A2ii Newsletter 05/22

Welcome! In this newsletter, we provide you with updates on the work of the A2ii, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Subscribe to our mailing list to receive our newsletter in your inbox.

Navigation

Recent Events | New Training Resources | Upcoming Events | A2ii is Hiring | Useful Tools on Our Website

Recent events

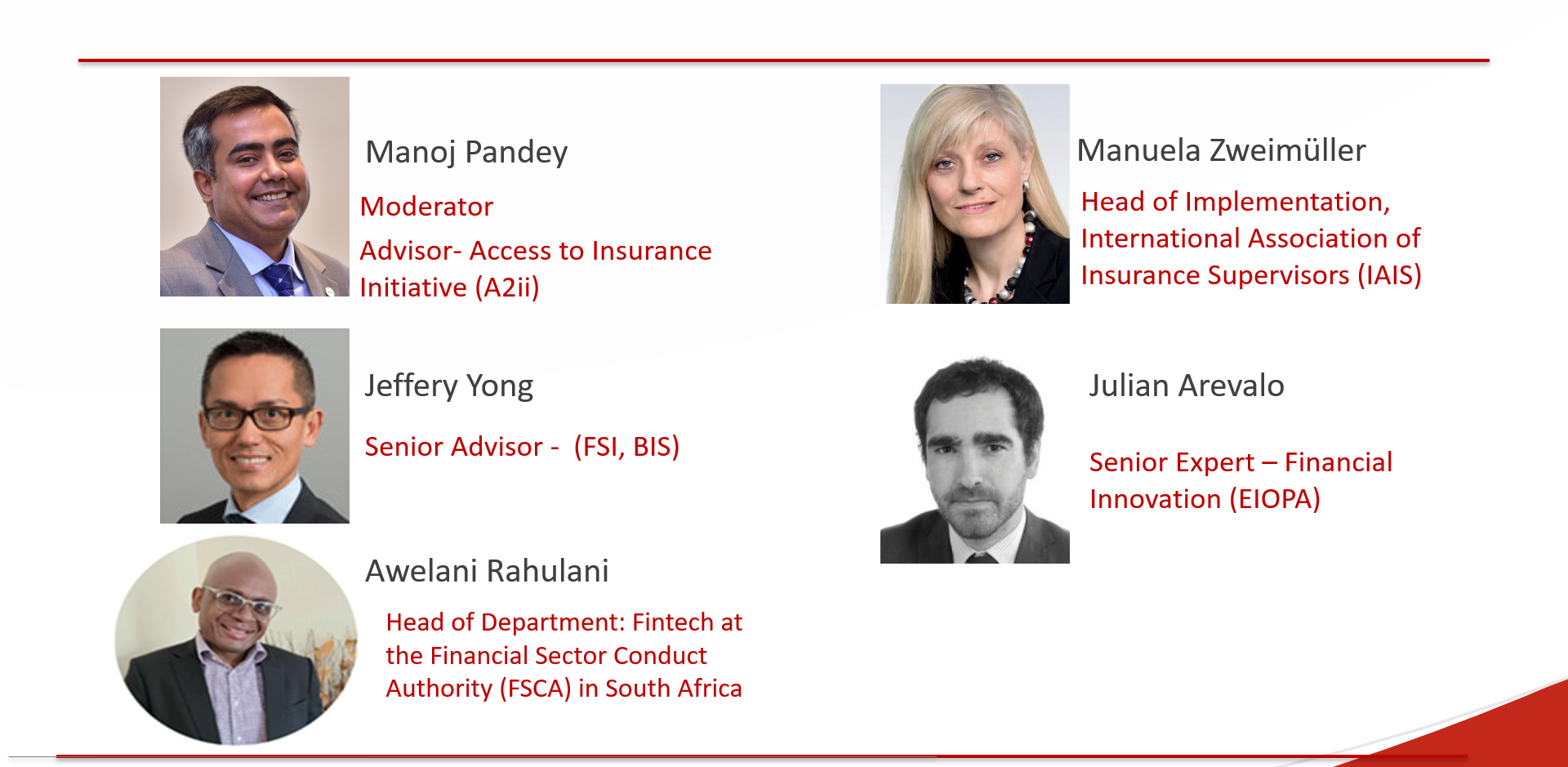

Artificial Intelligence (AI) and emerging regulatory expectations - Supervisory Dialogue | 7 April

On 7 April 2022, the A2ii jointly with the IAIS hosted a Supervisory Dialogue that was based on FSI’s paper “Humans keeping AI in check – emerging regulatory expectations in the financial sector” written by Jeffery Yong and Jeremy Prenio and published in August 2021. For this event, Jeffery Yong (FSI, BIS) presented the insights from this paper. This presentation was complemented by Julian Arevalo (EIOPA), who presented EIOPA’s report on Governance Principles and, for the afternoon session, we were joined by Awelani Rahulani from South Africa (FSCA), who presented a case study on the FSCA’s experience with BrandsEye (Data EQ), a reputation and social media monitoring tool that uses AI.

