A2ii Newsletter 03/21

Welcome! In this newsletter, we provide you with updates on the work of the Initiative, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Subscribe to our mailing list to receive our newsletter in your inbox.

The A2ii taking precautionary measures related to Covid-19

To safeguard the well-being of the A2ii staff and its partners, the A2ii is cancelling or postponing all physical events through the spring of 2021 and exploring the use of virtual formats when possible. Events that are scheduled to take place from June 2021 onwards are currently under review. The A2ii will communicate any changes pertaining to our events on our website, social media channels and through our newsletter.

Covid-19 Insurance Supervisory Response Tracker

We have a special page on our website dedicated to tracking worldwide supervisory responses, insurance news and learning resources (such as webinars).

Feel free to share relevant news with us via secretariat@a2ii.org, by tagging Access to Insurance Initiative on LinkedIn or by mentioning us on Twitter.

New on the A2ii Website

The A2ii interactive Inclusive Insurance Regulation map

The A2ii interactive Inclusive Insurance Regulation map is a searchable collection of inclusive insurance regulations from around the world.

The map incorporates data sourced through A2ii's research, work and interaction with supervisory authorities worldwide. As such, it is by no means exhaustive and the information within is continuously updated to the best of A2ii's knowledge. To find out about legislation around the world, simply click on a country or explore the table.

In 2009, when the A2ii first compiled a map on inclusive insurance regulation, there were only six jurisdictions on the map. Since then, the A2ii and the IAIS have drawn on the experience of these pioneering countries to promote the implementation of proportionate regulations. As the numbers grew, we began to see that our collection of data could serve as a public tool for learning, research and peer exchange.

We welcome regulators to submit new information about the state of inclusive insurance in their jurisdiction by emailing secretariat@a2ii.org.

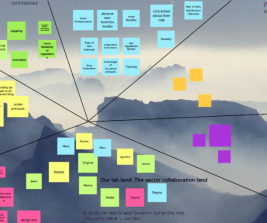

Inclusive Insurance Innovation Lab update

The Inclusive Insurance Innovation Lab (iii-lab) is an international capacity-building programme where 4 country teams work on innovative solutions to advance the development of their insurance market. Currently participating are Argentina, India, Morocco and Rwanda.

Second national workshop phase | November 2020 – January 2021

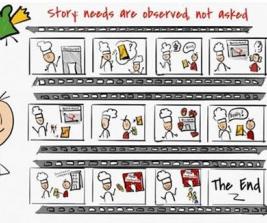

During this phase, there was an emphasis on design-thinking methodology to build on the identification of priorities and to address them through development of prototypes. The initial prototypes were presented to the other lab teams for feedback on 19 January. Teams are now embarking on an iterative experimental process to test their prototypes.

Global Webinar on designing successful educational and marketing campaigns | 25 February

Central to all lab teams is education and awareness, marketing of products, and how to craft digital strategies to get messages across. Three experts joined us for this call. First we learned from Ivan Poltoracki, a senior marketing executive, about key factors to consider when developing a marketing/educational campaign. Following this, we heard about two innovative approaches to raise awareness about insurance, which were developed by AB Consultants, a Kenya-based microinsurance consultancy seeking to make financial services more accessible in Africa. Barbara Chesire-Chabbaga, Managing Director and Co-founder of AB Consultants and a participant of the first iii-lab, and Jeremiah Siage, Director & Digital Finance Specialist, talked about their experiences developing ResilientME!, a game designed to demystify risk management and insurance in a way that is fun and engaging. They also presented the insurance platform app – CoverApp developed by AB consultants, where people can purchase insurance and file claims on-the-go.

Recent events

IAA Seminar Mini-Series: Risk-Based Financial Management with a focus on the Americas and Africa | 4, 11, and 18 February

The International Actuarial Association partnered with A2ii and the IAIS to organise a series of short webinars focused on Risk-based Financial Management and Supervision. The first series of three sessions was held in January, focusing on Asia-Pacific time zones with about 70-100 participants in each webinar. Recordings of the webinars can be seen here.

In February, three more were held to cover time zones in the Americas and Africa and were simultaneously translated into French and Spanish. About 120-160 participants attended each webinar. On 4 February, Alex Kuhnast discussed the ORSA as a core tool of risk-based supervision, providing some guidance for supervisors on what to look for when assessing an ORSA and what a strong ORSA process looks like. The second session on 11 February focused on de-mystifying the supervisory task of using actuarial reports, with Britta Hay and Stuart Wason sharing their experiences in supervision and the industry, including examples for life and non-life. In the last session on 18 February, Nigel Bowman and Jules Gribble presented a tool developed by the IAA’s Inclusive Insurance Working Group, the IAA Risk Tool, which provides supervisors with a framework to assess risks and aggregate their cumulative portfolio impact. During the session, Edith Apoo and Ivan Kalimeri from the Insurance Regulatory Authority of Uganda (IRA) also shared their experience of working with the tool at the IRA. Recordings of the webinars in English, French and Spanish can be seen here.

