A2ii Newsletter April-May 2023

Welcome! In this newsletter, we provide you with updates on the work of the A2ii, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Subscribe to our mailing list to receive our newsletter in your inbox.

Navigation

Scholarship Opportunity | Recent Events | Upcoming Events | Blog | Publications | Useful Tools on Our Website

Scholarship Opportunity

Full scholarship available for the ILO course ‘Seguros para el Desarrollo’

The A2ii is offering insurance supervisors the chance for a full scholarship for the online course in Spanish ‘Seguros para el Desarollo’ provided by the International Training Centre of the International Labour Organisation (ITCILO). The deadline is 12 June 2023. Find out more on our website.

Recent events

ASSAL Annual Conference | 2 - 3 May, San José, Costa Rica

The XXI Conference on Insurance Regulation and Supervision in Latin America was jointly organised by the Latin American Association of Insurance Supervisors (ASSAL), the International Association of Insurance Supervisors (IAIS), and Superintendencia General de Seguros (SUGESE) of Costa Rica. More than 100 people from 25 countries attended, of which 44 were insurance supervisors.

The agenda included a range of panels on trending topics such as Artificial Intelligence and Insurtech, Cybersecurity, Diversity, Equity and Inclusion (DEI), Post-pandemic Challenges of the Insurance Sector, Sustainable Development, and Climate Change. The supervisors also presented trends and recent changes in Ibero-American legislation. Manoj Pandey represented A2ii on the Diversity, Equity and Inclusion (DEI) panel.

The event ended with the signing Ceremony of the ASSAL Declaration on Climate Change.