Supervisors are carefully considering how to protect consumers against potential abuse through AI, whilst still allowing for it to grow and fulfill its potential. The European Commission published in April 2021 the first proposal for a regulation regarding this issue. Other national authorities have published guidelines, principles and discussion papers.

As argued in FSI’s paper and presented by Jeffery Yong during the dialogue, the regulatory expectations that have been developed on AI common principles can be summarized in 5 themes or areas: Reliability/soundness, accountability, transparency, fairness and ethics to which the existing requirements on governance, risk management, and development of operation for traditional models apply. However, when applied to AI, there is a stronger emphasis on fairness, as the need to avoid biased/discriminatory outcomes requires human intervention. As the use of AI models that can impact authorities’ conduct and prudential objectives increases, so too does the relevance of reliability, accountability, transparency, fairness and ethics requirements.

Keep an eye on our website, where we will soon publish a blog with insights from this dialogue.

Check-in meeting on financial inclusion between the BIS, global standard-setting bodies (SSBs) and financial inclusion organisations | 21 April

On 21 April, the A2ii participated in the check-in meeting on financial inclusion between the Bank of International Settlements (BIS), global Standard-Setting Bodies (SSBs) and financial inclusion organisations. These bi-annual check-in meetings organised by the BIS serve as an important forum for SSBs to exchange information on financial inclusion. The A2ii, having only recently joined the group, was invited to provide a short introductory presentation on its work.

An insightful presentation was given based on the FSI Insights paper ‘Central bank digital currencies: a new tool in the financial inclusion toolkit?’ followed by a lively discussion on the topic.

New training resources on Connect.A2ii

Supervisory Dialogue on ‘Accounting Standards & IFRS 17: The role of Insurance Supervisors’ now available as a training module on Connect.A2ii platform in English and Spanish

The Supervisory Dialogue on ‘Accounting Standards & IFRS 17: The role of Insurance Supervisors initially took place on January 2021. This valuable learning resource is now available on Connect.a2ii – the A2ii’s supervisors-only learning and exchange platform.

Ahead of the IFRS 17 implementation deadline, this module provides:

-

Insights into the Financial Stability Institute (FSI) and the International Monetary Fund (IMF) joint paper on Accounting Standards and Insurer Solvency Assessment presented by the two institutions

-

A look into the results of a survey carried out by 20 insurance supervisors on the subject

-

An overview of potential regulatory and supervisory implications arising from IFRS 17

-

Case Studies from the supervisory authorities of the Cayman Islands, Zimbabwe, Malaysia and Jordan discussing the transitioning process

The release of this recording is carefully timed to coincide with next month's Supervisory Dialogue on the topic of IFRS 17. Please see upcoming events at the end of this newsletter if you would be interested in registering.

If you are not a Connect.A2ii member, we look forward to welcoming you: Create new account.

For members, you will find the module in your Catalogue.

For any questions or comments on the platform, reach out to us at connect@a2ii.org.

Upcoming events

A2ii-RFPI/MEFIN-MiN Asia Regional Dialogue on "The Role of Insurance and Data in closing the Climate Risk Protection Gap"| 17 May

With climate change, natural disasters are becoming more frequent and severe. This affects developing and emerging economies in particular, because of a higher vulnerability that can be attributed amongst others to a strong reliance on climate-reliant activities such as farming. At the same time, there is a lack of accessible and affordable insurance services which would contribute to closing the climate protection gap, leaving large segments of society under-protected.

Against this background, there is a need to assess the effectiveness of current insurance solutions against climate change related perils and the potential role of technology and data in closing the climate risk protection gap.

This event brings together regional and international experts and practitioners to share their experiences and best practices that may help provide answers to the following questions:

-

Why is today’s insurance not good enough to close the climate protection gap?

-

What is the role of technology and data in pushing the limits for climate-related insurance services?

-

How do we move forward?

This event will be hosted by the Access to Insurance Initiative (A2ii), the Microinsurance Network (MiN), and the GIZ-Regulatory Framework Promotion of Pro-poor Insurance Markets in Asia (RFPI) in partnership with the Mutual Exchange Forum on Inclusive Insurance (MEFIN).