A2ii meets with Guatemala’s Technical Roundtable on Inclusive Insurance | 25 February

A2ii participated in a meeting with Guatemala's Technical Roundtable on Inclusive Insurance on 25 February.

The Inclusive Insurance Technical Roundtable was created in the context of Guatemala's National Financial Inclusion Strategy (Estrategia Nacional de Inclusión Financiera – ENIF). It aims to broaden the scope and penetration of insurance, through the development of new distribution channels and the diversification of insurance, as well as the development of new insurance products.

During the meeting, attended by representatives of the Ministry of Economy, Superintendence of Banks - SIB (insurance supervisory authority) and The Central Bank of Guatemala, the A2ii Latin America regional coordinator, Regina Simões, presented on inclusive insurance, its specific features and the challenges faced by both industry and supervisors.

A2ii-ASSAL-IAIS First Strategic Roundtable for Latin American Supervisors | 9 February

The First Strategic Roundtable took place on Tuesday, 9 February 2021, jointly organised by the Access to Insurance Initiative (A2ii), the Association of Latin American Insurance Supervisors (ASSAL) and the International Association of Insurance Supervisors (IAIS). It was the first time such an event was organised for supervisors in the region.

The event was opened by Jonathan Dixon, IAIS Secretary General, and Tomás Soley, President of ASSAL. The A2ii, the IAIS and the Financial Stability Institute (FSI) presented their strategic priorities and plans for 2021. Representatives of each supervisory authority were then invited to present their strategic priorities and training demands.

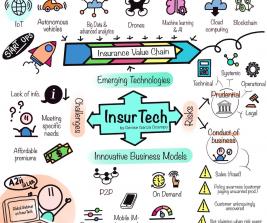

The roundtable was attended by more than 60 senior supervisors from 12 jurisdictions in Latin America: Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, El Salvador, Guatemala, Honduras, Mexico, Peru and Uruguay. Among the most mentioned topics were: actuarial capacities, IFRS 17, InsurTech and SupTech, cyber risk and data protection, index insurance, digital channels and innovation, risk-based supervision, climate and catastrophic risk insurance, and anti-money laundering and combating the financing of terrorism. The A2ii, IAIS, and ASSAL will continue to work toward addressing the needs and interests of the supervisory authorities in Latin America, and we thank all for their fruitful participation in this valuable session.

Upcoming events

A2ii-FSI-IAIS-SARB Regional meeting for insurance supervisors from Sub-Saharan Africa | 15 - 16 March

The upcoming regional meeting for Sub-Saharan Africa insurance supervisors will be organised virtually and hosted by the International Association of Insurance Supervisors (IAIS), the Prudential Authority within the South African Reserve Bank, the Financial Stability Institute (FSI) and the Access to Insurance Initiative (A2ii).

The 2021 regional meeting will give insurance supervisors the opportunity to engage on topical issues impacting insurers such as developments in climate change, cyber security, business interruption insurance, Covid-19 and its impact, and there will also be an opportunity for supervisors to share and engage on regulatory developments, supervisory developments and strategic initiatives in their respective jurisdictions. The meeting will also provide an update on key activities and initiatives of the IAIS over the past year, and will also afford insurance supervisors the opportunity to engage in the overall strategic planning of the IAIS over the next few years.

The regional meeting will take the format of 3 hour sessions over two days (15 and 16 March 2021), and will be hosted virtually. For more information, please email secretariat@a2ii.org.

Index Insurance – A2ii-IAIS Public Dialogue addressing SDG 2 – Zero Hunger | 25 March, WebEx

The use of index insurance as an alternative to traditional indemnity-based insurance has increased over the last years, particularly as a mechanism for insuring extreme weather risks. Index insurance – also known as parametric insurance – has been evolving. Today, it reaches a wide range of customers, at the micro, meso and macro levels, ranging from the most vulnerable segments of the population to the most sophisticated and complexes sectors.

To take stock of recent developments, the A2ii conducted a survey with supervisors and other stakeholders on the current state of index insurance.