A2ii interactive session and survey

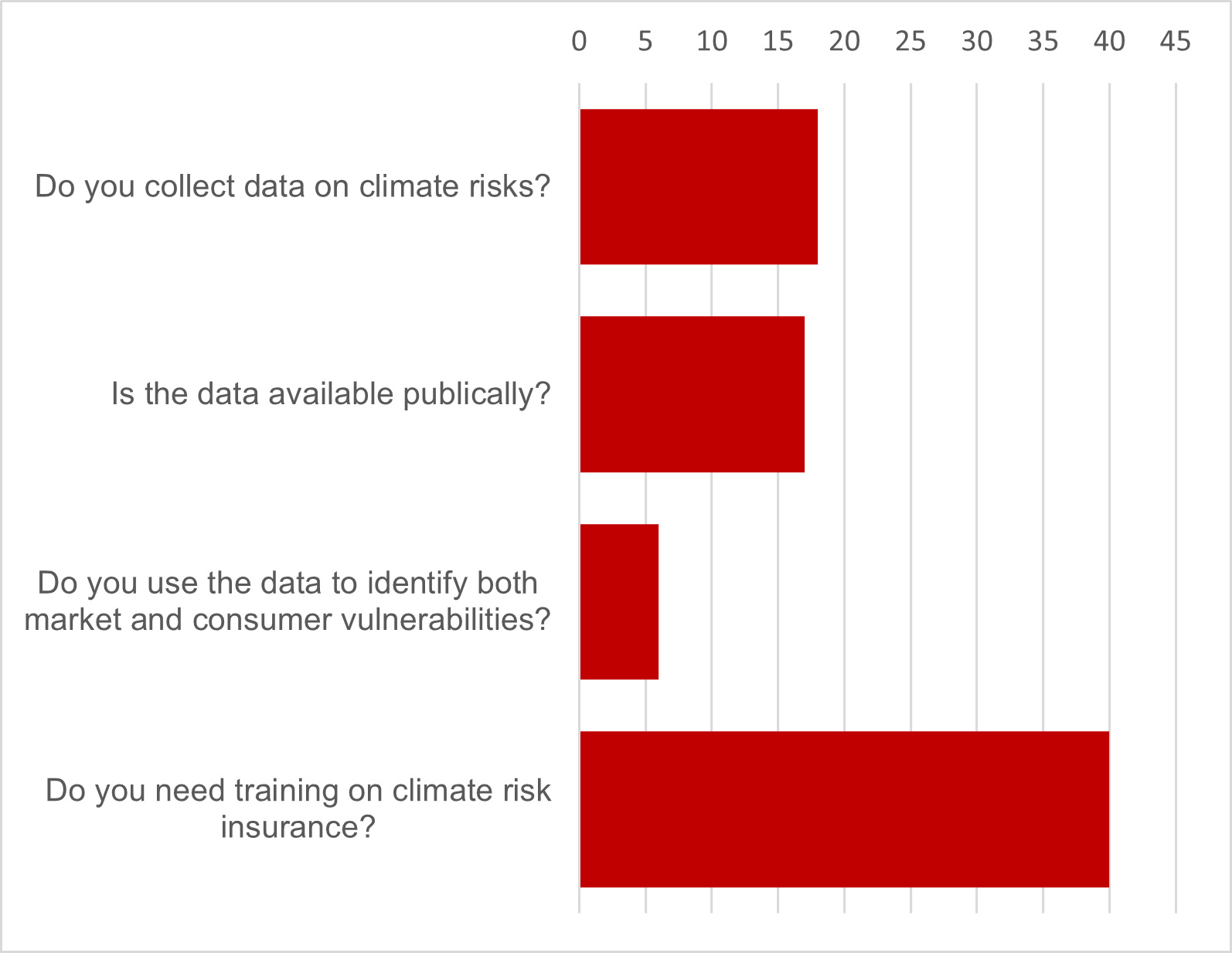

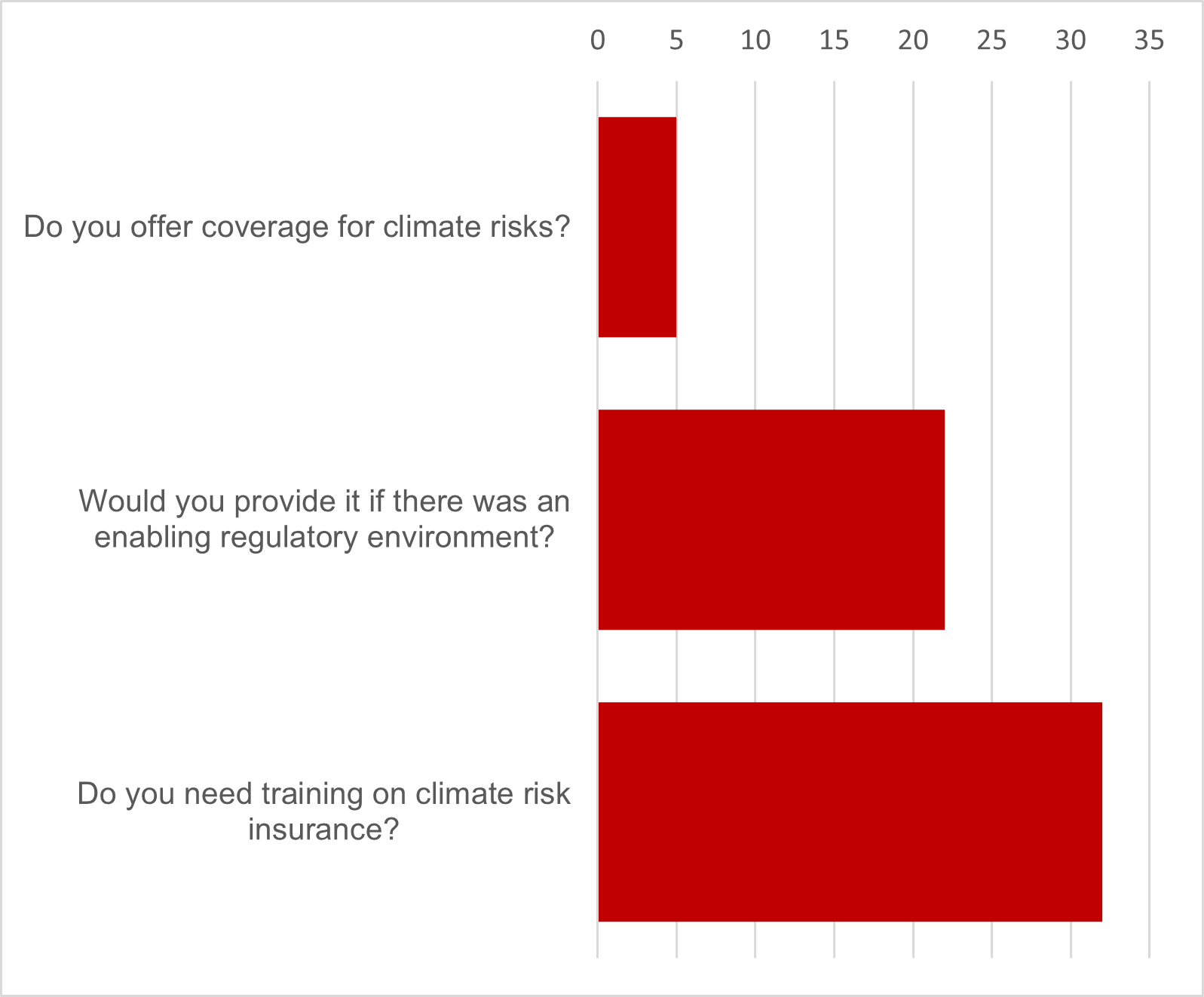

A2ii also organised the interactive session "Climate and Data", during which live surveys of 1) supervisors and 2) industry and other stakeholders was carried out, moderated by the Latin American Regional Coordinator Regina Simões. A summary of the results is below, and the full report will later be available on the A2ii website.

