Back to Newsletters

Newsletters | 2022

A2ii Newsletter 03/22

Welcome! In this newsletter, we provide you with updates on the work of the A2ii, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Subscribe to our mailing list to receive our newsletter in your inbox.

Navigation

Supervisory Needs Assessment Survey | iii-lab Update | Recent Events | Upcoming Events | Scholarship Opportunity | Publications | Partner Events | Useful Tools on Our Website

Supervisory Needs Assessment Survey

The A2ii currently stands at an important point of looking into its further organisational development and strategic orientation. To this end, we are kindly inviting you to take this A2ii Supervisory Needs Assessment Survey and help shape our workplan and activities for the years to come.

Specifically, we have crafted this survey to better understand:

-

The strategic priorities of your authority in both the short and medium term and the place of financial inclusion/inclusive insurance in this list of priorities

-

Your most important capacity building needs, in general and related to inclusive insurance

-

Whether and how these priority capacity building needs are currently being met

-

Your perspective on the A2ii's activities

Please plan 20 minutes of your time to complete the survey.

We thank you for engaging with our work.

iii-lab Update

Discovery phase of the climate lab completed | February

The four teams of the A2ii’s third Inclusive Insurance Innovation Lab (Costa Rica, Grenada, Zambia and Zimbabwe) completed the first phase of the 12-month-process in February. This phase focused on forging a close country team and finding common ground through an analysis of the challenges related to climate risk resilience and insurance in each country.

The teams interviewed the beneficiary groups they would like to serve with their innovations. Grenada, Zambia, and Zimbabwe chose smallholder farmers, Grenada is additionally focusing on fisher folk, and Costa Rica chose SMEs in the tourism sector. These interviews helped country teams to identify unmet, unarticulated needs that are crucial to know about when creating compelling new solutions.

Common learnings from the interviews across countries were:

-

interview partners were often not aware of (future) impacts of climate change on their lives and livelihoods

-

customer-centric products that meet the real needs of farmers are not available hence new partnerships and more proactive governments are needed

Finally, working in international groups, participants learned about innovations to increase resilience against climate risks. Starting mid-March, teams will start the innovation phase on the national level and will present their prototypes to an expert jury and other country teams in May.

Recent events

How to raise insurance awareness for market development? Lessons from the second Inclusive Insurance Innovation Lab - Public Dialogue | 10 February

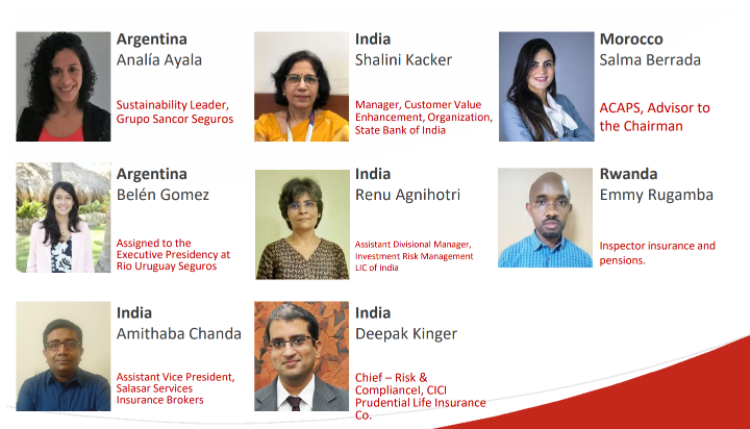

The results of the second iii-lab were presented in an A2ii-IAIS Public Webinar entitled “How to raise insurance awareness – Lessons from the Second Inclusive Insurance Innovation Lab” on 10 February attended by around sixty participants. The call was moderated by the A2ii’s iii-lab project managers Manoj Pandey, Teresa Pelanda and Mariella Regh and divided into three parts: (1) An introduction to the iii-lab methodology; (2) Innovations and learnings in designing and implementing awareness-raising campaigns and new products; (3) Supervisors’ discussion on the innovation experience.

The following innovations were presented:

-

Rwanda: Awareness raising campaigns through radio, TV and university competition

-

India: Awareness raising campaigns through mobile caller tunes and Combi-product for low-income households

-

Argentina: Awareness raising campaign through social media

-

Morocco: Digital health insurance business model

The supervisors from the four countries discussed the benefits of the lab for shaping their innovation strategy going forward. Emmy Rugamba (National Bank of Rwanda), highlighted that participation enabled them, as a supervisor, to understand the challenges to greater financial inclusion faced in their jurisdiction. These included low insurance penetration, low awareness, and a lack of suitable products for the low-income segment - these challenges were universal across the four jurisdictions. He confirmed the need to focus on market development and encourage innovation. A.V. Rao, Insurance Regulatory and Development Authority India (IRDAI), contributed by saying that the lab has taken their regulatory approach to inclusive insurance to a different level. At IRDAI, they have now put the customers and their needs at the centre, and this was realised when the customers’ needs were manifested in their ask for a combi-product. For Malena Kramer, Superintentencia de Seguros de la Nación, Argentina (SSN), the #betterwithinsurance campaign in Argentina brought the public and private sectors together in addressing the great challenge of low access to insurance. Salma Berrada, Supervisory Authority of Insurance and Social Welfare, Morocco (ACAPS) emphasised the supervisors’ leadership role in rallying relevant public and private stakeholders around the topic of inclusive insurance and maintaining this dynamic across the innovation lab process and beyond. Morocco will continue engaging in this multi-stakeholder dialogue within a dedicated committee.

