’ve seen as a result of the pandemic and the robust responses needed by the sector to counter and sustain momentum during these adverse circumstances and ensure that insurance is more inclusive in the post-pandemic world.

Speakers include Tomás Soley, Superintendent at Superintendencia General de Seguros, Costa Rica and Chair of the IAIS Financial Inclusion Forum, Manuela Zweimueller, Head of Implementation, International Association of Insurance Supervisors, Miles Larbey, Head of Financial Consumer Protection from the OECD and Barbara Chesire-Chabbaga, Managing Director at AB Consultants, Kenya.

The session will take place on Tuesday, 26 October from 14:00-15:30 CET. The ICII takes place from 25-29 October. Click here to register for the conference.

A2ii-IAIS Public Dialogue on Pandemic Risk: Opportunities to improve insurability | 25 November

More details will be announced on the event page.

If you have any questions or comments, please send them to dialogues@a2ii.org.

Recommended Reading

Global Insurance Market Report (GIMAR)

The International Association of Insurance Supervisors (IAIS) published the 2021 special topic edition of its Global Insurance Market Report (GIMAR). The report, a first such global quantitative study, assesses how insurance sector investments are exposed to climate change.

Drawing on unique quantitative and qualitative data gathered from 32 IAIS Members covering 75% of the global insurance sector, this report represents the first global deep-dive analysis on insurers’ investment exposures and supervisors’ views on climate-related risks.

“Climate change is the defining challenge for this generation. The GIMAR uses data from our wide membership in combination with analytical tools to understand how the insurance sector is exposed to climate risk,” said Vicky Saporta, IAIS Executive Committee Chair. “The results highlight the benefits of pursuing an orderly transition towards internationally agreed climate targets to minimise the risks to solvency and financial stability.”

Staffing Update

Dorothee Ohl, our former financial manager, has taken a promotion as a senior finance manager within a GIZ project in Sub-Saharan Africa. We wish her the best and thank her for her years with us!

The A2ii warmly welcomes Mariana Otto as our new Financial Manager. Mariana is responsible for the financial steering and controlling of the A2ii, i.e. for budget planning, monitoring, contracting and financial reporting to A2ii funders and the Governing Council. Before joining the A2ii, Mariana worked in various administrative support structures in GIZ (project financial management, internal control, contracting) and as management assistant of the head of GIZ´s sectoral department. She holds a diploma in business administration and speaks German, English and Spanish fluently.

Useful Tools on Our Website

Covid-19 Insurance Supervisory Response Tracker

Global tracker of supervisory responses, insurance news and learning resources. Share relevant news with us via secretariat@a2ii.org, by tagging Access to Insurance Initiative on LinkedIn or by mentioning us on Twitter.

Supervisory KPIs Lexicon

Interactive, searchable directory of KPIs for insurance supervisors across four pillars: prudential soundness, market conduct, insurance market development and the Sustainable Development Goals.

Inclusive Insurance Regulations Map

The interactive map incorporates data about existing inclusive insurance regulation and regulation which supports inclusive insurance sourced through A2ii's research, work and interaction with supervisory authorities worldwide.

Insurance and the Sustainable Development Goals (SDGs)

The SDG pages include resources on the importance and the role of insurance across nine SDGs: 01 No Poverty, 10 Reduced Inequalities, 02 Zero Hunger, 03 Good Health and Well-being, 05 Gender Equality, 08 Decent Work and Economic Growth, 09 Industry Innovation and Infrastructure, 13 Climate Change and 17 Partnerships for the Goals.

ICP Self-assessment Tool

The tool is intended to help supervisors assess the level of observance of the Insurance Core Principles (ICPs).