Supervisors

Forty supervisors participated in the survey, and also highlighted the two main challenges that they faced regarding data availability were the lack of data expertise and knowledge and the lack of a climate risks database.

Industry and other stakeholders

Thirty-two responded, also identifying two of the main barriers to offering climate risk insurance as lack of knowledge on the topic and lack of data.

ASSAL-FSI-IAIS high-level meeting on insurance supervision | 4 May

Following the ASSAL Conference, on 4 May, the ASSAL-FSI-IAIS high-level meeting on insurance supervision took place. The supervisors-only event was jointly organised by the Association of Insurance Supervisors of Latin America (ASSAL), the Financial Stability Institute (FSI) of the Bank for International Settlements (BIS) and the International Association of Insurance Supervisors (IAIS) and hosted by the Superintendencia General de Seguros (SUGESE) of Costa Rica. It provided a space for high-level discussions between experts and supervisors on topics such as macroeconomic developments, risk-based solvency regimes, climate and disaster-related financial risks, and recovery and resolution strategies for insurers.

A2ii Supervisory Special - Lessons from Colombia and Argentina on Supervisory Approaches to Data for Bridging the Gender Protection Gap | 17 May

The Supervisory Special: Lessons from Colombia and Argentina on Supervisory Approaches to Data for Bridging the Gender Protection Gap took place virtually on 17 May. During this session, Óscar Martínez, Financial Inclusion Advisor at the Superintendencia Financiera of Colombia, shared how the Colombian Supervisor is using a recent update to the financial inclusion reporting tool to analyse inclusive insurance, and how sex-disaggregated data is included in it. The data disaggregated by sex is further broken down for specific groups of the population, such as low-income or rural, which aims to foster specific public policies to support the inclusion of such vulnerable groups.

After Óscar’s presentation, Natalia López Uris, Senior Policy Advisor at the Superintendencia de Seguros de la Nación gave an overview of how the Argentinian Supervisor has been advocating for the inclusion of women in insurance. Natalia shared how the SSN has joined forces with the industry, as well as other insurance stakeholders. One of the outputs is the campaign “Mejor con Seguros” which has the objective to educate and build a culture of prevention and encourage insurance awareness as a tool for financial inclusion, with a particular focus on low-income women.

The presentations were followed by a Q&A discussion.

The recording of this event will be available shortly in A2ii’s learning and exchange platform Connect.A2ii as a learning module.

Supervisory Specials aim to promote peer exchange and discussions, based on presentations of real-life case studies from across jurisdictions. If you would like to present a case study, please contact secretariat@a2ii.org.

A2ii-IAIS Supervisory Dialogue on Diversity, Equity and Inclusion | 25 May

During the A2ii-IAIS Supervisory Dialogue on Diversity, Equity and Inclusion (DEI), Lauren Eckermann, Senior Policy Advisor at the IAIS, gave a presentation on the key insights from the 2022 IAIS Stocktake on diversity, equity and inclusion in the insurance sector. She covered the benefits that DEI can bring to an insurer’s institution in governance, risk management and corporate culture, as well as how DEI considerations in insurer’s conduct of business and supervision can result in fairer treatment of customers who are vulnerable, under-served or have specific needs.

After Lauren’s presentation, a panel discussion took place moderated by Helen Rowell, IAIS DEI Champion and Deputy Chair at the Australian Prudential Regulation Authority (APRA). The discussion featured four panellists: Anna Jernova, Senior Manager at the Prudential Regulatory Authority (UK) and Chair of the IAIS Governance Working Group, Mark White, CEO at the Financial Services Regulatory Authority of Ontario (Canada) and Chair of the IAIS Market Conduct Working Group, Natalia López Uris, Senior Policy Advisor at Superintendencia de Seguros de la Nación (Argentine Supervisory Authority) and Lezanne Botha, Senior Manager at the Regulatory Frameworks Department at the Financial Sector Conduct Authority (South Africa).

Each one shared the actions that are being undertaken in their jurisdictions to implement DEI, as well as the challenges that have arisen. Panellists also shared concrete examples of measures taken by their supervisory authority.

One highlight was the discussion around data, the collection and reporting of data and its challenges. Data can make DEI less subjective and provide a more accurate image of the society and the groups that are being excluded or under-served. Data can also make monitoring of DEI measures feasible, establishing concrete benchmarks. The collection of this type of data is however still a challenge, as there is a large amount of trust needed from consumers to disclose personal information. Measuring inclusion is also still challenging as it is hard to quantify, but efforts are being made to make this a reality.

The recording of this session will soon be available for supervisors only on A2ii’s e-learning and peer exchange platform, Connect.A2ii.