The regional dialogue takes place on 17 May 2022 from 9:00-11:00 CEST (17:00-19:00 PHT). Click here for more information and to register.

Reflection on the Implementation of IFRS 17 - Supervisory Dialogue | 19 May

What challenges do supervisors face, and what progress has been made before the IFRS implementation deadline in 2023? We will pick up from our last Supervisory Dialogue from 2021 (supervisors now can access the 2021 recording on our Connect platform as a training module, and read our blog report for a refresher).

On 19 May, a presentation will be made by Peter Windsor, an expert from the IMF who will share his experiences of supporting several countries in their preparations for the implementation of IFRS 17. There will also be case studies presented by supervisors sharing their experiences, including Jun Oh and Leron Kwong from the Australian Prudential Regulation Authority during the morning session, and David Correia from the Office of the Superintendent of Financial Institutions (Canada) during the afternoon session.

Registration is open now on our website. This webinar will be open to supervisors only and will take place at 10:00 CEST in English (with simultaneous French interpretation) and 16:00 CEST in English (with simultaneous Spanish interpretation).

If you have any questions or comments, please send them to dialogues@a2ii.org

Inclusive Insurance Training Programme | 23 August – 15 September

This training programme is offered in partnership with the Toronto Centre and IAIS. In 2022, It will be offered to supervisors from all regions in English. It will take place over virtually over 8 days, Tuesdays and Thursdays from 23 August to 15 September 2022, from 13:00 to 17:00 CEST on MS Teams. Participants will also be required to complete online modules on the Connect.A2ii platform.

The training is targeted to entry- to mid- level insurance supervisors.

Topics covered in the training include:

-

Regulation and Supervision Supporting Inclusive Insurance Markets

-

The Role of the Supervisor

-

Prudential Aspects in Inclusive Insurance Supervision

-

Climate and Environmental Risks

-

Understanding the Market and the Environment

-

Uses of Technology in Inclusive Insurance

-

Key Performance Indicators

-

Sustainable Development Goals and Insurance

Places will be limited – if interested, please register on our website.

A2ii is hiring

Advisor position

The A2ii is looking for a new advisor with previous experience in an insurance supervisory authority or a closely related field. The ideal candidate will:

-

Research and create knowledge on regulation and supervision with a focus on inclusive insurance and emerging risks, including insurance in the context of the Sustainable Development Goals

-

Lead project developing online training modules on supervisory data reporting in close collaboration with consultant experts and insurance supervisors

-

Take the lead on different A2ii capacity building formats, including virtual dialogue events, webinars and trainings

-

Technical review of A2ii publications

-

Representation of the A2ii at relevant regional and global events and in IAIS working groups

-

Bringing great ideas to a welcoming team

Applications are due by 30 May 2022. Click here for more information.

Junior Advisor position

The A2ii is looking for a new junior advisor with business fluency in English and French. The ideal candidate will:

-

Support the organisation of physical regional and global events, esp. for Francophone jurisdictions

-

Proofreading and editing of A2ii’s French publications and support communication with Francophone supervisory network

-

Participate in inclusive insurance innovation lab workshops, support participant communication and external communication (impact stories, videos, social media)

-

Support A2ii's knowledge generation work with research on inclusive insurance topics with a focus on regulatory and supervisory issues and drafting A2ii knowledge and communication products

-

Provide ad hoc general support to the A2ii secretariat team across the range of its activities as requested

Applications are due by 29 May 2022. Click here for more information.

Useful Tools on Our Website

Insurance and the Sustainable Development Goals (SDGs)

The SDG pages include resources on the importance and the role of insurance across nine SDGs: 01 No Poverty, 10 Reduced Inequalities, 02 Zero Hunger, 03 Good Health and Well-being, 05 Gender Equality, 08 Decent Work and Economic Growth, 09 Industry Innovation and Infrastructure, 13 Climate Change and 17 Partnerships for the Goals.

Supervisory KPIs Lexicon

Interactive, searchable directory of KPIs for insurance supervisors across four pillars: prudential soundness, market conduct, insurance market development and the Sustainable Development Goals, with four accompanying handbooks.

Inclusive Insurance Regulations Map

The interactive map incorporates data about existing inclusive insurance regulation and regulation which supports inclusive insurance sourced through A2ii's research, work and interaction with supervisory authorities worldwide.

ICP Self-assessment Tool

The tool is intended to help supervisors assess the level of observance of the Insurance Core Principles (ICPs).