On 25 March 2021, the A2ii and IAIS will be sharing the outcomes of the research on athea public dialogue on index-based insurance. Highlights from the A2ii report on the topic and results from the index insurance survey will be presented. Participants will hear from industry experts as well as supervisory authorities who will share their experiences.

This webinar is also part of the A2ii’s 2021 theme of the year - the Sustainable Development Goals (SDGs). Insurance plays an important role in achieving multiple SDG goals and this dialogue will focus on how index insurance is a key component to achieving food security and ending hunger (SDG 2).

This 75-minute Dialogue will be open to all stakeholders and will take place at 10 am CET in English (with simultaneous French interpretation) and 4 pm CET in Spanish (with simultaneous English interpretation). Click here for more information or to register.

Sustainable Development Goals and Inclusive Insurance – A2ii-IAIS Public Dialogue | 22 April, WebEx

The webinar will be open to all stakeholders and will take place in English with simultaneous Spanish and French interpretation. Check the event page for more information to come.

Scholarship opportunities

Scholarships for the Leadership and Diversity Program for Regulators from A2ii and InsuResilience Global Partnership

Access to Insurance Initiative (A2ii) together with InsuResilience Global Partnership are once again jointly sponsoring the participation of insurance supervisors in the Leadership and Diversity Program for Regulators, taught by Women's World Banking and faculty from Oxford University’s Saïd Business School. In 2021, the scholarship will cover six applications.

The participating regulator will nominate a team of a senior official and a high-potential woman official from the agency. During the program, the senior official identifies a policy initiative to sponsor at their institution related to serving the women’s market and will work with their high-potential woman leader to implement it, while simultaneously supporting her professional development during and after the program.

The program lasts 16 weeks and involves a series of interactive live online sessions, individual and group assignments, peer action learning and expert consultation opportunities. Each senior official identifies a policy initiative to advance women’s financial inclusion. The programme is in English and begins in April 2021.

The new deadline is 12 March 2021.

Click here for application information.

Oportunidades de beca para el curso en línea "seguros para el desarrollo"

Access to Insurance Initiative (A2ii) ofrece dos becas completas para supervisores de seguros para el curso "Seguros para el desarrollo," que tendrá lugar en línea del 6 de abril al 7 de mayo de 2021.

Las becas cubrirán la matrícula del curso y se otorgarán mediante un proceso de solicitud competitivo basado en los siguientes criterios:

- País: se dará preferencia a los participantes que vivan o trabajen en un país de ingresos bajos o medianos bajos, según la clasificación del Banco Mundial;

- Habilidad para hablar español (los seminarios web y los materiales están completamente en español y no habrá traducción disponible);

- Capacidad para demostrar cómo la formación beneficiará a su trabajo y al sector de seguros inclusivo de su país, y

- Capacidad para implementar las lecciones aprendidas del curso.

Como participar

- Regístrese en el curso en línea completando el formulario de registro en el sitio web del ITC-OIT;

- Envíe un correo electrónico solicitando beca a impactinsuranceacademy@itcilo.org con el asunto: “Solicitud de beca A2ii”. Por favor incluya lo siguiente en su correo electrónico:

- Nombre, información de contacto y país, nombre del cargo y posición en el supervisor de seguros, años de experiencia en seguros inclusivos;

- Al menos tres razones por las que asistir al curso beneficiará su trabajo y al sector de seguros inclusivos del país.

La fecha límite para las solicitudes de becas es el 5 de marzo de 2021. Los solicitantes serán notificados de la decisión de los organizadores antes del 19 de marzo de 2021. Si tiene alguna pregunta, escriba un correo electrónico a impactinsuranceacademy@itcilo.org.

Knowledge Hub Highlight

Proportionality in practice: distribution

The A2ii Proportionality in practice case studies aim to provide practical guidance on how regulations have been implemented in a proportionate manner in order to achieve access to insurance and other insurance development goals, while being in line with the Insurance Core Principles. It is an effort to systematically collate practical examples from supervisors who have implemented or begun the process of implementing such proportionate regulations, and generate lessons from their experience.

Proportionality in practice: distribution looks at proportionality in regulations relating to distribution by drawing on the experiences of Ghana, Mexico and the Philippines. Proportionate regulation of distribution aspects can encourage the industry to offer inclusive insurance in two main ways. The first is by reducing the barriers to entry, such as via lower, more flexible or more tailored licensing requirements that allow the relevant types of distribution channels to operate. The second is by lowering the ongoing cost of doing business, and this can be done via adapting supervisory requirements such as reporting or minimum training requirements.

Read the Proportionality in practice: distribution in English, Spanish or French.

Share this #KnowledgeHubHighlight on Twitter or LinkedIn.