For more information on each innovation please consult the video or reach out to iii-lab@a2ii.org. The recording of the Dialogue is available on our website in English, French and Spanish.

IAIS-A2ii-South African Reserve Bank-Financial Stability Institute Regional Meeting for Sub-Saharan African Supervisors | 24-25 February

This two-day virtual event organised by the SARB brought together 54 insurance supervisors from 15 countries across the region.

The IAIS and A2ii presented strategic priorities and updates on key workstreams. Topics such as climate risk, SupTech, supervision in the new normal, pandemic risk, impact of Covid-19, and use of key performance indicators dominated the agenda. The A2ii also presented its its new e-learning platform Connect.A2ii, raising supervisors' awareness of the trainings available for them through the platform, such as the public module on Supervision of Climate-related Risks in the Insurance Sector.

The regional implementation plan developed with the support of the A2ii was also presented by Suzette Vogelsang, SARB, in her capacity as IAIS regional coordinator. This plan highlights supervisory capacity building needs across the region and is used to inform the activities of A2ii and other partners in the region.

A live poll was conducted during the meeting to capture recent changes in supervisory priorities and emerging training needs. With respect to prudential and market conduct priorities, risk-based supervision, RegTech and SupTech and data reporting were identified as the top three priorities. With respect to market development priorities, digitalisation and use of technology, proportionate regulation and supervision (microinsurance) and new innovative products were the top priorities.

Launch of Costa Rican insurance industry commitment to responsible business conduct | 25 February

On 25 February, A2ii attended the launch event where 21 key stakeholders from Costa Rica's insurance sector came together to commit to a protocol of responsible business conduct. The protocol, which had been developed jointly, committed the various stakeholders, to manage their businesses in a responsible and sustainable manner and thus contribute to sustainable development. More than 60 representatives of insurers, intermediaries, regulators, and public institutions contributed to the development of the protocol.

The initiative is part of the "Responsible Business Conduct in Latin America and the Caribbean (RBCLAC)" project. The process is led by the Business Alliance for Development (AED) in Costa Rica and Sumarse Panama, with the participation of the Costa Rican General Superintendence of Insurance (SUGESE), and the Panamanian Superintendence of Insurance and Reinsurance (SSRP).

The participating organisations received training, support, and tools to improve due diligence, to identify risks in environmental, social and governance matters, to define critical issues of their sector, to build a protocol and a consensual sectoral roadmap, to work in priority areas and to contribute to sustainable development. This protocol comes as a response to commitments already acquired by SUGESE, such as the Principles of Sustainability in Insurance (PSI), of the United Nations Environment Program Finance Initiative (UNEP-FI).

"The Sustainable Development Goals represent an urgent challenge for humanity to achieve fairer, more inclusive, and resilient societies. In this regard, insurance is an instrument like few others to achieve such high aspirations. The Corporate Responsibility Protocol of the insurance industry has been developed through a comprehensive participatory process of the insurance sector, defining commitments, priorities, and actions in the environmental, social and governance areas. For SUGESE, this first step is a powerful signal from the industry to be part of a national project that will have an impact on the social welfare of the entire population," said Tomás Soley Pérez, Costa Rica’s Superintendent of Insurance.

Upcoming events

Artificial Intelligence (AI) and emerging regulatory expectations - Supervisory Dialogue | 7 April

Artificial Intelligence, including machine learning, is reshaping the financial sector. It has the potential to improve various aspects of the provision of insurance to consumers and improve the operational and risk management processes within firms. However, this could be overshadowed by the challenges and complexity presented by AI, as it may also exacerbate and/or introduce risk exposures, especially regarding fairness. For this reason, clear guidelines and tailored regulatory responses that keep in mind the specific areas in which AI might have negative consequences are necessary to protect consumers and firms against AI’s unique risks and challenges.

On April 7, the A2ii and IAIS will be hosting a Supervisory Dialogue based on the Financial Stability Institutes (FSI) Insights Paper on Humans keeping AI in check - emerging regulatory expectations in the financial sector. This paper provides insights on how high-level principles on Transparency, Reliability and Soundness, Accountability, Fairness and Ethics, and Addressing regulatory/supervisory challenges through proportionality can be implemented when using AI. It also analyses the need for human intervention in some AI processes, especially accountability and fairness.

This webinar will be open to supervisors only and will take place at 10:00-11:00 CET in English (with simultaneous French interpretation) and from 16:00-17:00 CET in English (with simultaneous Spanish interpretation). Registration is open now on our website.