IAIS Sub-Saharan Africa Regional Seminar | 19 April, Kenya

The A2ii attended the IAIS SSA regional seminar on the topic of Strengthening Resilience of Insurance in Sub-Saharan Africa for Sustainability.

The A2ii presented on the role of supervisors in climate risk insurance and presented the KPI lexicon project. The A2ii also co-moderated a session on the supervision of inclusive insurance.

During the discussion, challenges were highlighted including whether efforts to implement microinsurance legislation lead to more penetration, challenges around regulation index insurance, data collection, and the implementation of IFRS 17.

The supervisory KPIs Lexicon is an interactive, searchable directory of key performance indicators for insurance supervisors. The KPIs span four ‘pillars’: prudential soundness, market conduct, insurance market development and the link between insurance and sustainable development.

Upcoming events

Adapting for Success: Key Lessons from Climate Risk Insurance Implementation in the Pacific | 19 June

Join the United Nations Capital Development Fund (UNCDF)'s Pacific Insurance and Climate Adaptation Programme (PICAP) for an upcoming webinar where we will reflect on the key lessons learned from implementing climate risk insurance solutions in the Pacific region. It will take place on Monday, 19 June 2023 at 19:00 Fiji time (9:00 CEST).

During this webinar, a panel of experts will share their insights and experiences as the PICAP expands its reach.

The PICAP is jointly implemented by UNCDF, UNU-EHS, and the UNDP Pacific Office in Fiji. It is supported by the New Zealand Ministry of Foreign Affairs & Trade, Australian Department of Foreign Affairs and Trade, and the Government of Luxembourg. The Fiji component of PICAP receives support from the India-UN Development Partnership Fund administered by the United Nations Office for South-South Cooperation (UNOSSC).

Don't miss this opportunity to gain valuable insights into climate risk insurance solutions in the Pacific. Register now and join us for this enlightening webinar.

Asian Insurance Meet | 8 - 10 June, Nepal

A2ii is a co-organiser of the upcoming Asian Insurance Meet in Kathmandu, Nepal, a three-day conference with the theme "Building Resilience of Insurance towards Emerging Risks". It is exclusively tailored to insurance supervisors, international and local insurers, reinsurers, brokerage firms and other related sectors most vulnerable to the impact of emerging risks. For more information, visit the event website.

Blog

Risk-based Capital and Supervision - A2ii-IAIS Supervisory Dialogue Report

Supervisors have been increasingly refining their solvency standards and moving towards risk-based regimes. This shift to risk-based solvency (RBS) approaches has many benefits for stakeholders in the insurance sector including consumers, industry players and supervisors. Not only does it support the development of the insurance market by providing flexibility and encouraging innovation, but it is also more efficient, allocating capital more appropriately to risk and reducing the amount of dormant capital. Additionally, RBS gives supervisors improved measures of financial soundness, insights into insurers’ risk management practises and corporate governance structures, comparability and proportionate ladders of intervention, leading to better supervision.

However, implementing RBS is not without challenges. Read more...

Publications

Session Report: Closing the protection gap – pandemic risk

This report collects the lessons and discussions that took place during the last three sessions of the ASSAL-IAIS Regional Training Seminar on “Challenges of Insurance Systems in Latin America”, on 22-23 September of 2022 in Lima, Peru.

A2ii co-organised the three final sessions with the Microinsurance Network, which focused on pandemic risks. During these, reflections were raised about the lessons learnt by the insurance sector in facing the challenges posed by the Covid-19 pandemic, which exposed vulnerabilities in the preparedness and resilience of facing systemic risks of such magnitude.

In this report, you can learn more about the last session results, an interactive exchange where participants discussed how to develop actions and/or programmes promoting the inclusion of three traditionally underserved groups: migrants, women and MSMEs.

Useful Tools on Our Website

Insurance and the Sustainable Development Goals (SDGs)

The SDG pages include resources on the importance and the role of insurance across nine SDGs: 01 No Poverty, 10 Reduced Inequalities, 02 Zero Hunger, 03 Good Health and Well-being, 05 Gender Equality, 08 Decent Work and Economic Growth, 09 Industry Innovation and Infrastructure, 13 Climate Change and 17 Partnerships for the Goals.

Supervisory KPIs Lexicon

Interactive, searchable directory of KPIs for insurance supervisors across four pillars: prudential soundness, market conduct, insurance market development and the Sustainable Development Goals.

Inclusive Insurance Regulations Map

The interactive map incorporates data about existing inclusive insurance regulation and regulation which supports inclusive insurance sourced through A2ii's research, work and interaction with supervisory authorities worldwide.

ICP Self-assessment Tool

The tool is intended to help supervisors assess the level of observance of the Insurance Core Principles (ICPs).