If you have any questions or comments, please send them to dialogues@a2ii.org

Scholarship Opportunity

Apply for a scholarship for the Leadership and Diversity Program for Regulators | 20 March

Access to Insurance Initiative (A2ii) together with the InsuResilience Global Partnership, through its Centre of Excellence on Gender-smart Solutions, are once again jointly sponsoring the participation of an insurance supervisor and a high-potential woman from the same agency for the Leadership and Diversity Program for Regulators. The program is taught by Women’s World Banking and Faculty from Oxford University’s Saïd Business School and implemented together with the Alliance for Financial Inclusion (AFI). It is intended to support insurance supervisors and regulators in developing policies that close the gender gap in inclusive insurance and in developing women’s leadership capacity in regulatory organisations.

The virtual, 12-week global leadership program brings together senior officials (male/female/nonbinary) from central banks and other regulatory agencies and high-potential women (mid-level professionals) from their respective institutions.

Click here for more information and eligibility requirements.

If you are interested in the scholarship opportunity, please send an email to jana.siebeneck@insuresilience.org and manoj.pandey@a2ii.org with the subject line: “Scholarship: Leadership and Diversity Program for Regulators” for application information. Please contact us before 20 March 2022.

Publications

Market Development and Sustainable Development KPI Handbooks Published

The A2ii has published two KPI Handbooks, Market Development and Sustainable Development, respectively, as part of the KPI Reporting Toolkit for Insurance Supervisors project. Supervisors can use the Handbooks to understand what data they should need and how to collect, analyse, and use data, in line with ICP 9.

The Market Development KPI Handbook covers: a framework for assessing market development in a holistic way, guidance on selecting and tracking fit-for-purpose KPIs, case studies on analysing the KPIs and finally, acting on the insights.

The Sustainable Development KPI Handbook covers guidance on identifying which SDGs matter, selecting and tracking fit-for-purpose KPIs, case studies on analysing the KPIs focusing on SDGs 1, 5 and 13, and finally, how to act on the insights.

About the KPI Reporting Toolkit Project

The outputs of the KPI Reporting Toolkit for Insurance Supervisors project span four pillars: prudential soundness, market conduct, insurance market development and the SDGs.

They include:

-

Background paper ‘Evolving insurance supervisory mandates in Sub-Saharan Africa – implications for data practices’, available in English, French and Spanish

-

Supervisory KPIs Lexicon – interactive, searchable directory of KPIs

-

In conjunction with the Lexicon, the four KPI Handbooks: Prudential, Market Conduct, Market Development and SDGs.

In this video, Hui Lin Chiew, A2ii, summarises the use case for the Handbooks in more detail.

Partner Events

IAIS member survey on diversity, equity, and inclusion initiatives | 11 April

IAIS members are invited to respond to a new survey via the IAIS extranet (log-in required).

In September 2021, the Executive Committee (ExCo) added issues related to DE&I in the insurance sector as a new strategic theme for the IAIS. Part A of the survey asks questions on the state of DE&I in your insurance sector, and on supervisory initiatives being taken or considered in support of advancing insurers’ DE&I. Your responses will be an input to the GWG stocktake. The IAIS is also committed to further building DE&I into its own internal governance and processes. Part B of the survey invites Members’ input and ideas for what the IAIS can do to achieve this.

Please respond to the survey questions via the online survey tool. For convenience, a Word document containing the survey questions is provided to help you prepare your responses manually beforehand. Please note that only responses submitted electronically through the online survey tool will be considered. The deadline for submission of responses is close of business on 11 April 2022.

If you have any questions regarding the survey please contact the IAIS Secretariat (lauren.eckermann@bis.org).

Apply for the Spring NAIC International Fellows VIRTUAL Program | 29 April

The National Association of Insurance Commissioners (NAIC) invites you to apply for the Spring NAIC International Fellows VIRTUAL Program taking place May 16–20, 2022. The program will feature recorded lectures by NAIC technical experts covering all aspects of U.S. state-based insurance regulation, with opportunities for participants to engage with NAIC staff in order to gain deeper insights into how insurance is regulated in the U.S. and the role of the NAIC in supporting state-based regulation. The deadline is 29 April.

Useful Tools on Our Website

Insurance and the Sustainable Development Goals (SDGs)

The SDG pages include resources on the importance and the role of insurance across nine SDGs: 01 No Poverty, 10 Reduced Inequalities, 02 Zero Hunger, 03 Good Health and Well-being, 05 Gender Equality, 08 Decent Work and Economic Growth, 09 Industry Innovation and Infrastructure, 13 Climate Change and 17 Partnerships for the Goals.

Supervisory KPIs Lexicon

Interactive, searchable directory of KPIs for insurance supervisors across four pillars: prudential soundness, market conduct, insurance market development and the Sustainable Development Goals.

Inclusive Insurance Regulations Map

The interactive map incorporates data about existing inclusive insurance regulation and regulation which supports inclusive insurance sourced through A2ii's research, work and interaction with supervisory authorities worldwide.

ICP Self-assessment Tool

The tool is intended to help supervisors assess the level of observance of the Insurance Core Principles (ICPs).